Introductory Remarks:

A high level inter-ministerial committee was constituted in 2017 under the Chairmanship of Secretary Department of Economic Affairs, to study the issues related to virtual currencies. The mandate of the Committee included examination of policy and legal framework for the regulation of virtual currencies. The subject of virtual currencies is assuming importance day by day after every country in the world drafting regulations either to allow or prohibit usage of same. Further, the current regulatory and legal framework does not squarely cover the issues presented by the usage of virtual currencies and technology involved therein.

The absence or inadequate regulatory and legal framework over the usage of virtual currencies presents a challenge to the customers, economy and society. The recent ponzi scheme unearthed by Pune Police where a person claiming himself to be a Bitcoin1 entrepreneur has duped 8000 people involving INR 2000 Crore scam2. Also, various scams in other countries and the value of Bitcoin falling rapidly on the Coin Stock Exchanges and such value is not being backed by any concrete assets, the virtual currencies offer various challenges. The Ministry of Finance in India has issued a press release dated 29th Dec 173 stating that virtual currencies do not have any intrinsic value and are not backed by any kind of assets and cautioned that such currencies are not backed by Government and thereby are not legal tender.

Further, there is also classification issue in the virtual currencies, which also offers a significant challenge in designing the regulatory and legal framework around the same. Many countries generally classify virtual currencies into payment, utility and security tokens. Also, in certain countries another category of hybrid tokens that share characteristics of multiple categories also exits.

For example, the Monetary Authority of Singapore (MAS) has issued a note ‘A Guide to Digital Token Offerings’, wherein a guidance on the application of securities laws administrated by MAS in relation to offer or issues of digital tokens in Singapore. The Guide states that a digital token may constitute – (a) share, where it confers or represents ownership interest in a corporation, represents the liability of token holder in the corporation, and represents mutual covenants with other token holders in the corporation inter-se, (b) a debenture, where it constitutes or evidences the indebtedness of the issuer of the digital token in respect of any money that is or may be lent to the issuer by a token holder or (c) a unit in collective investment scheme (CIS), where it represents a right or interest in a CIS, or an option to acquire a right or interest in CIS.

MAS has clarified vide the Guide that if a digital token offered does not confer any right in the corporation or does not fit under the CIS regulation, then the offeror need not take any approval respective government authorities. If the same is conferring a right or a unit in a CIS, then such offering is governed by the respective legislations like Securities and Futures Act and others. Hence, classification of digital token assumes importance because of the regulatory requirements vary across the board and it is common that issuers would classify their currencies as currencies which does not require any approval. Not only Singapore, various other countries have different classifications of virtual currencies and accordingly either drafted new legislations or amended the current legislations to protect the interest of consumers and economy.

1 One of the most famous Virtual Currencies

2 The Committee in its report also mentioned about the scam. For further reading

https://www.financialexpress.com/market/bitcoin-fraud-in-india-man-arrested-for-duping-8000-people-in-rs-

2000-crore-cryptocurrency-scam/1122575/

3 http://pib.nic.in/newsite/PrintRelease.aspx?relid=174985

A recent study by Cambridge Centre for Alternative Finance, titled ‘Global Cryptocurrency Regulatory Landscape Study4’ which covered 23 jurisdictions to study about the legal and regulatory framework around virtual currencies. The study shows that scope of different regulatory authorities often does overlap when regulating cryptoasset activities leading to a situation, on an average, three distinct national bodies per jurisdiction have issued official statements on cryptoasset, including warnings. The study also

states that there is no standard usage of terminology across regulators and a variety of terms have been used to refer to cryptoasset in official statements. Virtual Currencies has been used interchangeably with cryptocurrency and digital currency. The study also reveals that in majority of the jurisdictions the first step taken by regulators has typically been to distinguish cryptoasset which are deemed to be securities from other type of cryptoasset.

From the above, it is evident that there is a huge gap among various jurisdictions in understanding the virtual currencies and the regulatory and legal framework. Coming back to India, the Committee has recommended that respective regulators to make best use of the underlying technology pertaining to virtual currencies to solve certain legacy issues dealt by them. Further, the Committee has also recommended that Central Bank can form a committee to explore the issuance of Central Bank Digital Currency and regulation thereof. The Committee’s recommendation of using the distributed ledger technology is a welcome move and if implemented in true spirit, there will rapid changes as indicated in the report. Further, the Committee’s recommendation to ban the virtual currencies and launch of Official Digital Currency is also in a kind aligning with positions taken by major countries.

