Introduction:

Issue of Notice under section 148 of ITA[1] after 31.03.2021 under old provisions has created a buzz in the reassessment matter in recent times. Finally, the matter reached the Supreme Court in the case of Ashish Agarwal[2] and CBDT[3] has issued an instruction[4] to implement the decision of Supreme Court. For detailed analysis of the above issue, read our article here[5].

When the above issue is taking the discussion at various judicial fora, parallelly, one more issue has stood up and raised its voice to make a big impact in the reassessment controversy.

Section 149 (old provisions as well as amended provisions) states that the Notice under section 148 shall not be ‘issued’ after the expiry of time limit specified in section 149 for making the reassessment under section 147.

After the introduction of FAS[6], assessments are being completed digitally wherein issue of Notice and submission of reply to such Notice are to be performed digitally in the e-filing website of the Income Tax.

As such notices are to be issued digitally, the question arises, whether the signing of notice by using digital signature certificate (DSC) is to be considered as issue of notice or sending of such notice through email is to be considered as issue?

In this regard, the Allahabad High Court in the case of Daujee Abhushan Bhandar Pvt Ltd[7] has held that firstly notice shall be signed by the income tax authority and then it has to be issued either in paper form or be communicated in electronic form by delivering or transmitting the copy thereof to the person therein named by modes provided in section 282 which includes transmitting in the form of electronic record.

Accordingly, the Allahabad High Court has held that the point of time when a digitally signed notice in the form of electronic record is entered in computer resources outside the control of the originator i.e., the assessing authority that shall the date and time of issuance of notice under section 148 read with Section 149 of the Act.

However, the Hon’ble Madras High Court in the case of Malavika Enterprises[8] has negated the Allahabad judgement in Daujee Abhushan Bhandar Pvt Ltd (supra) and held that

‘With due respect to the Division bench of the Allahabad High Court, the issue threadbare discussed by it refers to the date of issuance and not of receipt, but after making discussion in reference to all the provisions, conclusions have been drawn referring to the date of receipt, without discussion as to when it enters a computer resource outside the control of the originator.’

Accordingly, Madras High Court has dismissed the writ petition filed by the appellant stating that as the notice has been signed by using DSC on 31.03.2021 and same has been issued on 31.03.2021, date of receipt of email cannot be considered as date of issue of notice. For detailed analysis of the above two judgements, read our article here[9].

The whole issue is to determine the date of issue of notice when such notice is issued digitally. In order to understand this issue, one has to read section 282A of the ITA and section 13 of the Information Technology Act, 2000.

Number of writ petitions have been filed before the Delhi High Court in the cases of Suman Jeet Agarwal & Ors[10] and Delhi High Court has categorically framed various instances under which notice under section 148 has been issued.

- Category A: is in respect of writ petitions -where Notice is dated 31st March, 2021 or before but digitally signed on or after 1st April, 2021, however sent and received on or after 1st April, 2021.

- Category B: is in respect of writ petitions where Notice is dated 31st March, 2021 or before digitally not signed, however sent and received on or after 1st April 2021.

- Category C: is in respect of writ petitions where Notice is dated 31st March, 2021 or before digitally signed on or before 31st March, 2021, however sent and received on or after 1st April 2021.

- Category D: is in respect of writ petitions where Notice is dated 31st March, 2021 or before digitally signed on or before 31st March, 2021, no service either by e-mail or by post or any other mode and assessee came to know later on through Portal or receipt of subsequent Notice under Section 142(1).

- Category E: is in respect of writ petitions where Notice is dated 31 March, 2021 or before manually signed, no service by e-mail but dispatched through speed post on or after 1st April, 2021.

Before the Delhi High Court, both revenue and the assessee have vehemently argued to support the stand taken by them in respect of issue of notice under section 148 through digital mode.

Contention of the Revenue:

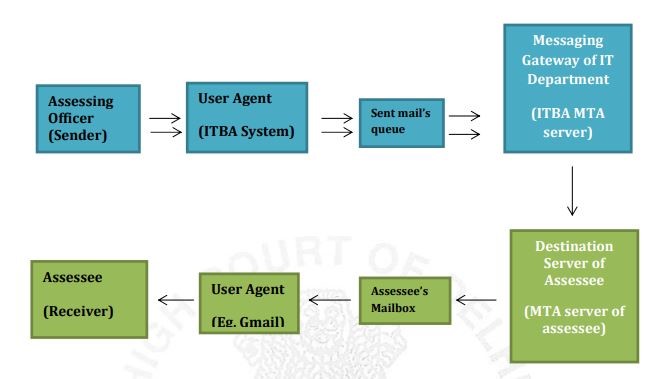

In respect of notices issued by the authorities, it has been stated that a special software has been designed by the Income Tax Department namely ITBA, through which notices to assessee would be issued. Functioning of the ITBA software is as follows:

- AO[11] uses the ITBA software and generates the notice under section 148.

- AO has two options while generating the Notice viz. generating the notice with DSC and generating the notice without affixing the DSC.

- If first option is exercised, AO has to affix the DSC within 15 days. Once the DSC is affixed then, ITBA software generates the mail to the assessee. If AO fails to affix the DSC within such 15 days, ITBA software triggers the email and sends the notice to the assessee.

