When the positive list of taxation under service tax laws was done away with the introduction of negative list, a new concept of ‘declared services’ was introduced with effective from 01 July 12. Declared services are list of activities or transactions, which were specifically covered under the definition of ‘service’ under the pre-GST[1] laws to clear away the ambiguity, if any, and to drive home the point that such activities or transactions are also services. When the negative list was phased out with the advent of GST laws, majority of the entries of declared services were carried and incorporated into GST laws vide Schedule II of CT Act[2].

In this article, we shall deal with one of the entries of declared services/Schedule II (supra) namely ‘agreeing to obligation to refrain from act or to tolerate an act or a situation, or to do an act’. This entry created a lot of confusion and infused a cloud of ambiguity. Whenever, a particular transaction or activity is doubtful whether it would fall under the ambit of expression of ‘service’, this entry was used by tax authorities to bring the same into the tax net. Having no established judicial precedents, clear instructions, boundaries and scope this entry would cover or deal with, helped the revenue to issue notices proposing fat demands on the taxpayers. Since, the said entry also finds place in Schedule II, it would be important to understand the depth of this entry, as the taxpayers would be haunted by similar notices even under the GST laws.

Before proceeding to understand the depth of said entry with the help of judgments, it is important to note that the judgments under pre-GST laws have just touched the tip of the iceberg and in coming days, this entry would create more confusion. The jurisprudence available under the pre-GST laws was already set aside or not considered by the Authority for Advance Ruling or Appellate Authority for Advance Ruling under the GST laws.

