In Part I, the concept of recognized provident fund (‘RPF’) has been discussed. In this part, concepts of approved superannuation fund (‘ASF’) and gratuity fund will be discussed.

Approved Superannuation Fund [ASF]:

The term ASF is defined under section 2(6) to mean a superannuation fund which is recognized by the PCCIT/CCIT/PCIT/CIT in accordance with the rules contained in Part B of Fourth Schedule to the ITA[1]. The procedure for obtaining registration has been provided in the rules contained in Part B of Fourth Schedule.

Tax Implications on contributions to ASF:

There are certain deductions/exemptions available in respect of contributions made to ASF. Let us proceed to understand the tax implications on contributions made to ASF.

Employer’s Contribution to ASF:

As far as employer’s contribution to ASF, section 36(1)(iv) states that the contribution to a ASF is to be allowed as expenditure subject to the limit as may be prescribed.

In this regard, Rule 87 of IT Rules[2] provides that employer’s contribution to ASF shall not exceed 27% of the salary as reduced by contribution to RPF. If employer’s contribution is to RPF is 12%, contribution to ASF shall not exceed 15% of the salary.

In addition to the provision of 36(1)(iv), it is required to analyse the provision of section 43B, to claim deduction in respect of the employer’s contribution to ASF. Section 43B states that notwithstanding anything contained in other provisions of ITA, employer’s contribution to ASF shall be allowed as a deduction only if such contribution is paid to the respective ASF account within the due date specified for filing the return of income under section 139(1). If the amount is not paid within the due date but paid after such date, the deduction is allowed in the year in which such amount is paid to the ASF account.

The next aspect is taxability of employer’s contribution in the hands of the employee. In this regard, section 17(2)(vii) states that aggregate contribution to provident fund, national pension scheme and/or approved superannuation fund in excess of Rs.7,50,000 shall be considered as perquisite and taxable accordingly.

Which means that aggregate contribution to three funds in excess of Rs.7,50,000 shall be considered as perquisite under section 17(2).

Interplay between the RPF and ASF:

As discussed earlier, employer’s contribution to RPF in excess of 12 percent of salary is considered as salary under section 17(1) however on the other hand aggregate contribution to three funds in excess of Rs.7,50,000 shall be considered as perquisite under section 17(2).

Let us consider an example for better understanding:

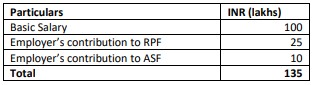

Mr. A, an employee is drawing the following salary from his employer:

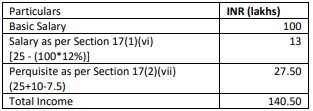

Let us compute the taxable income of Mr. A:

From the above example, it can be understood that though the actual amount/benefit received by Mr. A is Rs. 135, total income is computed at 140.50. This is because section 17(1) and section 17(2) of ITA tries to tax the same income.

Employee’s Contribution to ASF:

Though the employee makes contribution to ASF from his salary income, employer collects the contribution from the employee and remits the same to the provident account of the employee. As the employer is collecting the amount from the employee, in order to make sure that the amount is remitted to the account of the employee within a time, certain checks have been provided in the ITA.

Section 2(24)(x) of the ITA states that any amount received from the employee as a contribution to the superannuation fund shall be considered as income in the hands of the employer. However, once the amount is remitted to the employee’s superannuation account, such amount is allowed as deduction under section 36(1)(va).

However, unlike the employer’s contribution, if the amount is not remitted to the ASF account within the due date under section 36(1)(va) then, such amount is permanently disallowed no deduction is allowed even if such amount is credited to the ASF account in the next year.

For the purpose of section 36(1) (va), due date has been defined to mean due date specified under the respective Acts. However, certain High Courts have held that employer is eligible to claim deduction under section 36(1) (va) even though the amount is not remitted within the due date specified under respective Act but before the due date for filing the return of income under section 139(1). High Courts have come to such a conclusion by taking recourse to the provisions of section 43B.

In order to provide clarification on the due date, section 36(1)(va) has been amended by the FA[3] which states provisions of section 43B are not applicable for the purpose of determining the due date under section 36(1)(va). This amendment has been inserted by way of Explanation to section 36(1)(va). However, judicial fora have held that the amendment to section 36(1)(va) by way of Explanation is applicable prospectively and not retrospectively. This argument has initiated another line of litigation.

