Introduction:

Sources[1] say that 535 cases involving fraudulent input tax credit (ITC) of Rs 2,565 Crores have been booked so far in the previous financial year. For Financial Year (FY) 2018-19, the statistics were even more staggering with 1,620 cases involving fraudulent ITC claims of Rs 11,251 crore.

Thus, fake invoicing turned out to be a menace in GST implementation and is affecting the GST collections. Government is looking at e-invoicing as effective tool to curb this menace. It has been introduced w.e.f. 01.01.2020 on voluntary basis and is mandatory w.e.f. 01.04.2020. However, the same was relaxed till 30.09.2020 due to myriad reasons. As on date, the Government has implemented the e-invoicing with effect from 01.10.2020.

e-Invoicing— the myths and reality:

Many people think that e-invoicing involves direct generation of tax invoice in tax portal. This a myth, the invoices continues to be generated in taxpayer’s billing/accounting/ERP software. The taxpayers are required to ensure that the data fields as per the prescribed format of standard invoice are adopted. The invoice shall be prepared using existing billing/accounting/ERP software of taxpayers without disrupting their existing business practices.

|

· Aimed at eradication of fake invoicing! · Mandatory from 1st Oct 2020 for notified suppliers · e-invoicing does not mean generation of invoice outside business’s ERP. · Invoice becomes e-invoice with IRN once digital sign is affixed by IR Portal. · Under e-Invoice, every invoice generated in the accounting package shall be registered to obtain IRN |

The JSON file of the invoice so prepared has to be generated and uploaded in the specified e-invoice registration portal (IRP) which will digitally sign the uploaded invoice and generate unique Invoice Reference Number (‘IRN’).

Legal Framework Related to e-Invoicing:

Rule 48 (4) of CT Rules[2] provides that invoice shall be prepared by such class of registered persons as notified by Government by including such particulars contained in Form GST INV-01 after obtaining an IRN by uploading in common GST portal subject to such conditions and limitations as may be prescribed. The common GST portal for this purpose is also called Invoice Registration Portal (‘IRP’). In order to cater to the requirement of heavy demand, Government has notified ten portals[3] as IRP.

Notified Suppliers:

A registered person whose aggregate turnover in a financial year exceeding Rs. 100 Crores is notified[4] as a class of registered person who is required to issue e-invoice in respect of supply of goods or services or both to a registered person. E-Invoicing is applicable to B2B[5] GST Supplies, Export Invoices, Credit Notes, Debit Notes issued by the notified class of taxpayers. E-Invoicing is also not applicable in case of B2C[6] invoices and Exempt Invoices.

E-Invoicing is not applicable to the following registered persons even though their aggregate turnover exceed the specified turnover limit of Rs. 100 crores:

- Units located in Special Economic Zones

- Insurer or a banking company or a financial institution, including NBFC (non-banking financial company)

- Goods Transport Agency for transport of goods by road in a goods carriage

- Suppliers of passenger transportation service

- Suppliers of services by way of admission or exhibition of cinematograph films in multiplex screens

Benefits of e-Invoicing:

Apart from the fact that e-invoicing will prevent the menace related to fake invoicing, e-invoicing has the following advantages:

- One time reporting of B2B invoice data. The e-invoicing portal will automatically upload the invoice data in GSTR-1, e-way bill portal. Therefore, there is no need to fill in the invoice data separately in these portals.

- Substantial reduction of input tax verification issues as same data will be reported to tax department as well as to buyer/recipient.

- e-Invoicing system will leave a complete trail of B2B invoices. This will facilitate tax administrator’s system level matching of input tax credit and output tax.

|

· Notified Suppliers are those whose aggregate turnover exceeds Rs. 100 Crs · Required to be issued for B2B, Exports, Debit Notes, Credit Notes · Not required in case of B2C supplies · e-Invoicing helps in input tax verification and matching · Saves time as data is automated in GSTR-1 and e-way bill portal |

Documents to be reported through e-Invoicing System:

Though the word ‘invoice’ is used in the name of ‘e-Invoice’, in addition to invoice, credit notes, debit notes issued by suppliers shall also be required to be reported to IRP.

e-Invoice Schema:

There are hundreds of accounting/billing/ERP software which generate invoices, but they all use their own formats to store information electronically and data on such invoices cannot be understood by the GST system if reported in their respective formats. Hence a need was felt to standardize the format in which electronic data of an Invoice will be shared with others to ensure there is interoperability of the data. The adoption of standards will in no way impact the way user would see the physical (printed) invoice or electronic invoice.