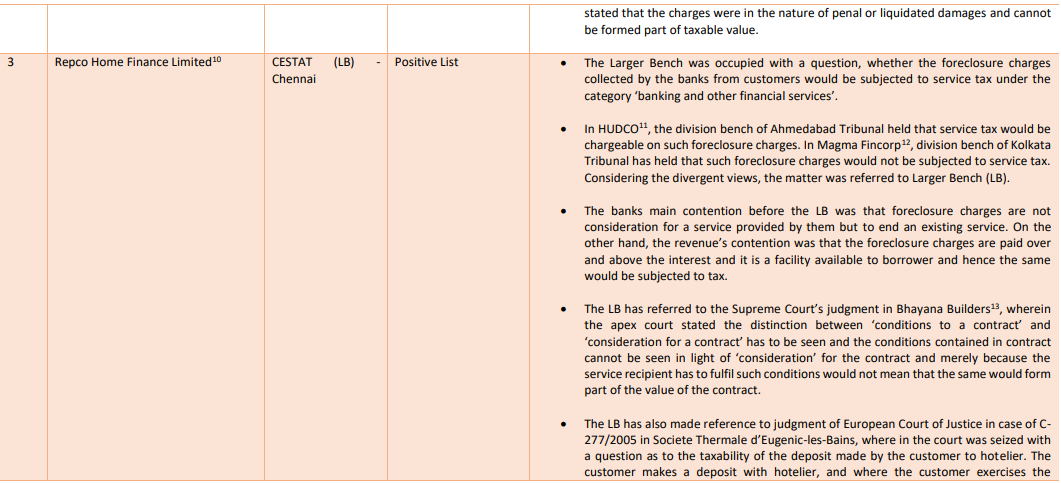

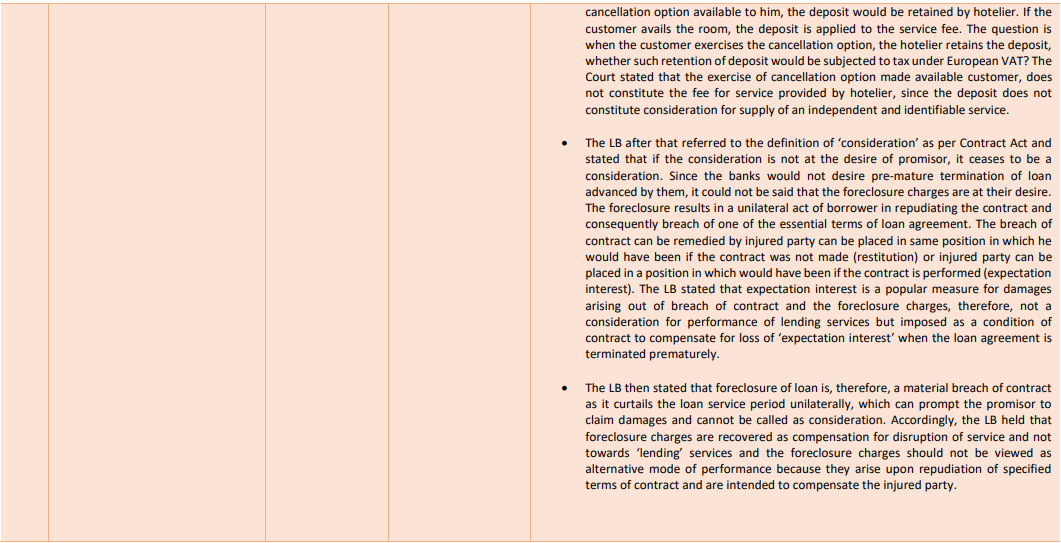

There was certain amount of jurisprudence even under the European VAT[3] relating to the current subject. In the matter of Societe thermale d’Eugenie-les-Bains[4], the Court was dealing with a question, whether the payment of deposit, in the context of a contract relating to supply of hotel services, is to be regarded as consideration for supply, especially, when the client exercises the cancellation option, the deposit is retained by the hotel for the loss suffered because of client default. The Court stated that deposit retained by the hotel has no direct connection with the supply of any service for consideration and as such, is not subjected to tax. The Court further stated that payment of deposit by the client, on the one hand, and the obligation of hotelier on the other, not to contract with anyone else in such a way as to prevent it from honouring its undertaking towards the client cannot be classified as reciprocal performance, because the obligation in those circumstances arise directly from the contract for accommodation, not from the payment of deposit.

In another matter, Services de Comunicacoes e Multimedia SA (MEO)[5], the court while dealing with taxability of charges for pre-termination of contract of telecommunication services, held that such amounts are subjected to tax. MEO concludes the contract with its customers which provide for minimum commitment periods for a lower monthly subscription fee. These contracts stipulate that in case of deactivation of services before the expiry of agreed minimum commitment period at the request of customers for their own reasons, MEO is entitled to compensation corresponding to the amount of agreed monthly subscription fee multiplied by difference between the duration of the minimum commitment period provided for in the contract and number of months during which the service provided. The court held that such amounts received by MEO would be subjected to tax, since the payment that was charged by MEO for breaking of minimum commitment period is equal to that which it would have received if the customer had not terminated the contract prematurely and that does not alter the economic reality of the relationship between MEO and customer. The Court further distinguished the judgment of Societe thermale d’Eugenie-les-Bains (supra) by stating that in that matter, the client has not availed any service by paying the deposit, whereas in the instant matter, MEO has provided service to its customers.

Recently, in the matter of Apcoa Parking Danmark[6], the court was considering the taxability of penal charges collected by the appellant from its customers for violating the conditions of parking of cars. Apcoa was charging a fixed amount per day from customer who infringe the regulations relating to parking of cars. The question that came up for consideration is, whether such penal amount (which constitutes approx. 35% of total revenues) would be subjected to tax. Apcoa was of the belief that since the amounts were akin to cancellation charges collected by hotelier in Societe thermale d’Eugenie-les-Bains (supra), the same are not subjected to tax. The tax authorities have placed reliance on the judgment of Services de Comunicacoes e Multimedia SA (MEO) (supra) to tax the said amounts. The Court stated that it must be noted that parking in a particular space in of the car parks managed by Apcoa gives rise to a legal relationship between that company and the motorist and accordingly, the condition of reciprocal performance was satisfied. The Court stated that though the motorist pays additional amount as penal charges, the same was for using the parking space and accordingly the said amounts are subjected to tax. The question whether the penal charges are subjected to tax or not is left to the national law and the court opined that the same would not have any difference under the VAT laws.

