Introduction:

The concept of Fees for Technical Services (for brevity ‘FTS’) or Fees for Included Services (for brevity ‘FIS’) is a subject matter for constant litigation. The main reason for the litigation is because of the definition of FTS/FIS differs among Income Tax Act (for brevity ‘ITA’) and treaties. Added to this layer of confusion, is that such definition varies from treaty to treaty. Further, there are no hard and fast rules to consider a particular service as FTS/FIS and every transaction has to be decided on facts of each case which results in multiple interpretations and long drawn litigation for FTS/FIS.

It is known fact, that multinational groups companies incorporate a subsidiary in India and provides various management or business support services to its subsidiary company in India to ensure effective and efficient maintenance of business operations in India.

These services inter alia include finance, accounting, group taxation, engineering, human resources, marketing and strategic planning, management support, legal etc. (referred as ‘management support services’/’MSS’).

ABC Inc a company incorporated in USA has entered into license agreement with ABC India Private Limited for manufacturing of goods in India. Subsequent to such license agreement, ABC Inc has entered into another agreement for providing various MSS.

Now, let us proceed, to understand taxability of such MSS in India in the context of treaty between India – USA.

While the taxability of MSS has multiple dimensions, this Article is limited to management support services when Indian party is paying royalty in respect of license obtained from foreign party.

The question that arises is whether the above services provided by non-resident to a person resident in India is taxable as FTS/FIS in India or not?

The definition of term FTS under Section 9(1) (vii) of ITA contains three limbs i.e., managerial, technical or consultancy services. While such terms are not expressly defined under ITA, judicial fora have defined what constitute managerial, technical or consultancy services.

MSS described earlier, would fit into the definition of FTS under section 9(1)(vii) of ITA. However, as it is required to analyse the provisions of treaty as well (considering Section 90(2) of ITA), to understand the liability of such services in India, definition of FTS/FIS under treaty is also required to be seen.

However, treaties with India have differently defined the term FTS/FIS. Let us try to understand the definition of FTS/FIS from certain treaties:

India – USA:

Article 12 (4) of India – USA treaty defines the term FIS to mean any payment for rendering of any technical or consultancy services if such services:

- are ancillary and subsidiary to the application or enjoyment of right, property or information in respect which royalty is paid (for brevity ‘ancillary and subsidiary clause’) or

- make available technical knowledge, experience, skill, know how, or process, or consist of the development and transfer of technical plan or technical design (for brevity ‘make available clause’).

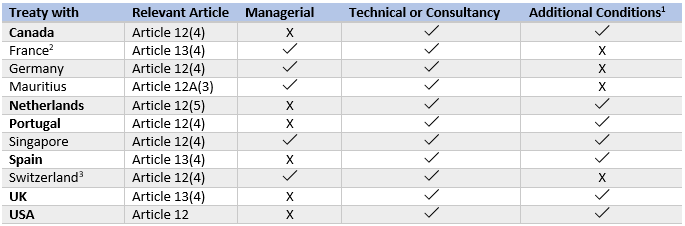

In simpler words, it means that in order to consider a particular payment as FIS, such service should be in the nature of technical or consultancy services and such services satisfies any one of the two conditions i.e., ancillary and subsidiary clause or satisfies make available clause. Summary of FIS/FTS clause in respect of some of the treaties with India has been provided below:

The definition of FTS under ITA is wider in its coverage as it includes managerial, technical or consultancy services in its definition whereas the definition of FTS/FIS under treaty with Canada, Netherlands, Portugal, Spain, USA and UK does not have place for managerial services.

Treaty between India – USA states that FTS/FIS is taxable in India if such services are in the nature of technical or consultancy services and if such services satisfy either ancillary and subsidiary clause or make available clause.

To understand the taxability of above services when royalty is paid, such services have to qualify following tests:

- Whether such services are in nature of technical or consultancy services?

- Whether such services satisfy ancillary and subsidiary clause?

Let us proceed to examine each of the above test in the context of the facts of the case study taken.

Whether such services are in nature of technical or consultancy services?

When the term ‘managerial’ is not included in the definition of FTS/FIS, it is not appropriate to consider MSS as FTS/FIS and such services may be taxable as business income subject conditions in this connection.

The Kolkata Tribunal in the case of Koninklijke Philips Electronics N.V.[4] has held that management support services are not taxable as FIS as per the Article 12 of DTAA. The Tribunal has found that treaty between India – Netherlands does not contain the term ‘managerial’ in FTS/FIS definition and assessee has received various management support services. As such services are managerial in nature, Tribunal has held that such services are not taxable in India.

The AAR in the case of Cummins Ltd., In re[5] has in the context of India – UK treaty has held that as the term ‘managerial’ is excluded from the ambit of FTS w.e.f. from 11.02.1994, management support services could not be considered as FTS under the treaty. Same view has been held by AAR in the case of Measurement Technology Ltd, In re[6] and Mumbai Tribunal in the case of Raymond Ltd.[7]

However, the term ‘Managerial’ has not expressly defined either in section 9(1)(vii) or treaty. When a particular term is not expressly defined, it leads to litigation at various judicial fora.