The proposed legislation prohibits in dealing directly or indirectly in virtual currencies. In a way, the proposed legislation prohibited usage of virtual currency and officialised usage of digital currency issued by Central Banks. Further, a transition period is given to deal with virtual currencies in hand, once the bill is enacted. The inclusion of dealing in virtual currencies under the list of scheduled offences vide the Prevention of Money Laundering Act, 2002 also makes the issue of dealing in virtual currencies a serious

offence.

In this first note, we have summarised important observations and recommendations of Committee and dealt with various provisions of the proposed bill. Hope you enjoy reading the same!

4 https://cdn.crowdfundinsider.com/wp-content/uploads/2019/04/CCAF-2019-global-cryptoasset-regulatorylandscape-

study-1.pdf

Committee on Distributed Ledger Technologies:

Distributed Ledgers (DL) use independent computers (referred as nodes) to record, share and synchronise transactions in the respective electronic ledgers instead of keeping the data centralised as in traditional ledger. DLs are shared record of data across different parties. DLs may be permissioned or permissionless, depending on whether the network participants referred to as nodes need permission from any entity to changes to the ledger. DLs can be categorised either as public or private depending upon whether the ledgers can be accessed by anyone or only to the participating entities in the network. DLTs enabling recording of transactions and transfer of ‘value’ peer to peer (P2P) could have applications in number of fields. ‘Value’ refers to any record of ownership of assets – money, security, land titles and also record of specific information like identity, health information.

Core Attributes of DLTs

- DLTs are able to store records of ownership of assets without need the need for a centralised record keeping mechanism. Any changes in ownership of assets or transactions are also recorded in an immutable, non-repudiable manner.

- DLTs also ensure that there is no ‘double spend5’. This is an important future of DLTs, where it is ensured that same asset cannot be spent twice. Currently, vide a centralised ledger, it is ensured that there is no ‘double spend’. DLT offers a decentralised solution to the double-spending problem. All transactions are updated on a ledger and the authenticity of the digital asset spent can be verified by users. Once a transaction is validated, it is grouped into a block, which contains details of the current transactions as well as that of the previous transactions. As more blocks are added to the blockchain, it becomes increasingly difficult to change the records and double spend the asset.

- The legitimacy of transactions is arrived at using ‘consensus mechanism’6 using predefined specific cryptographic validation method. This is not true for DLT in general, but in recent past, most of the DLs based on the structure of Bitcoin Blockchain have adopted cryptography at their core. Each new transaction is hashed.

Smart Contracts

As DLT evolved, the evolution of ‘smart contracts7’ have rendered further versatility to DLT. Participants are allowed to enter agreements and embed them in the records of DLT network. Through such mechanisms, smart contracts obviate the need for intermediation. This feature brings a number of benefits such as faster and automatic execution, lower transaction costs, and non-ambiguity in performance of the contract by making the execution more objective and eliminate the need of intermediation.

5 Double spend is a flaw, which is unique to the digital assets as digital data can be reproduced at a rather negligible cost with the current resources, relative to physical currency/tokens. Digital assets can be thought of being a digital file. The file locally stored on a computer can be reproduced and subsequently shared multiple times with multiple users. This severely limits the capability of using digital currencies as a part of money supply.

6 The core innovation that Bitcoin brought in this space was through its consensus mechanism, known as Nakamoto

Consensus.

7 One prominent example of smart contracts is the automatic triggering of a payment when a specified event is

completed, or a specified date is reached.