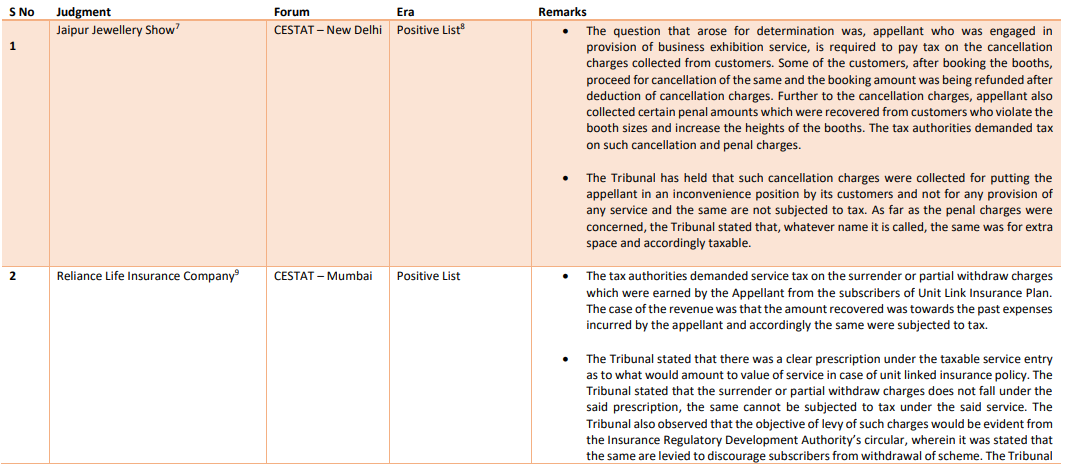

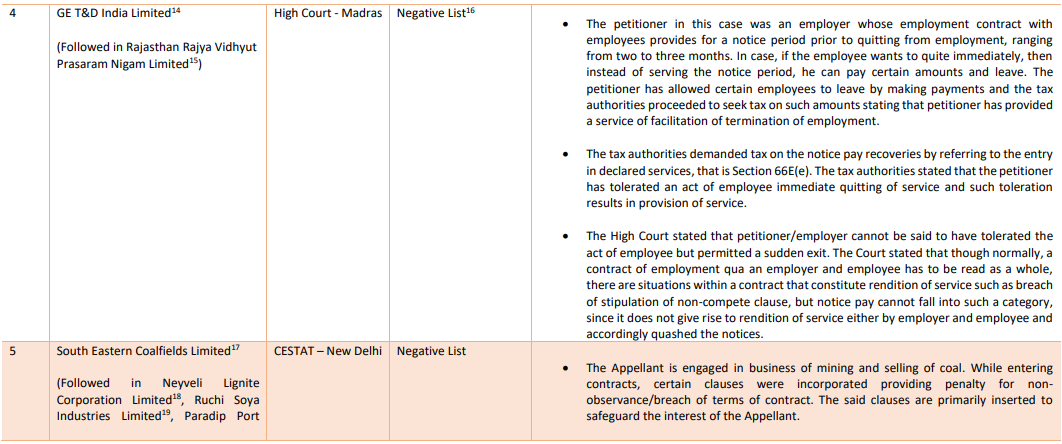

From the above, it would be evident that if at all there is an identifiable service for which a consideration is received, the same would be subjected to tax. In the Societe thermale d’Eugenie-les-Bains (supra) case, there was no identifiable service provided by hotelier for receipt of deposit and hence it would not be subjected to tax. However, in both the other matters, there was an identifiable service and the amounts received, by whatever name, they are called, would be subjected to tax. Further, the VAT laws therein were not considered with the nature of consideration and left the same to the national laws. With the above background, let us proceed to analyse the judgments delivered in the Indian context to understand the taxability.