- If second option is exercised, ITBA software generates the email and sends the Notice to the assessee. The ITBA software’s process of triggering of e-mail and sending of Notices to the E-filing portal’s data base is an automated function in both the scenarios.

On 31st March, 2021, the average time taken for triggering of the email by the ITBA software was approximately 6 hours. The said delay was due to the high number of documents being generated on the said date.

Once the AO exercises his option and generates the notice, he cannot cancel it. In other words, once the notice is generated and DIN[12] is created, AO loses complete control over the notice and he can neither amend, alter nor cancel the said notice.

In terms of section 13 of the Information Technology Act, 2000, AO is to be considered as ‘originator’ and ITBA portal is the ‘computer source’. Therefore, such generation of the notice and creation of DIN has to be considered as issue of notice for the purpose of section 149 of ITA.

Contention of the Assessee:

Section 149 states that notice has to be issued within the time limit. It does not contain expression ‘assessing officer’, therefore no distinction can be made between the AO and the ITBA software. Time taken by the ITBA software is attributable to the AO.

Under section 13 of the Information Technology Act, ITBA software is to be considered as ‘originator’. Therefore, the dispatch of electronic would occur only when same enters the computer source outside the control of the ITBA software and only after such dispatch, it shall be considered that the notice is issued.

As per the provisions of section 282A of the ITA, for a notice to be issued, such notice has to be signed and thereafter it can be issued (in paper form) or can be communicated (in electronic form). When such notice is issued in the paper form, it has to leave the office of the concerned authority to consider is has valid issue. However, in the digital mode, communication is instant and therefore, merely putting the notice into transmission cannot be considered as valid issue, but such notice has to be effectively sent out by the concerned authority. Until a ITBA server sent the email to the assessee, it cannot be considered as valid issue of notice as stated in section 282A of the ITA.

High Court Ruling:

After considering the arguments made by the revenue as well the assessee, and after considering the various judicial precedents, High Court has framed following questions of law to be answered.

1. Whether the JAO’s act of generating Notice in the ITBA portal on 31st March, 2021, without dispatching the notice meets the test of the expression ‘shall be issued’ in Section 149 of the Act of 1961, and saves the notices from being time barred?

In this regard, the High Court has held that the expression ‘issue’ in its common parlance and legal interpretations means that the issuer of the notice must after generating and signing it make an overt act to ensure due dispatch of the notice to the assessee. On perusal of the submission of the revenue, it is revealed that while the function of generation of notice in ITBA software and signing of such notice is executed by the AO, function of drafting of email and triggering of email to the assessee is performed by the ITBA software.

The High Court held that mere generation of the notice on ITBA software shall not constitute the issue of notice in the eyes of law. Issue of notice in paper form is completed when such notice is dispatched and in electronic form, it is when the email has been dispatched.

2. Whether “dispatch” as per Section 13 of the Act of 2000 is sine qua non for issuance of Notice through electronic mail for the purpose of Section 149 of the Act of 1961?

3. Whether the time taken by the ITBA’s e-mail software system on 31st March, 2021, in dispatching the e-mails to the assessees is not attributable to the JAOs and the Notices will be deemed to have been issued on 31st March, 2021?

For the purpose of this illustration, the double arrows indicate transmission between computer resources that are of the ITBA e-mail software system and therefore, within the control of the Department; and the single arrows indicate transmission between computer resources that are within the control of or used by the assessee.

It would be relevant to note that the time taken by the ITBA software on 31st March, 2021 was not due to any software glitches. The programming to dispatch the notices in a controlled manner and batch mode was pre-existing fact and to the knowledge of the revenue.

Hence, it is sine qua non for issuance of notice through electronic mail for the purpose of Section 149 of the Act and time taken by the ITBA’s e-mail software system on 31st March, 2021, in dispatching the e-mails to the assessees is attributable to the AO.

4. Whether the Section 148 Notices sent as an attachment through e-mails, from the designated e-mail addresses of the JAOs, which do not bear the respective JAO’s digital signature, are valid under Section 282A the Act of 1961 read with Rule 127A of the IT Rules?

In this regard, the High Court after referring to section 282A and memorandum to the Finance Bill, 2016, it has held that affixation of DSC is not mandatory for the purpose of issue of Notice under section 148.

5. Whether upload of the Section 148 Notice on the “My Account” of the assessee on the E-filing portal is valid transmission under the Act of 1961?

In this regard, the High Court has held that in order to consider the issue of notice by placing the same in e-filing website is valid, revenue must have issued a real time alert.

However, as the assessee is aware of the notices later and such proceedings are pending, High Court has inclined to quash the same. The first date on which the notices were accessed by the assessee in e-filing website shall be considered as date of issue of notice.

The whole issue arose in writ petition before various High Courts because, if is considered that the notice is issued on or after 01st April, 2021, it would be considered outside the time limit specified in section 149 of the ITA and bad in law as scheme of reassessment has been changed substantially from 1st April, 2021.