Accordingly, e-Invoice schema was introduced by prescribing invoice format in Form GST INV-1[7]under Rule 48. The said format has mandatory and optional fields. Mandatory fields are required to be included by all business while optional fields can be included or excluded as per the business requirement of each taxpayer.

Invoice Registration Portal (IRP):

Under the e-invoice system, the taxpayer who is required to generate e-invoice is required to register in the Invoice Registration Portal (IRP).

|

· Invoice generated will be validated by IRP and returned with digital sign. · Validated invoice bears unique IRN and QR Code · QR Code facilitates verification of e-invoice using offline application. |

Under the e-invoice system, the invoice generated by the supplier will be required to be validated in the IRP portal. As mentioned, to provide higher availability, redundancy, speed and a diversified and distributed service to taxpayers, the Government has notified[8] as many as ten IRP portals.

As on date, the portal einvoice1.gst.gov.in is the IRP that has been made operational. Further, the IRP portal and e-way bill portal are interlinked. If a taxpayer is already registered under e-way bill portal, the same login credentials can also be used for IRP portal. If a taxpayer has not previously registered under e-way bill portal and has now registered under IRP portal, then the same login credentials can also be used to login to e-way bill portal.

The invoice data will be uploaded on the IRP which will also generate the hash in order to verify it and then digitally sign it with the private key of the IRP. In case the taxpayer submits hash also along with invoice data, the same will be validated by IRN system. The IRP will sign the e-invoice along with hash and the e-invoice signed by the IRP will be a valid e-invoice and used by GST/E-Way bill system.

Invoice Reference Number (IRN):

The unique IRN will be based on the computation of hash of GSTIN of generator of document (invoice or credit note etc.), year and document number like invoice number. This hash will be as published in the e-invoice standard and unique for this combination. This way hash will always be the same irrespective of the registrar who processes it. Alternatively, the hash could also be generated by the taxpayers based on above algorithm. The providers of accounting/billing/ERP software are being separately asked to incorporate this feature in their products. One can pre-generate and print it on the invoice book, however, the same will not make the invoice valid unless it is registered on the portal along with invoice details.

Quick Response (QR) Code:

The IRP will also generate a QR code containing IRN, some important parameters of an invoice, digital signature so that it can be verified by anyone using an offline application as well. The officers can check these invoices on roadside without the help of internet. The QR code will consist of GSTIN of supplier, GSTIN of recipient, invoice number as given by supplier, Date of generation of invoice, invoice value (taxable value and gross tax), number of line items, HSN code of main item (the item having highest taxable value) and IRN.

Step by Step procedure for Generation of e-Invoice:

Generation of e-invoice will be the responsibility of the taxpayer supplying the goods or services or both. The e-invoicing system being implemented consists of two aspects viz.

- Generation of invoice in standard format so that invoice generated on one system can be read by another.

- Reporting of e-invoice to a central system

The broad procedure involved is as follows:

The digitally signed e-invoice received in JSON shall be converted into readable formats viz. word/PDF and can be printed for the purpose of sharing to the corresponding recipient, transporter and for other purposes.

Upon generation of e-Invoice in the IRP portal, the details of e-invoice will be shared by IRP portal with GST portal and e-way bill system. The GST portal will update the details of the said invoice under B2B column of respective month GSTR-1 return. The e-way bill system will fill in the Part-A of the e-way bill based on the details of e-invoice received from IRP and the respective supplier is required to fill in Part-B of the e-way bill by filling relevant details of the transporter in order to generate e-way bill. Thus e-invoice system is not only a tax reform but also a business reform as it makes e-invoices inter-operable eliminating duplication of efforts and avoiding transcription and other errors.

Generation of Json file from Invoice Generated in ERP/Accounting Package:

Json file for the invoice generated in ERP/Accounting package can created using API access tools. Json file can be generated based on invoice generated in ERP/Accounting package using web system or bulk upload system. Under web system, invoice details can be typed in the portal to generate Json file. Whereas under bulk upload system, the taxpayers can download an offline tool from IRP Portal[9]. Details of more than one invoice can be uploaded in the offline tool. After validating the data filled in offline tool, Json file can be generated. The said Json file can be uploaded in the IRP portal and can be validated. Upon validation, e-invoice involved will be digitally signed in the portal and a unique has code called IRN. After validating the IRN, e-invoice generated in the portal can downloaded in PDF format. A sample copy of e-invoice is given as under:

3 Modes of JSON generation for reporting/uploading to IRP:

Step-by-Step procedure for JSON generation through ‘Bulk Generation Tool’

Bulk IRN generation facility is provided by the Invoice Registration Portal (IRP) where multiple invoices can be uploaded at once. Generation of IRN is the responsibility of the supplier who will be required to report the same to Invoice Registration Portal (IRP) for authentication. After successful verification, the portal will generate a unique Invoice reference number (IRN) and digitally sign the e-invoice and a QR code.