Recently, the Hon’ble Supreme Court in the case of Checkmate Services (P.) Ltd[4] has held that the non-obstante clause would not in any manner absolve the employer’s obligation to deposit the amounts deducted by it from the employee’s income, unless the same is deposited on or before the due date as per the respective acts as given in section 36(1)(va).

SC also held that the leeway granted to assesses to allow deductions on deposits made beyond the due date, but before the date of filing the return, cannot be applicable in the case of amounts held in trust, as of the employees in the given case. They are deemed to be held as income of the employers only with the object of ensuring the timely deposit of the same as per the respective laws. Hence, if the employer fails to deposit the monies collected towards ESI and PF from its employees within the said time limits of respective acts, the eligibility to claim such sums as deduction is lost forever.

The next aspect would be tax implication in the hands of the employee in respect of employees’ contributions to ASF.

In this regard, section 80C states that employees are eligible to claim deductions up to an amount of Rs.1,50,000 while computing the taxable income for the year.

Annual Accretion to RPF, ASF and NPS:

Annual accretion to the funds specified section 17(2)(vii) is taxable as perquisite under section 17(2)(viia).

The computation mechanism has been provided in Rule 3B of IT Rules.

Amount paid by ASF:

Section 10(13) of the ITA states that any payment from an approved superannuation fund made in the following situations is exempt from tax—

- on the death of a beneficiary; or

- to an employee in lieu of or in commutation of an annuity on his retirement at or after a specified age or on his becoming incapacitated prior to such retirement; or

- by way of refund of contributions on the death of a beneficiary ; or

- by way of refund of contributions to an employee on his leaving the service in connection with which the fund is established otherwise than by retirement at or after a specified age or on his becoming incapacitated prior to such retirement, to the extent to which such payment does not exceed the contributions made prior to the commencement of this Act and any interest thereon; or

- by way of transfer to the account of the employee under a pension scheme referred to in section 80CCD and notified by the Central Government.

Approved Gratuity Fund:

Section 2(5) defines the approved gratuity fund to mean a gratuity fund which has been and continues to be approved by the PCCIT/CCIT/PCIT/CIT in accordance with the rules contained in Part C of the Fourth Schedule to ITA.

Part C of the Fourth Schedule provides that gratuity funds shall be created as irrevocable trust and shall be created with the sole purpose of provision of gratuity to the employees.

Rule 101 of IT Rules states that amount contributed to the fund (including interest received on such fund) shall be invested in post office savings account, savings/current account with the schedule account or group gratuity scheme of LIC and other investments as specified in Rule 67.

Further, receipt of gratuity to the employee is exempt from tax under section 10(13) subject to the limits specified therein.

Tax Implications in the hands of RPF, ASF and gratuity fund:

Till now, taxability in the hands of the employer and the employee has been discussed. Now, let us proceed to analyse the income tax implications in the hands of respective funds namely RPF, ASF and gratuity fund.

Section 10(25) states that that any income received by the trustee on behalf of RPF, ASF and approved gratuity fund is exempt from tax and these funds are assessable under sub clause (iv) of first proviso to section 164(1).

Requirement to file Return of Income:

The question arises is whether the above funds are required to file income tax return under the ITA. In this regard, section 139 states that any person other than a company is required to file a return of income if his total income exceeds maximum exemption limit which is not chargeable to tax. Which means that if the total income does not exceed maximum exemption limit, it may be required to file return of income.

However, in the case of RPF, ASF and gratuity fund, it would be having income by way of interest which is exempt under section 10(25) (iv) and hence, its total income does not exceed maximum exemption limit.

Further, CBDT Circular No. 18/2017 dated 29th May 2017 states that:

“it has been decided that in case of below mentioned funds or authorities or Boards or bodies, by whatever name called, referred to in section 10 of the Income-tax Act, whose income is unconditionally exempt under that section and who are also statutorily not required to file return of income as per section 139 of the Income-tax Act, there would be no requirement for tax deduction at source, since their income is anyway exempt under the Income-tax Act:

(xi) Provident fund to which the Provident Funds Act, 1925 (19 of 1925) referred to in sub-clause (i), recognized provident fund referred to in sub-clause (ii), approved superannuation funds referred to in sub-clause (iii), approved gratuity fund referred to in sub-clause (iv) and funds referred to in sub-clause (v) of clause (25);”

Considering the above, total income of RPF, ASF and gratuity fund is exempt from tax and hence, these funds are not required to file return of income.

[1] Income Tax Act, 1961

[2] Income Tax Rules 1962

[3] Finance Act 2021

[4] [2022] 143 taxmann.com 178 (SC)