However, it is imperative to remember the decision of the Hon’ble Supreme Court in the case of Ashish Agarwal (supra). The Hon’ble Supreme Court has held that notices issued under section 148 to assessees under the old provisions shall be deemed to have been issued undersection 148A as substituted by the Finance Act, 2021.

After the above analysis, the High Court has proceeded to answers the questions relating to various instances under which notice under section 148 was issued.

- Category ‘A’ (Notice is affixed with DSC):

Notices falling under category ‘A’, which were digitally signed on or after 1st of April, 2021, are held to bear the date on which the said notices were digitally signed and not 31st March 2021. The said petitions are disposed of with the direction that the said notices are to be considered as show-cause-notices under Section 148A(b) as per the directions of the apex court in Ashish Agarwal (supra).

- Category ‘B’ (Notice without affixing DSC):

Notices falling under category ‘B’ which were sent through the registered e-mail ID of the respective JAOs, though not digitally signed are held to be valid. The said petitions are disposed of with the direction to the JAOs to verify and determine the date and time of its dispatch as recorded in the ITBA portal in accordance with the law laid down in this judgment as the date of issuance. If the date and time of dispatch recorded is on or after 1st April, 2021, notices are to be considered as show-cause-notices under Section 148A(b) as per the directions of the apex court in Ashish Agarwal (supra).

- Category ‘C’ (Notice is affixed with DSC):

Notices falling under category ‘C’ which were digitally signed on 31st March 2021, are disposed of with the direction to the JAOs to verify and determine the date and time of dispatch as recorded in the ITBA portal in accordance with the law laid down in this judgment as the date of issuance. If the date and time of dispatch recorded is on or after 1st April, 2021, the notices are to be considered as show-cause-notices under Section 148A(b) as per the directions of the apex Court in Ashish Agarwal (supra).

- Category ‘D’ (Notice uploaded in the e-filing website):

Notices falling under category ‘D’ which were only uploaded in the E-filing portal of the assessees without any real time alert, are disposed of with the direction to the JAOs to determine the date and time when the assessee viewed the notices in the E-filing portal, as recorded in the ITBA portal and conclude such date as the date of issuance in accordance with the law laid down in this judgment. If such date of issuance is determined to be on or after 1st April 2021, the notices will be construed as issued under Section 148A(b) as per the directions of the apex court in Ashish Agarwal (supra).

- Category ‘E’ (Notice is dispatched physically):

Notices falling under category ‘E’ which were manually dispatched, are disposed of with the direction to the JAOs to determine in accordance with the law laid down in this judgment, the date and time when the notices were delivered to the post office for dispatch and consider the same as date of issuance. If the date and time of dispatch recorded is on or after 1st April, 2021, the notices are to be construed as show-cause-notices under Section 148A(b) as per the directions of the apex Court in Ashish Agarwal (supra).

Further, another issue which is originally not categorised has also been cleared by the High Court. i.e., issue of notice through email of the unrelated party.

In this regard, the High Court has held that issue of notice to email of the unrelated party cannot be considered as valid issue. However, as per section 282 of the ITA read with Rule 127 of IT Rules, notice can be issued to email address available in ITR filed by the assessee, in the case of the company, email address available in the MCA website, any email made available by the assessee to the AO. If such email is sent to different mail other than the above-mentioned cases, it shall not be considered as valid issue of notice. However, as assessee is aware of the notice by way of e-filing website, such case can be covered under ‘Category D’ above.

Author’s Comments:

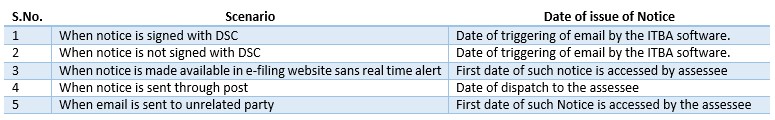

The Delhi High Court has cleared the clouds to the major extent when it comes to issue of notice under digital mode. In summary, date of issue of notice can be determined as follow:

Further, all above cases in writ, though the decision of the above High Court provides relief, has go back to the file of the AO to start the reassessment proceedings afresh. This is because of the decision of the Supreme Court in the case of Ashish Agarwal (supra).

However, the analysis and the judgement provided by the High Court is useful for future notices and is the notice is issued digitally, the date of triggering of email by the ITBA software shall be considered as date of issue of notice and not the date of its generation/signing.

Further, as far as signing of the notice with the DSC, the High Court has held that for the purpose of section 148, notice need not be affixed with the DSC. However, if any particular provision requires affixing the DSC, same shall be duly signed with the DSC by the respective authority.

[1] Income Tax Act, 1961

[2] [2022] 138 taxmann.com 64 (SC)

[3] Central Board of Direct Taxes

[4] Instruction No. 01/2022, dated 11-05-2022

[5] Supreme Court on Reassessment controversy – more than 90,000 Notices to be alive - Taxmann

[6] Faceless Assessment Scheme

[7] WRIT TAX No. - 78 of 2022

[8] [2022] 137 taxmann.com 398 (Madras)

[9] Issue of Notice through Email

[10] [TS-752-HC-2022(DEL)]

[11] Assessing Officer

[12] Document Identification Number