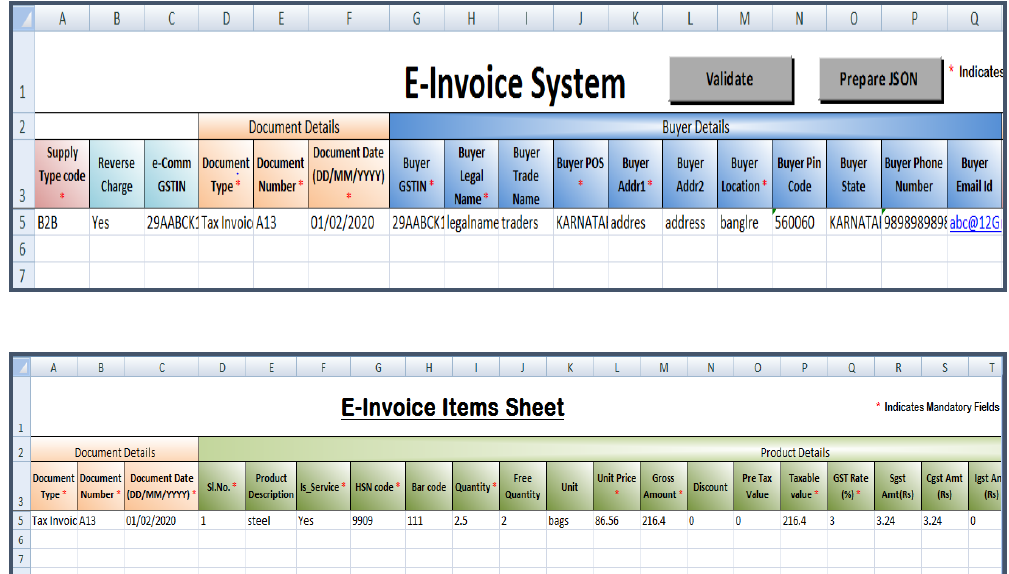

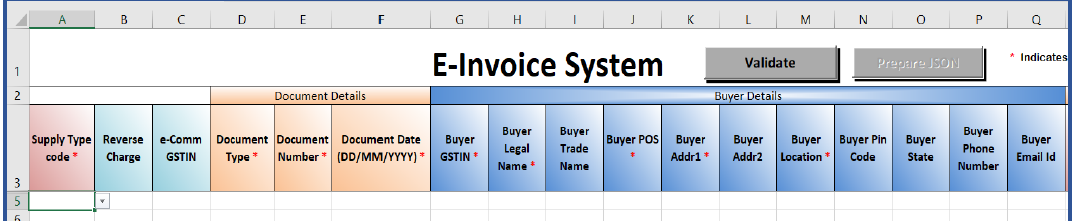

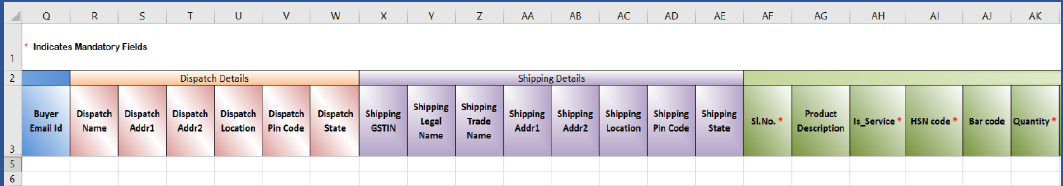

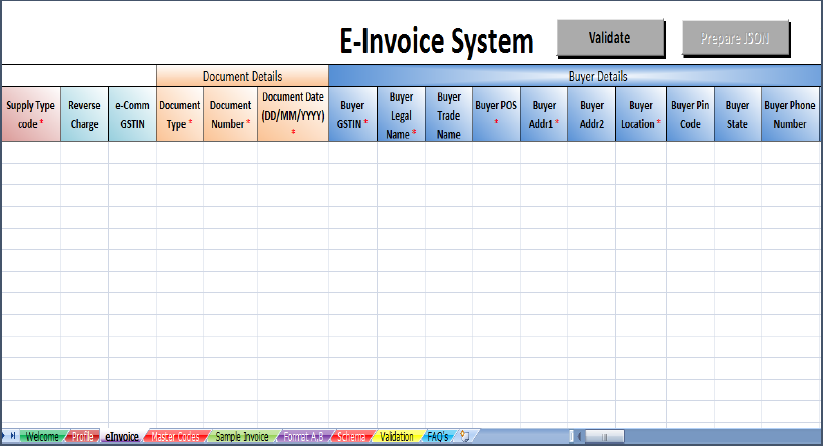

Step 1: Download the ‘Bulk Generation Tool’ from the https://einvoice1.gst.gov.in/ website by following the following path: Help> Tools > Bulk Generation Tools. Please make sure you are using MS Office 2010 or higher version of it.