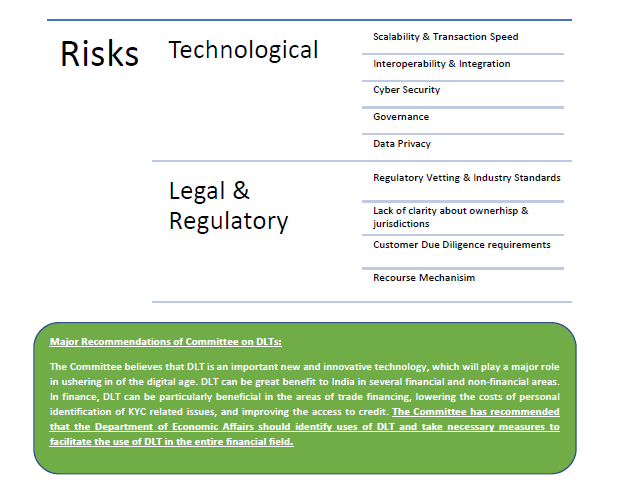

Risks & Regulatory Challenges

The Committee opined that DLT is still evolving and many regulatory and legal issues are still remaining to be resolved. The risks can be categorized into three broad buckets i.e., technological, legal and regulatory.

Committee on Virtual Currencies

A virtual currency is a digital representation of value that can be digitally traded and functions as

a. medium of exchange and/or

b. unit of account and/or

c. store of value but does not have legal tender status.

A virtual currency therefore may be a private medium of exchange but does not in any way reflect a sovereign guarantee of the value or legal tender status. Virtual Currency is therefore distinguished from the FIAT currency of a country that is designated as its legal tender. Cryptocurrencies are a subset of virtual currencies that is decentralised and is protected by cryptography. Bitcoin is an example of a cryptographic virtual currency and was the first of its kind.

In the context of more formal platforms like exchanges, certain exchanges list more than 900 cryptocurrencies where 440 of them have a market capitalisation of more than 1 Million USD. However, this market capitalization is mainly due to use of few numbers of coins. The major difference between coins based on a Bitcoin like structure and other coin emerges from development of different consensus schemes, which determine through different ways the validity of a block of transactions.

In terms of market capitalization, Bitcoin has the highest capitalisation, followed by Ethereum, Ripple and Cardano. Moreover, trading and investment in these cryptocurrencies has been driven mainly by speculation, resulting in volatile market. This severely limits the use of these cryptocurrencies as a store of a value.

Virtual Currencies as a form of assets – Initial Coin Offerings

The crypto space is evolving with a new state of art technology for fund raising and investment. The key word is token. A token is utility, an asset or a unit of value issued by company. Initial Coin Offerings (ICOs) are a way for companies to raise money by issuing digital tokens in exchange for fiat currency or cryptocurrency such as bitcoin or ether.

The issue of ICOs has emerged as alternative to traditional form of start-up financing. The issuance of ICO is generally preceded by company issuing a whitepaper on its technology and explaining the objective for raising funds. These tokens can be transferred across the networks and can be traded on cryptocurrency

exchanges. They can serve multiple functions:

a. from granting investors access to a service

b. entitling investors to share of the start-up company’s dividend

There is a clear risk with issuance of ICOs as many of the companies are looking to raise money without having any tangible products. The regulation of digital coins or tokens depend on the characteristics and the purpose for which they are being issued. Depending upon the objective of the issue, tokens can be grouped into two broad categories:

a. Utility Tokens – These are offered to investors to access to company’s products or services. They are not to be treated as investment in the company.

b. Security Tokens – These are offered as investments in a company. Just like shareholders in a company, token holders are given dividends in the form of additional coins every time the company issuing the tokens earns a profit in the market.

Virtual Currencies – Payment Systems, Legal Tender and means of exchange

The Committee observed that in countries like Russia and Canada, virtual currencies to be traded for other goods or services. These transactions are similar to using virtual currency as a mode of payment. Some countries like Switzerland and Thailand allow for virtual currencies to be mode of payments. However, since they are not classified as legal tender, the parties are not legally obliged to accept them. No country across the world treats virtual currencies as legal tender. Countries like China have completely banned virtual currencies. It does not allow any sort of legal transactions in virtual currencies.

In India, since the virtual currency does not have expressly guaranteed by the Central Government, the virtual currency cannot be called as legal tender.

Cryptocurrency vs Fiat Currency

The Committee has expressed that underlying technologies such as blockchains may be used beyond to bring efficiency and transparency in government services for citizens. It is therefore to be emphasised that the concerns of the Committee are narrowly focused on non-official digital currencies and not the underlying technologies or VCs issued by the Government.