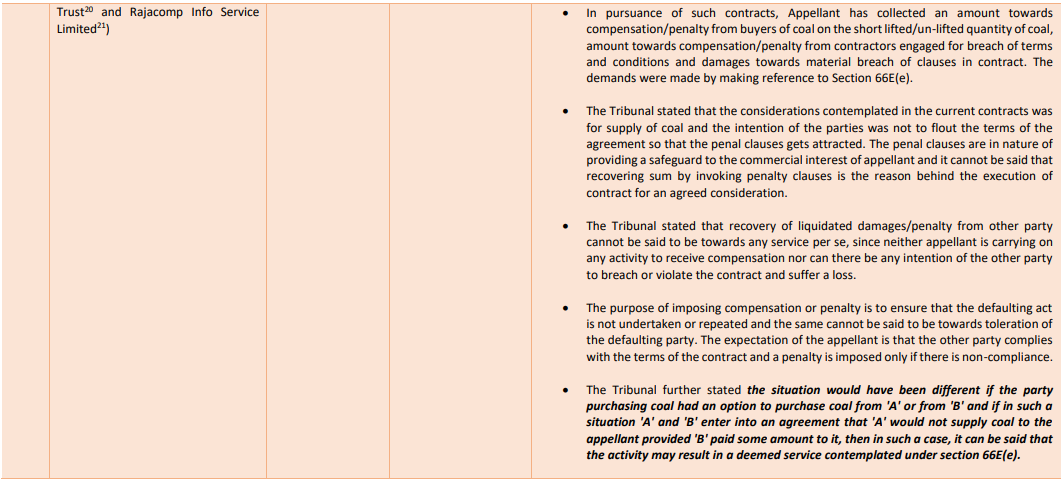

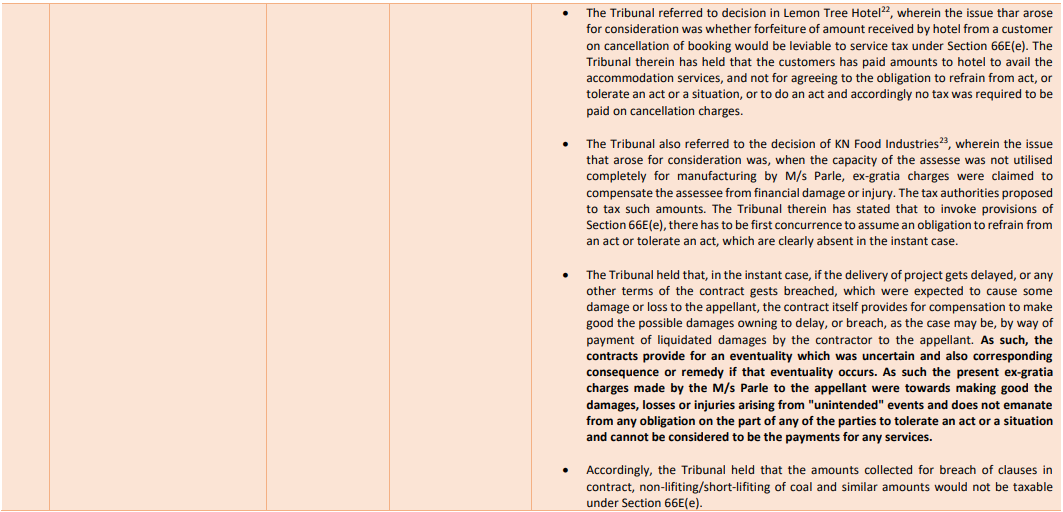

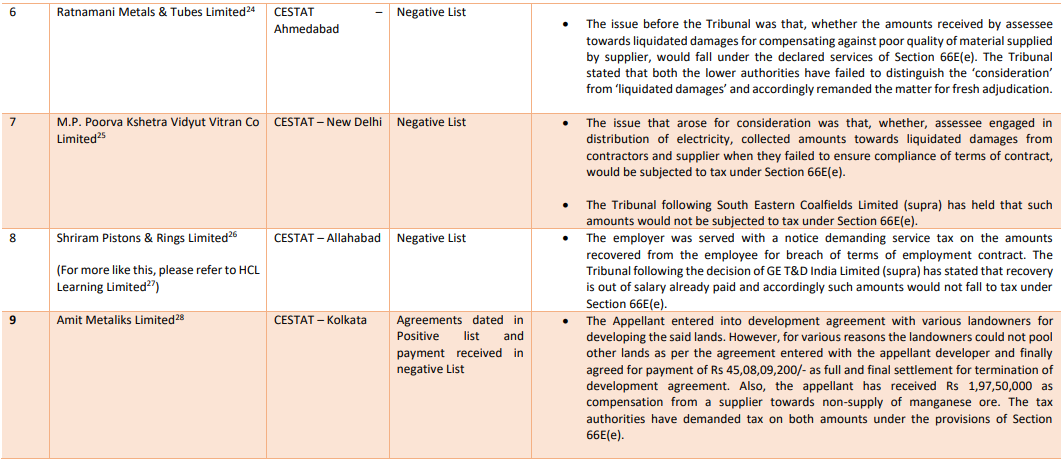

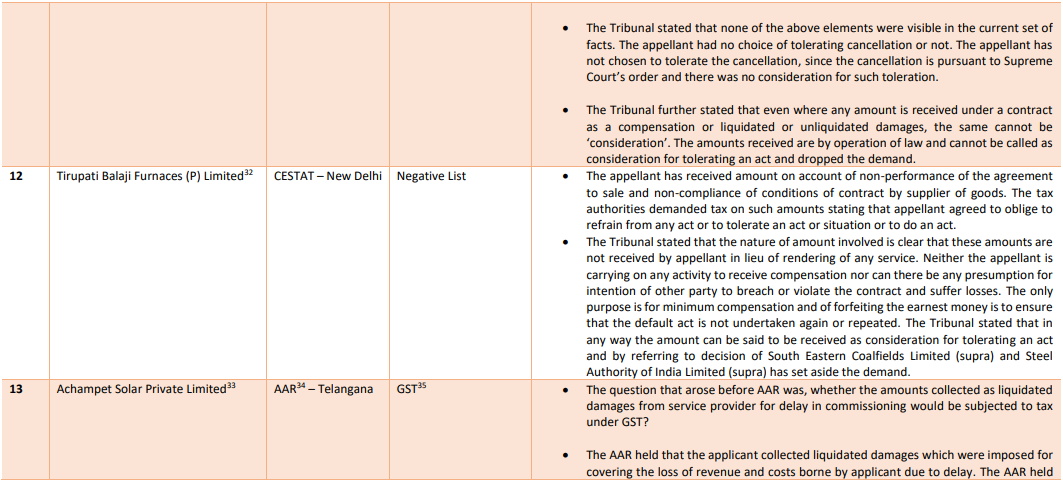

From the above, it is evident that the Courts/Tribunals in the pre-GST laws have clearly stated that the amounts received for non-satisfaction in conditions of contract are different from the considerations of the contract. The same would not be subjected to tax. However, the ruling under the GST laws have completely ignored the said jurisprudence and started inventing the wheel again. Hence, unless a clear guideline is available, it would be impossible to determine, whether the said amounts are taxable or not.

The jurisprudence under European VAT as observed in the introduction part is also not of great help. The larger bench of CESTAT in the matter of Repco Home Finance Limited (supra) has referred to the judgment of Societe thermale d’Eugenie-les-Bains (supra) to hold that foreclosure charges would not be taxable. However, the judgment of Societe thermale d’Eugenie-les-Bains (supra) was distinguished in subsequent judgments in European context, but the Repco Home Finance Limited (supra) was continued to be adopted by subsequent judgments in India. Though, the judgments of European VAT cannot be directly applied to the Indian context, especially, while dealing with contracts which have amounts which are penal, the exercise, whether the said amounts would be subjected to tax or not has to be carefully seen.

From the survey of judgments under European VAT and Indian laws, we can state that as long as there an identifiable service, the amounts paid for it, may be called as consideration and be subjected to tax. However, if there is no identifiable service, then the amounts cannot be called as consideration. The judgment of European Court in Societe thermale d’Eugenie-les-Bains (supra), would be of help here, as the deposit was not paid towards an identifiable service, the court held that the same cannot be subjected to tax. The same was applied in case of foreclosure charges, forfeiture of tender deposits, liquidated damages and penal charges. The context under which the Entry 5(e) would trigger is, when there was an express identifiable service is available and provided for a consideration. We cannot start looking for a transaction to call as service/supply, since there is an amount involved. Having said so, we conclude this piece with a word of caution that the real ambit of this entry is still in the process of evolution.