While downloading the tool E-invoicing system will display 4 different JSON preparation Tools as Format A, Format B, Format C and Format D. These formats have been made as per the requirements of different classes of tax payers and transactions. Taxpayer can select and download the most appropriate format of JSON preparation tool as shown below under ‘Bulk generation Tools’.

· E-Invoice JSON Preparation – Format A:

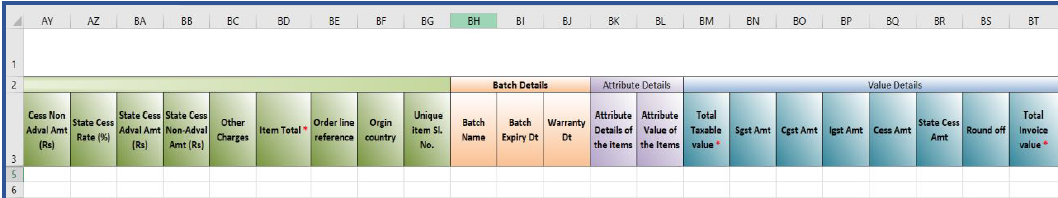

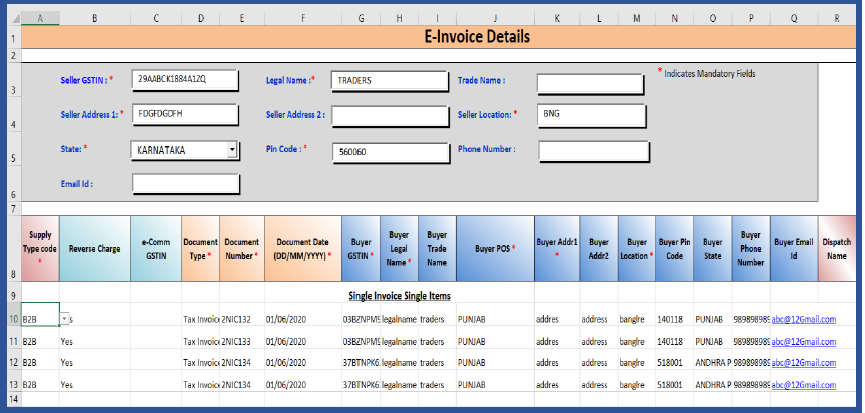

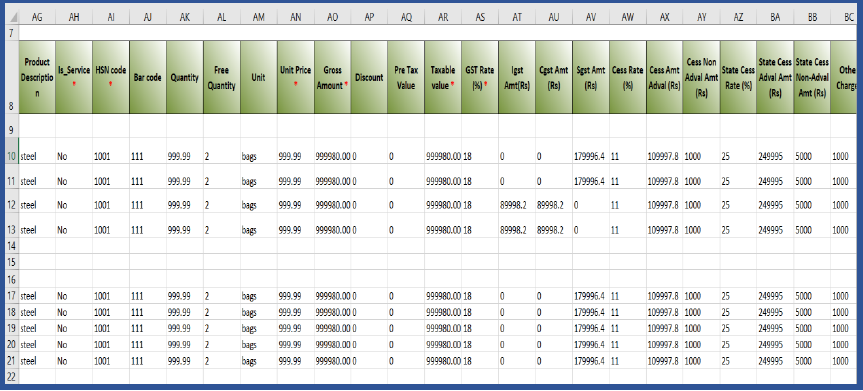

Format A consists of a single worksheet in which invoice and items details can be entered to prepare JSON file to upload the large number of e-Invoices by a single upload to the Invoice Registration Portal (IRP). Businesses having 1 or 2 items in the invoice can use this format. This format is advisable for invoices with B2B transactions. The seller GSTIN details are entered in the Profile as a one-time entry. As the item details are entered in the same worksheet, it is to be ensured that the same invoice details repeat for all the items of the invoice.

Payment details and Reference details cannot be entered in Format A.