It is essential to understand the basis for the underlying value of cryptocurrencies. Unlike fiat currencies, these cryptocurrencies do not have sovereign backing, nor do they have formal, verified backing of bullion. It is possible that the cryptocurrencies might have functional benefits, such as some special functionality or tangible benefit that the cryptocurrency could provide. However, the market potential of these functionalities is subject to technological and behavioural changes, as well as the scope of financial investment that the cryptocurrencies can raise. All these factors make cryptocurrencies negligible, and subject to severe shocks or fluctuations.

Further, the large gap in the transaction processing speed between cryptocurrencies (especially Bitcoin), and other electronic payment methods, hinders their ability to be used as medium of exchange. Large fluctuations in price preclude cryptocurrencies from being a suitable store of value. The volatility of the cryptocurrency to fiat exchange rates is large relative to even risky equities. These features are not in consonance with the essential characteristics of money, and hence cannot replace fiat currencies.

These characterstics of VCs create consumer protection issues, risks to financial system and the overall economy and can facilitate criminal activity, which is discussed hereunder.

Need to protect consumers:

- Non-Official VCs can be used to defraud consumers, particularly unsophisticated consumers. Recent scam of INR 2000 Crores involving GaintBitcoin is an example, where more than 8000 people were cheated.

- Besides outright fraud, there are inherent vulnerabilities in the design of some VCs that leave consumers open to risk. Miners of currency can collude to earn more revenue by forking, a currency, or changing the programming protocol to benefit themselves.

- Many instances of booms and busts in valuation of VCs have caused significant losses to investors. In December 17, Bitcoin was valued at $ 20,000 per coin. However, by November end bitcoin’s value toppled to approx. 80% of its peak value. Evidence of manipulation cryptocurrency prices are rampant. There are, therefore, many instances of investors and customers suffering heavy losses due to high volatility and speculative activity in VCs.

Need to protect the Financial System and Economy:

- The mining of non-official VCs is very resource intensive. The Bank for International Settlements report8 states that to scale to a national level retail payments system, a VC would require crippling levels of storage and processing power. According to a study, an estimate of 19 households in the US can be powered for one day by the electricity consumed in single Bitcoin transaction. The diversion of such large amounts of energy resources to mining VCs can have unfavourable longterm economic consequences.

- Non-Official VCs are extremely volatile as value is directly tied to demand in the absence of central bank intervention to control suppl. This is true even for VCs designed to be stable, for example BitUSD and Dai.

- Non-official virtual currencies could affect the ability of central banks to carry out their mandates. Central banks cannot regulate the money supply in the economy if non-official virtual currencies are widely used, as these are decentralised. This restricts their ability to stabilise the economy. In addition, cross-border transactions with non-official virtual currencies can violate limits on the inflow and outflow of money, particularly as such transactions happen irreversibly. This compromises an- other important lever of monetary policy.

Need to prevent Criminal Activity:

- Financial Action Task Force (FATF) identifies that VCs can provide greater anonymity than mainstream non-cash payments methods, making them vulnerable to money laundering and use in terrorist financing activities. The report by the FATF acknowledges that while virtual currencies have the potential to spur innovations, they also create new opportunities for criminals to launder their proceeds or finance their illicit activities. To address these challenges, it has called for riskbased

supervision.

Major Recommendations of Committee on VCs:

- The Committee notes that with serious concerns mushrooming of cryptocurrencies almost invariably issued abroad and numerous people in India investing in these cryptocurrencies. All these cryptocurrencies have been created by non-sovereigns and are in this sense entirely private enterprises.

- There is no underlying intrinsic value of these private cryptocurrencies. These private cryptocurrencies lack all the attributes of a currency. There is no fixed nominal value of these private cryptocurrencies i.e. neither act as any store of value nor they are a medium of exchange.

- A review of global best practises also shows that private cryptocurrencies have not been recognised as a legal tender in any jurisdiction. The Committee recommends that all private cryptocurrencies, except any cryptocurrency issued by the State, be banned in India.