[1] Goods and Services Tax

[2] Central Goods and Services Tax Act, 2017

[3] Value Added Tax

[4] EUR-Lex - 62005CJ0277 - EN - EUR-Lex (europa.eu)

[5] EUR-Lex - 62017CJ0295 - EN - EUR-Lex (europa.eu)

[6] EUR-Lex - 62020CJ0090 - EN - EUR-Lex (europa.eu)

[7] 2016 (12) TMI 344 – CESTAT New Delhi

[8] Prior to 01.07.2012

[9] 2018 (4) TMI 107 – CESTAT Mumbai

[10] [2020] 117 taxmann.com 755 (Chennai – CESTAT) (LB)

[11] [2012] 17 taxmann.com 14

[12] [FO No 75221-75222 of 2016 dated 03.02.16]

[13] [2013] 38 taxmann.com 221

[14] [2020] 119 taxmann.com 55 (Madras)

[15] [2022] 135 taxmann.com 6 (New Delhi – CESTAT)

[16] Post 01.07.2012

[17] [2021] 124 taxmann.com 174 (New Delhi – CESTAT)

[18] [2021] 128 taxmann.com 405 (Chennai – CESTAT)

[19] [2021] 129 taxmann.com 368 (New Delhi – CESTAT)

[20] 2022 (2) TMI 1010 – CESTAT Kolkata

[21] 2022 (2) TMI 955 – CESTAT New Delhi

[22] Final Order No 50820/2019 dated 08.03.19

[23] 2020 (1) TMI 6 – CESTAT Allahabad

[24] [2021] 125 taxmann.com 35 (Ahmedabad – CESTAT)

[25] [2021] 126 taxmann.com 182 (New Delhi – CESTAT)

[26] [2021] 126 taxmann.com 183 (Allahabad – CESTAT)

[27] [2020] 115 taxmann.com 170 (Allahabad – CESTAT)

[28] [2021] 127 taxmann.com 248 (kolkata – CESTAT)

[29] [2021] 128 taxmann.com 400 (Chennai – CESTAT)

[30] Ground rent is recovered for extension of due date for payment of full sale value at a cost of Rs 500 per lot for every day of, extension granted.

[31] [2021] 132 taxmann.com 115 (Kolkata– CESTAT)

[32] [2021] 132 taxmann.com 264 (New Delhi – CESTAT)

[33] 2022 (2) TMI 715 – AAR Telangana

[34] Authority for Advance Ruling

[35] Period post 01.07.2017

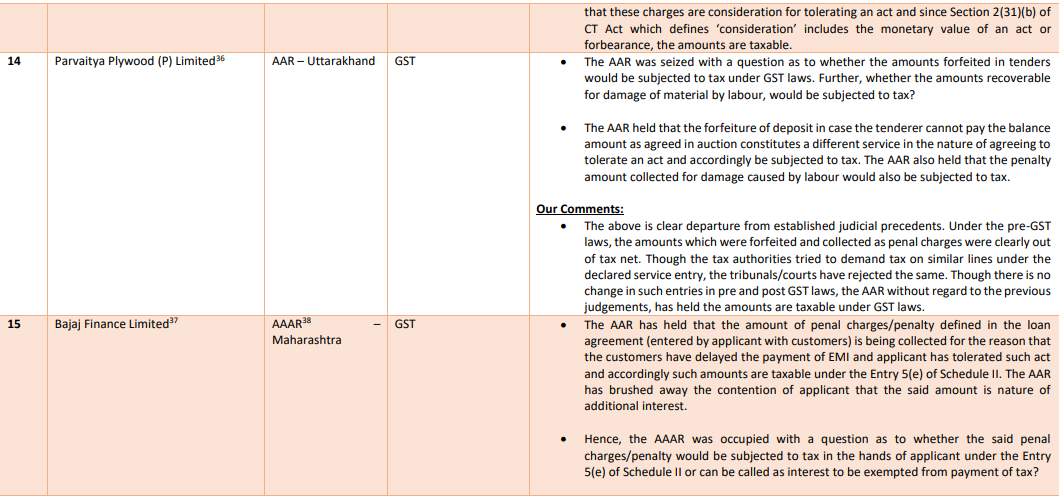

[36] [2020] 115 taxmann.com 62 (AAR- Uttarakhand)