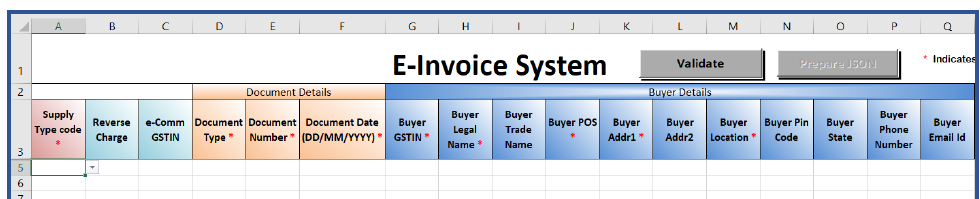

· E-Invoice JSON Preparation – Form B:

Format B Consists of two worksheets in which invoice and items details can be entered separately. This format is advisable for the businesses having many items in the invoice. As the item details are entered in different worksheet, ensure that every item will be referenced with Document number, Document type and document date of the invoice. Payment details and Reference details cannot be entered in Format B.

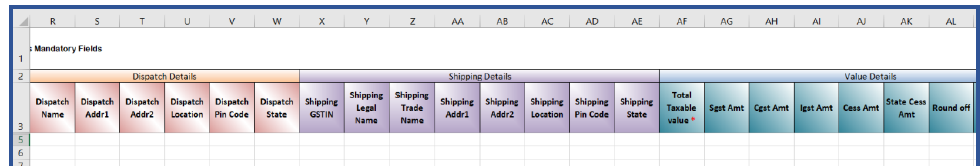

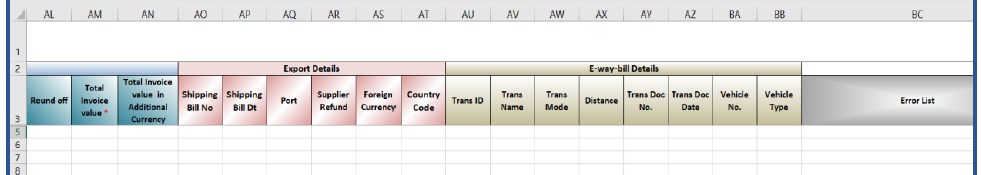

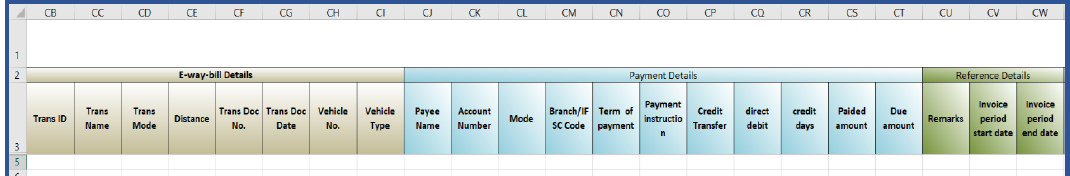

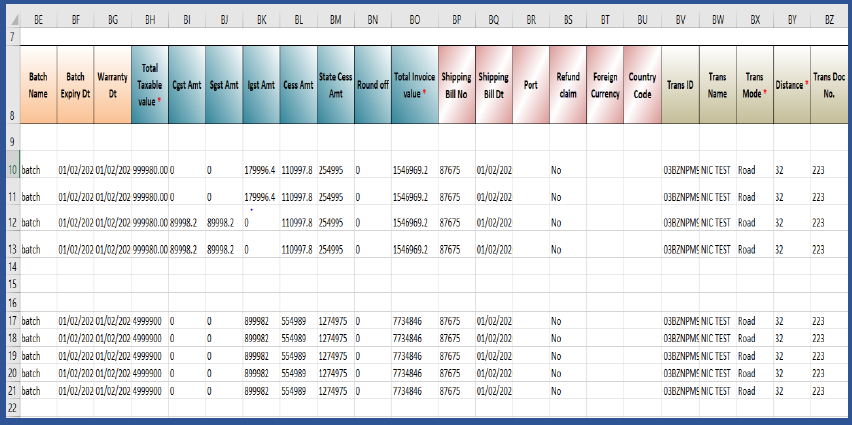

The other information such as Export details can be entered in the Invoice worksheet itself. If e- waybill needs to be generated, the part-B details can also be entered in the Invoice sheet.

- E-Invoice JSON Preparation – Form C:

Format C consists of 5 worksheets in which invoice details, items details, payment details, reference details and additional details can be entered separately.

This format is advisable for the businesses having many items in the invoice with payment details and reference details etc. As the item details are entered in different worksheet, ensure that every item will be referenced with Document number, Document type and document date of the invoice. The other information such as Export details can be entered in the Invoice sheet itself. If e-waybill needs to be generated, the part-B details can also be entered in the Invoice sheet.