- The Committee endorses the stand taken by the RBI to eliminate the interface of institutions regulated by the RBI from cryptocurrencies. The Committee also recommends that all exchanges, people, traders and other financial system participants should be prohibited from dealing with cryptocurrencies. Accordingly, the Committee has recommended a law banning the cryptocurrencies in India and criminalising carrying on of any activities connected with

8 Cryptocurrencies – Looking beyond The Hype

DLTs as the underlying technology for VCs

E-money and other existing electronic means of payments have their value stored on a piece of hardware (cards), for instance, in chips or the records of third party facilitating the transactions. This value is generally guaranteed by legislation of the state under which the hardware (or card) is issued. As stated earlier, the Cryptocurrencies are based on DLs, where the records of the transaction are stored on a publicly distributed chain, encrypted to provide pseudonymity to the transactors, and avoid doublespend, detactable through a working consensus algorithm.

A transaction in cryptocurrency space involves the transfer of certain units of the currency from one address (similar to the account number in bank records and also serves as shorter function of public key) on the network to another address via ‘wallet’. A wallet is typically a software such an app on a phone that allows the users to manage its address, public and private keys. While the account address is public, only a private key can ‘unlock’ the address to make the transaction.

Given that cryptocurrencies are not backed by an institution with legal or regulatory authority, the underlying decentralised ledger technology have in-built mechanisms to ensure symmetry of information across all the participating nodes on the system. In addition, the system is designed to make it computationally difficult for anyone to attack the ledger.

This goal is achieved by miners, who look for the hashes of the blocks, which not only contain the information about the block but also the hashes of the preceding blocks. The time-delay caused as well as the intensive computation required for finding the solution to the cryptographic puzzle as discussed above impedes the attacks aimed to create false changes in the blockchain. However, malicious activities have occurred at the expense of huge losses to the participating nodes.

DLTs for Digital Currency in India

Central Bank Digital Currency (CBDC) is the digital form of fiat money. They can be considered as digital form of central bank liabilities. Some central banks have started considering the possibility of issuing their liabilities in digital form at some stage in future. The interest in CBDC across the world has been motivated by:

a. Interest in technological innovation in the financial sector

b. Declining use of cash in a few countries

c. Emergence of new entrants in the payments landscape

Example of concept of CBDC – RSCoin

In 2016, the Blockchain Initiative Group at University College of London released the concept of centrally banked digital currency called RSCoin. The motivation was to create a scalable cryptocurrency which could be used with minimal computational costs, unlike Bitcoins. The central bank in this system will have complete control over money supply, while the maintenance of transaction ledger will be done through mintettes. The mintettes are analogous to miners, however instead of performing a computationally

difficult task to validate transactions, they will be authorised to collect transactions and collate it into blocks. The central bank will then take these collated blocks to form a consistent history in the form of a new block. Privacy of the transactions can be ensured through different techniques. The centralisation of monetary policy would be a more scalable consensus mechanism than the computational and resource intensive proof-of-work type mechanisms.

CBDC in India: Risks and issues in implementation

A review of existing literature highlights significant risks and issues to the implementation of CBDCs. These depend on varying factors such as:

a. The proposed design of CBDCs and its impact on existing payments infrastructure, monetary policy transmission and financial stability.

b. Requirements for building new infrastructure for CBDCs based on distributed and transparent validation and transition issues

c. The degree of cash available in the market and the usage of virtual or electronic money and payment systems and

d. The resilience of existing financial firms such as banks to deal with disruptions caused due to the CBDCs.

Major Recommendations of Committee on CBDCs:

- The Committee is of the view that it would be advisable to have open mind regarding the introduction of an official digital currency in India.

- It may possible to visualise some models of future official digital currencies but as of date it is unclear as to whether there is clear advantage in the context of India to come up with a official digital currency. Hence, the committee recommends that, if required, a group may be constituted by Department of Economic Affairs for examination and development of an appropriate model of digital currency in India.

Major Recommendations of Committee on DLTs usage:

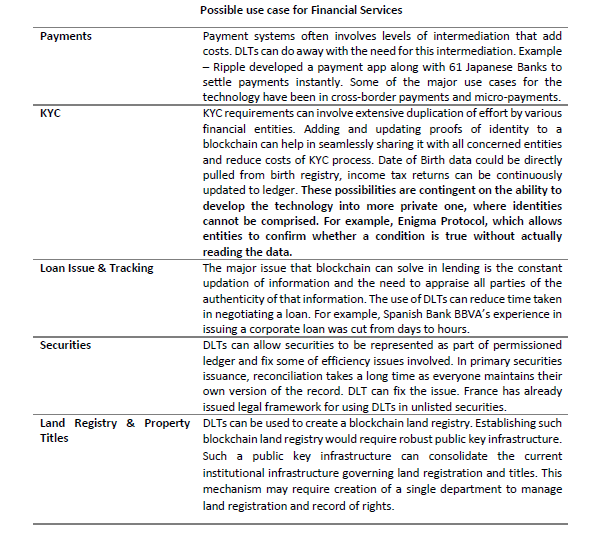

- The Committee recommends that RBI examine the utility of using DLT based systems for enabling faster and more secure payment infrastructures, especially cross-border payments.