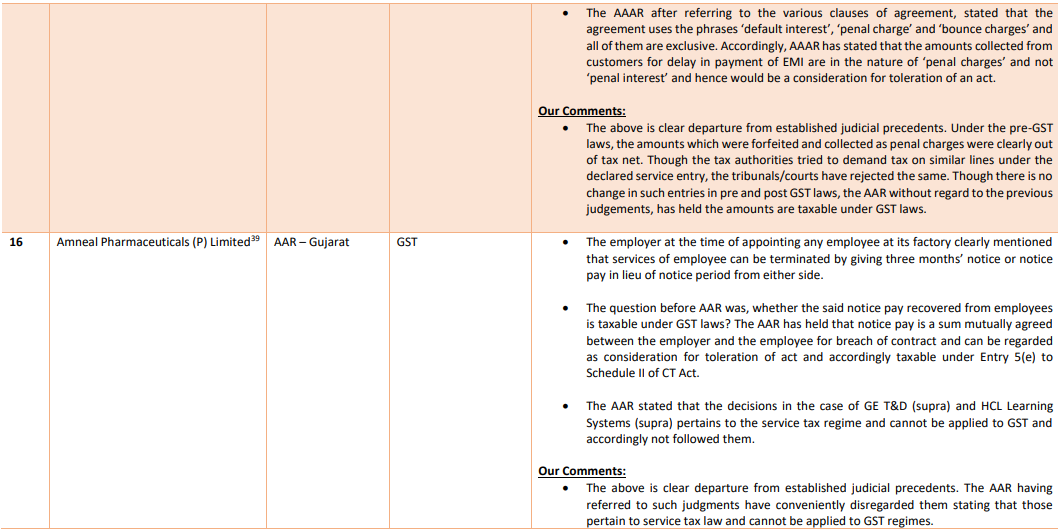

[37] [2019] 108 taxmann.com 1 (AAAR – Maharashtra)

[38] Appellate Authority for Advance Ruling

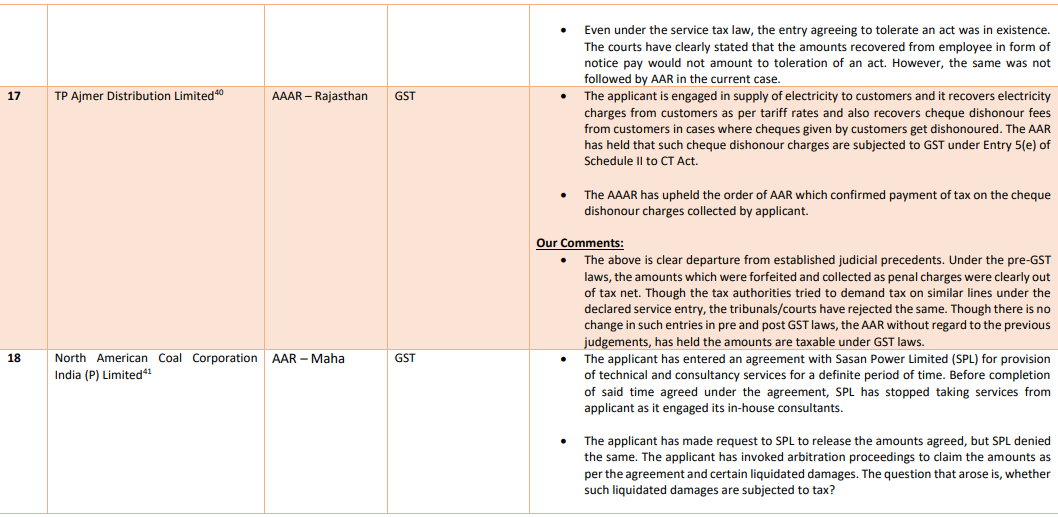

[39] [2021] 123 taxmann.com 191 (AAR- Gujarat)

[40] [2019] 103 taxmann.com 227 (AAAR- Rajasthan)

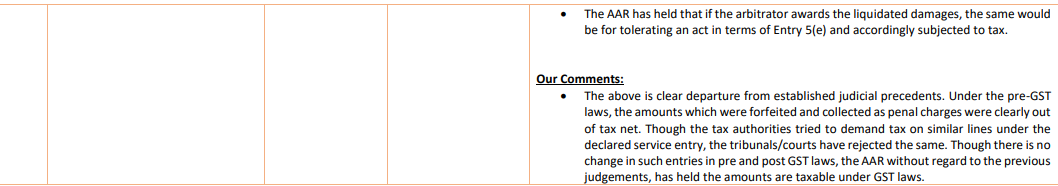

[41] [2018] 98 taxmann.com 331 (AAR – Maharashtra)