- E-Invoice JSON Preparation – Form D:

Format D consists of a single worksheet in which invoice details, items details, payment details, reference details and additional details can be entered in the same worksheets.

This format is advisable for the businesses having large number of items in the invoice having payment details and reference details etc. The other information such as Export details can be entered in the Invoice sheet. If e-waybill needs to be generated, the part-B details can also be entered in the Invoice sheet itself.

Step 2: After downloading the aforementioned utility, follow these steps:

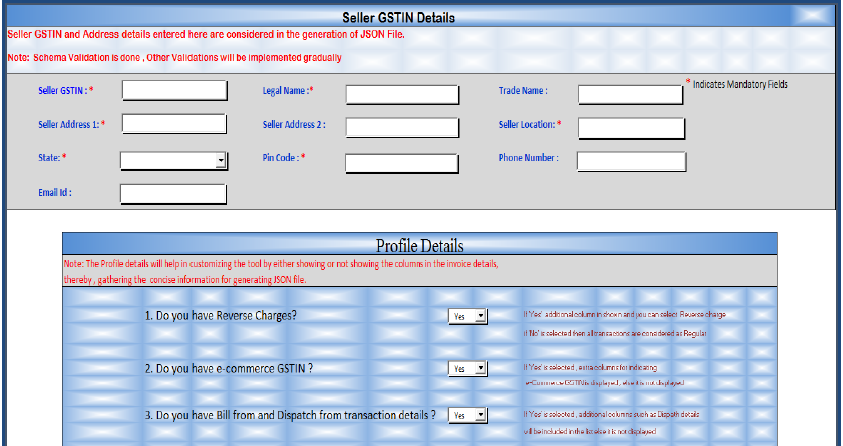

- Step (i): Enter all the seller GSTIN details as required in the ‘Profile’ sheet.

- Step (ii): Enter all the details of the invoices in the necessary fields as given in the ‘Invoice’ sheet.

- Step (iii): Once the invoice details are entered, to ensure that e-invoice schema is followed, validate the details using the ‘Validate’ button.

- Step (iv): Upon successful validation, click on the ‘Prepare JSON’ button. The JSON file will now be generated containing details of the multiple invoices entered.

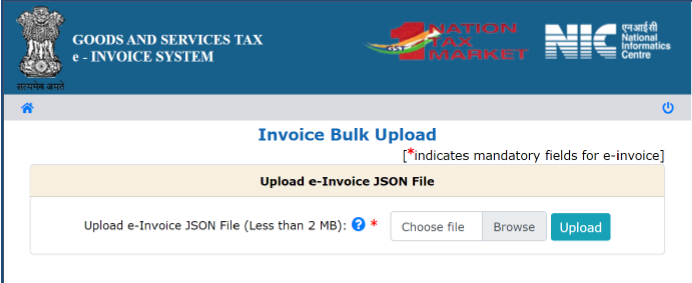

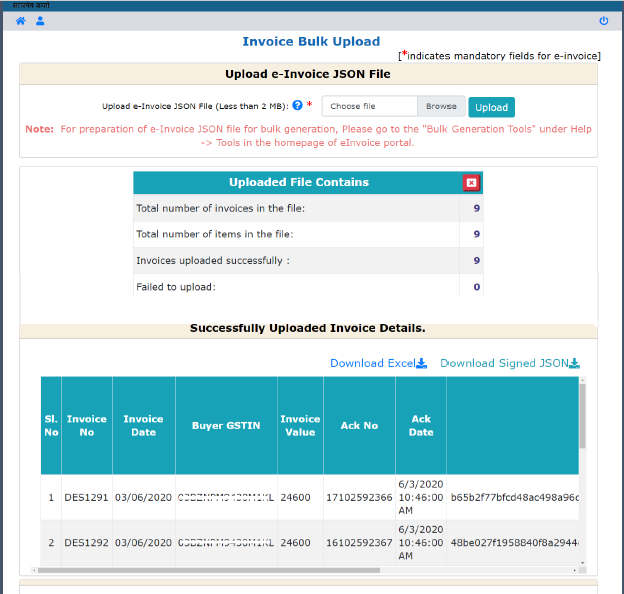

Taxpayer logs in to the E-Invoice system and uploads the file containing the multiple requests for IRN. Ensure that the size of the JSON file is not more than 2MB. The system then generates the IRN for all these requests one-by-one and shows the result in table. A summary of the contents of the JSON file will be displayed. Otherwise it shows error details. The table details can be downloaded into user’s system for further use and action.