- The Committee recommends that blockchain based systems may be considered by MEITY for building a lowcost KYC system that reduces the need for duplication of KYC requirements for individuals.

- The Committee is of the opinion that DLT-based systems can be used by banks and other financial firms for processes such as loan-issuance tracking, collateral management, fraud detection and claims management in insurance, and reconciliation systems in the securities market. The Committee therefore recommends that financial sector regulators examine the uses of DLT in processes that can be incorporated by banks, insurance companies, securities exchanges etc. in their functioning.

Banning of Cryptocurrency & Regulation of Official Digital Currency Bill, 2019

Clause 3 – General Prohibition

The said section deals with prohibited transactions. It states that no person shall mine, generate, hold, sell, deal in, issue, transfer, dispose of or use cryptocurrency9 in the territory of India. However, nothing the proposed act does not apply to any person using technology or processes underlying any cryptocurrency for the purpose of experiment or research, including imparting of instructions to pupils provided that no cryptocurrency shall be used for making or receiving payment in such activity.

Further, the said section also excludes the applicability of the act to use of DLT10 for creating network for delivery of financial or other services or for creating value, without involving use of cryptocurrency, in any form whatsoever, for making or receiving payment.

Clause 4 – Government authorised Cryptocurrency as Legal Tender and Currency

The said clause deals with recognition of official digital currency for the purposes of CBDCs as discussed earlier.

The Central Government, in consultation with Central Board of RBI, may approve Digital Rupee to be legal tender with effect from such date and to such extent as may be specified.

Clause 5 – Foreign Digital Currency as Foreign Currency

RBI may by notification declare any foreign digital currency to be recognised as foreign currency in India to the extent specified. Digital Rupee shall be governed by RBI via regulations and digital foreign currency will be governed by FEMA regulations.

Digital Rupee – means a form of currency issued digitally by RBI and approved by Central Government to be legal tender.

Foreign Digital Currency – means any class, category or type of digital currency recognised as legal tender in a foreign jurisdiction.

Official Digital Currency – means the digital rupee or digital foreign currency under Section 5(1).

Clause 6 – Prohibition on use of Cryptocurrency

No person shall directly or indirectly use Cryptocurrency in any manner, including as – a medium of exchange and/or storage of value and/or a unit of account. Cryptocurrency shall not be used as legal tender or currency at any place in India.

9 ‘Cryptocurrency’, by whatever name called, means any information or code or number or token not being part of any Official Digital Currency, generated through cryptographic means or otherwise, providing a digital representation of value which is exchanged with or without consideration, with the promise or representation of having inherent value in any business activity which may involve risk of loss or an expectation of profits or income, or functions as a store of value or a unit of account and includes its use in any financial transaction or investment, but not limited to, investment schemes – Clause 2(a).

10 ‘Distributed Ledger Technology’ means any technology that enables transactions and data to be recorded, shared, and synchronized across multiple data stores or ledgers, or a distributed network of different network participants, through the use of independent computers (referred to as nodes) who record, share and synchronize such transactions and data in their respective electronic ledgers (instead of keeping data centralized as in the case of a traditional ledger – Clause 2(e).