Step 3: For Generating Bulk IRN please follow the following steps:

- Step (i): To generate a Bulk Invoice reference numbers, user needs to select the sub option ‘Bulk Upload’ under ‘e-invoice’. On clicking this option, the following screen will be displayed.

- Step (ii): Upload JSON: On click of ‘Browse’ button, the system will request to select the JSON file. User has to upload the IRN request file (maximum allowed file size for upload is 2 MB) to the e-invoice system. After IRN request file is uploaded the following screen will be displayed.

- Step (iii): Generation of IRN: Next on click of ‘Confirm’ button the system processes the JSON file and generates the e-invoices and displays the 64 character length Invoice reference number for each request. If it is not possible it will show the appropriate error for each request.

Note: The user can export the e-invoices in excel file by clicking on ‘Download Excel”. IRN (Invoice Reference Number of 64 character length) shall be unique to each invoice and hence be the unique identity for each invoice for the entire financial year in the entire GST System for a taxpayer.

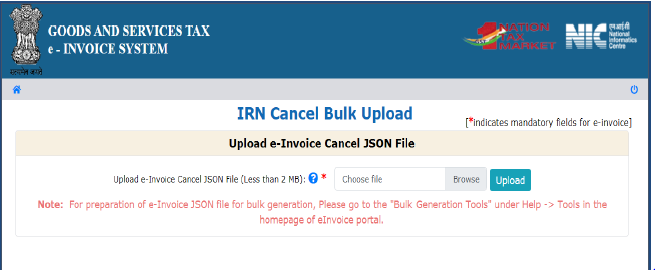

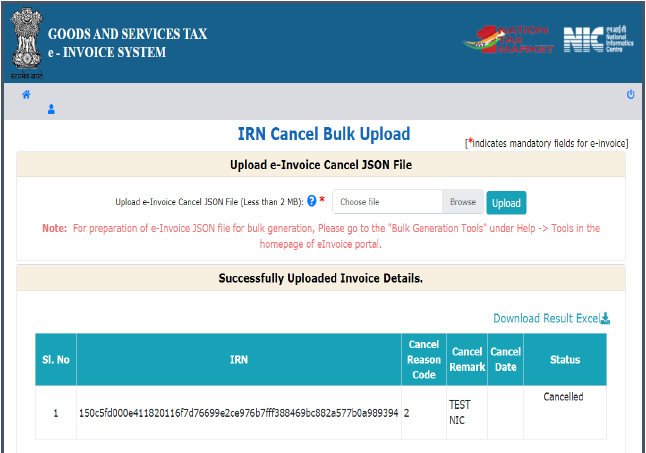

Step-by-Step procedure for Bulk IRN Cancellation:

The provision has been provided to the taxpayer to cancel the invoice reference number in bulk for various reasons like incorrect entry, duplicate entry etc.

Note: Before going for bulk IRN Cancellation, the user should have the “e-Invoice Cancel by IRN JSON File” ready in hand that is intended to be cancelled.

Step 1: For preparation of e-Invoice JSON file for bulk IRN cancellation, Please go to the "Bulk Generation Tools" under Help -> Tools in the homepage of e-invoice portal and download “E-Invoice Cancel by IRN - JSON Preparation” tool.

Step 2: To cancel bulk IRN, user taps the ‘Bulk IRN Cancel’ sub-option under ‘E-invoice’ in menu then the below screen will be displayed.

Step 3: Upload JSON: On click of ‘Browse’ button, the system will request to select the JSON file. User has to upload the Bulk IRN Cancel request file (maximum allowed file size for upload is 2 MB) to the e-invoice system.

Step 4: After processing the JSON file, the system e-invoice system will cancel IRN and displays status as cancelled. If it is not possible it will show the appropriate error for each request.

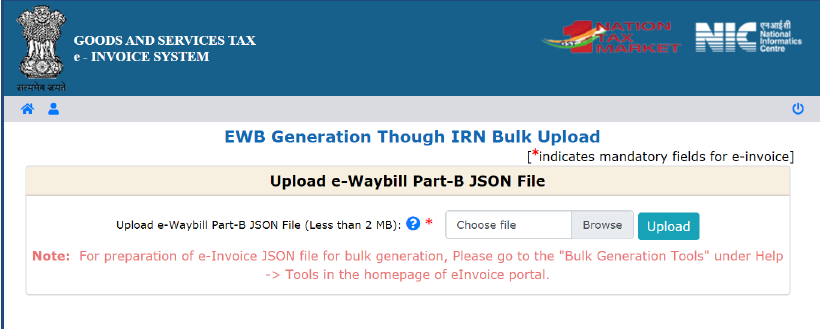

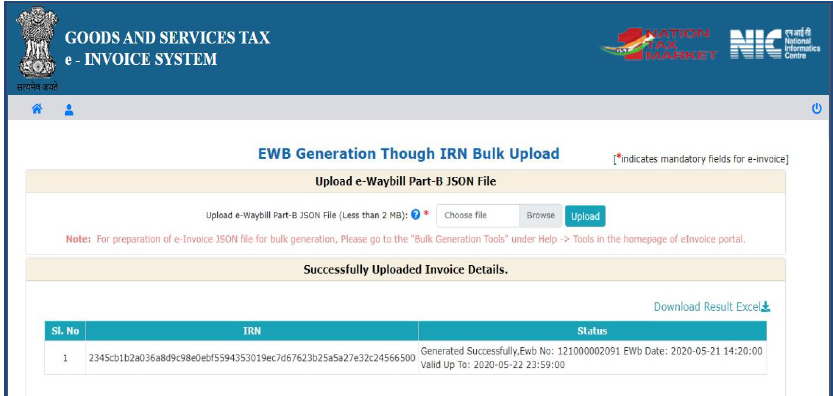

Step-by-Step procedure for generating E-waybill using IRN:

Bulk e-way bill generation facility using IRN is offered by the Government to businesses that generate a substantial number of transactions each day. Bulk e-way bill generation facility is a simple solution for generating multiple e-way bills using IRN in a one-time process. For generating a Bulk e-Way Bill using IRN the user needs to have the EWB bulk convertor or the excel file, which helps the user to create request for multiple EWB’s through IRN in a single JSON file.

Step 1: For preparation of e-Invoice JSON file for bulk generation, Please go to the "Bulk Generation Tools" under Help -> Tools in the homepage of e-invoice portal and download “E-Waybill Generation by IRN - JSON Preparation” tool.

Step 2: To generate a Bulk e-Way Bills using IRN, user needs to tap sub option ‘Bulk E-Way Bill’ under the option ‘E-Waybill’. On clicking this option, the following screen will be displayed.

Step 3: Upload JSON: On click of ‘Browse’ button, the system will request to select the JSON file. User has to upload the Bulk EWB through IRN request file (maximum allowed file size for upload is 2 MB) to the e-invoice system. After Bulk EWB request file is uploaded the following screen will be displayed.

Step 4: After processing the JSON file, the system generates the E-Way Bills with success message and shows the e-way bill no. for each request. If it is not possible it will show the appropriate error for each request.

Additional Issues:

- Modification of IRN: Not Possible.

- Cancellation of IRN: Following points are noteworthy for cancellation of IRN:

- An e-invoice can be cancelled within 24 hours from the time of reporting invoice to IRP.

- In case of cancellation of IRN, GSTR-1 also will be updated with such ‘cancelled’ status.

- Connected E-Way Bill (EWB) status has to be checked for cancellation of IRN. The same is mentioned in the following table:

|

Sl.No. |

Situation |

Cancellation of IRN |

|

1 |

EWB not generated with e-invoice |

Cancellation possible |

|

2 |

EWB generated with e-invoice |

EWB also to be cancelled, then user allowed to cancel IRN |

|

3 |

EWB generated with e-invoice + Active + Verified in transit(i.e., now EWB cancellation not possible) |

Cancellation not possible |

- Corrections of IRN:

- Correction in IRN is not possible over IRP but can be carried out on GST portal.

- Correction can be made while filing GSTR-1.

- In case GSTR1 has already been filed, then also corrections can be made using the mechanism of amendment as provided under GST law. However, these changes will be flagged to proper officer for information.

[2] Central Goods and Services Tax, Rules 2017

[3] www.einvoice1.gst.gov.in, www.einvoice2.gst.gov.in.................www.einvoice10.gst.gov.in

[4] NN 13/20-CT dt 21.03.2020

[5] B2B represents class of recipients who are registered under GST laws.

[6] B2C represents class of recipients who are not registered under GST law, example individual consumers.

[7] https://www.cbic.gov.in/resources/htdocs-cbec/gst/notfctn-60-central-tax-english-2020.pdf

[8] Under N. No. 69/2019-CT(R) dated 13.12.2019, ten IRP portals are from www. einvoice1.gst.gov.in to www.einvoice10.gst.gov.in are notified for this purpose.

[9] https://einvoice1.gst.gov.in/Others/BulkGenerationTools