Clause 7 – Prohibition on use of Cryptocurrency for certain activities

No person shall directly or indirectly use Cryptocurrency for activities including, the following:

a. as a payment system, whether authorised under Section 4 of Payment & Settlement Systems Act

b. buy or sell or store cryptocurrency

c. provides cryptocurrency related services to consumers or investors

d. trade cryptocurrency with Indian currency or foreign currency

e. issue cryptocurrency related financial products

f. as a basis of credit

g. issue cryptocurrency as a means of raising funds and/or

h. as a means of investment

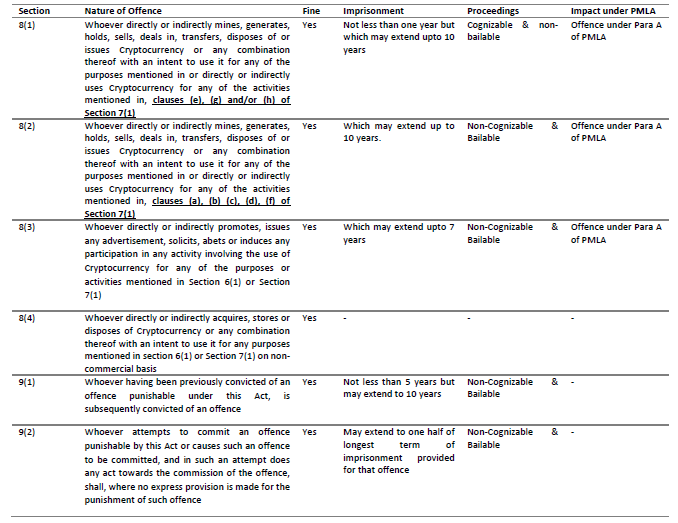

Clause 8 & 9 – Offences

Clause 10 – Maximum amount of Fine

For the purposes of Section 8 and Section 9, the maximum amount of fine that can be imposed on a person for an offence shall be:

a. Higher of –

i. 3 times of loss or harm caused by person or

ii. 3 times of gains made by person

b. If loss caused or gains made cannot be reasonably determined, the maximum amounts of fines are specified in First Schedule as under:

i. Section 8(1) – upto Rs 25 Crores

ii. Section 8(2) – upto Rs 25 Crores

iii. Section 8(3) – upto Rs 25 lakhs

iv. Section 8(4) – upto Rs 1 lakhs

v. Section 9(1) – upto Rs 50 Crores

vi. Section 9(4) – upto Rs 25 Crores.

Clause 11 – Investigating Authorities

Notwithstanding anything contained in the Code of Criminal Procedure, 1973, the investigating authority shall investigate any offence under this Act. The Central Government may notify appropriate levels of police officer for investigation of offences specified under this law.

Clause 16 – Power to grant Immunity

The Central Government may, on recommendation by the Investigating Authority, if it is satisfied, that any person, who is alleged to have violated any of the provisions of this Act or the rules made there under, has made a full and true disclosure in respect of alleged violation, grant to such person, subject to such conditions as it may think fit to impose, immunity from prosecution for any offence under this Act, or the rules made there under or also from the imposition of any fine under this Act with respect to the alleged violation.

However, no such immunity shall be granted in cases where the proceedings for the prosecution for any such offence have been instituted before the date of receipt of application for grant of such immunity.

Clause 19 – Act to have overriding effect

The provisions of this Act shall have effect notwithstanding anything inconsistent therewith contained in any other law for the time being in force.

Clause 26 – Transition Provision

Any person shall, on or after the date of commencement of this Act but on or before the expiry of 90 days from the date of commencement, make a declaration in respect of Cryptocurrency in such person’s possession and shall dispose of the same within the aforesaid period in the manner specified.

Clause 27 – Amendment to Certain Acts

Prevention of Money Laundering Act, 2002 (PMLA) has been proposed to be amended vide Clause 27. The proposed amendment is to insertion of offences under Section 8(1), 8(2) and 8(3) as schedule offences under Para A of PMLA.

The above is contributed by CA Suresh Babu S & CA Sri Harsha. For any further queries or discussion on the above, please reach This email address is being protected from spambots. You need JavaScript enabled to view it., This email address is being protected from spambots. You need JavaScript enabled to view it. or This email address is being protected from spambots. You need JavaScript enabled to view it.

Disclaimer:

The above is contributed by the respective resource persons and any opinion mentioned therein is his/their personal opinion. The first note is intended to be circulated among fellow professional and clients of the Firm, to provide general information on a particular subject or subjects and is not an exhaustive treatment of such subject(s). The information provided is not for solicitation of any kind of work and the Firm does not intend to advertise its services or solicit work through this note. The information is not intended to be relied upon as the sole basis for any decision. Before making any decision or taking any action that might affect your personal finances or business, you should consult a qualified professional adviser.