Different tribunals have interpreted the term ‘managerial’. Mumbai Tribunal in the case of UPS SCS (Asia) Ltd.[8] has analysed the meaning of the term ‘managerial’ in detail. The Tribunal has held that managerial services mean managing the affairs by laying down certain policies, standards and procedures and then evaluating the actual performance in the light of the procedures so laid down. The managerial services contemplate not only execution but also the planning part of the activity to be done. If the overall planning aspect is missing and one has to follow a direction from the other for executing particular job in a particular manner, it cannot be said that the former is managing that affair.

Further, in various occasions, Courts have held that human intervention is mandatory in to provide managerial services. Hence, the term managerial has to be understood from the facts of each case and cannot be defined.

When services provided by non-resident are in the nature of managerial services, such services cannot be construed as FTS/FIS when treaty does not contain such term in its definition. However, it is required to establish that services provided by non-resident are in the nature of managerial services to be out of the tax net.

Whether such services satisfy ancillary and subsidiary clause?

Once it is established that such services are not in the nature of managerial services and falls under the category of ‘technical’ or ‘consultancy’ services, services would not automatically become FTS/FIS unless such services satisfy either of the two additional conditions.

First of the additional condition states that if such services are ancillary and subsidiary to the application or enjoyment of right, property or information in respect which royalty is paid then, such services would be considered as FTS/FIS.

Let us proceed to understand what constitute ancillary and subsidiary for the purpose of FTS/FIS. The memorandum to India - USA explains the context in which ‘ancillary and subsidiary’ clause can be invoked.

‘It is understood that, in order for a service fee to be considered "ancillary and subsidiary" to the application or enjoyment of some right, property, or information for which a payment described in paragraph 3(a) or (b) is received, the service must be related to the application or enjoyment of the right, property, or information. In addition, the clearly predominant purpose of the arrangement under which the payment of the service fee and such other payments are made must be the application or enjoyment of the right, property, or information described in paragraph 3. The question of whether the service is related to the application or enjoyment of right, property, or information described in paragraph 3 and whether the clearly predominant purpose of the arrangement is such application or enjoyment must be determined by reference to the facts and circumstances of each case. Factors which may be relevant to such determination (although not necessarily controlling) include:

- The extent to which the services in question facilitate the effective application or enjoyment of the right, property, or information described in paragraph 3;

- The extent to which such services are customarily provided in the ordinary course of business arrangements involving royalties described in paragraph 3;

- Whether the amount paid for the services (or which would be paid by parties operating at arm's length) is an insubstantial portion of the combined payments for the services and the right, property, or information described in paragraph 3;

- Whether the payment made for the services and the royalty described in paragraph 3 are made under a single contract (or a set of related contracts); and

- Whether the person performing the services is the same person as, or a related person to, the person receiving the royalties described in paragraph 3 [for this purpose, persons are considered related if their relationship is described in Article 9 (Associated Enterprises) or if the person providing the service is doing so in connection with an overall arrangement which includes the payer and recipient of the royalties.

From the above, it is clearly stated that in order to treat a particular service as ancillary and subsidiary to the application or enjoyment of right, property or information, above factors needs to be considered in each case. If the predominant purpose of service agreement is for effective use of license and payment for such services would constitute insubstantial portion of total payment, such services may be considered as ancillary and subsidiary to the application or enjoyment of right, property or information. In order to better understand the above clause, memorandum further provides examples.

“Example1

Facts:

A U.S. manufacturer grants rights to an Indian company to use manufacturing processes in which the transferor has exclusive rights by virtue of process, patents or the protection otherwise extended by law to the owner of a process. As part of the contractual arrangement, the U.S. manufacturer agrees to provide certain consultancy services to the Indian company in order to improve the effectiveness of the latter's use of the processes. Such services include, for example, the provision of information and advice on sources of supply for materials needed in the manufacturing process, and on the development of sales and service literature for the manufactured product. The payment allocable to such services do not form a substantial part of the total consideration payable under the contractual arrangement. Are the payments for these services fees for "included services"?

Analysis:

The payments are fees for included services. The services described in this example are ancillary and subsidiary to the use of manufacturing process protected by law as described in paragraph 3(a) of Article 12 because the services are related to the application or enjoyment of the intangible and the granting of the right to use the intangible as the clearly predominant purpose of the arrangement. Because the services are ancillary and subsidiary to the use of the manufacturing process, the fees for these services are considered for included services under paragraph 4(a) of Article 12, regardless of whether the services are described in paragraph 4(b).

Example 2

Facts:

An Indian manufacturing company produces a product that must be manufactured under sterile conditions using machinery that must be kept completely free of bacterial or other harmful deposits. A U.S. company has developed a special cleaning process for removing such deposits from that type of machinery. The U.S. company enters into a contract with the Indian company under which the former will clean the latter's machinery on a regular basis. As part of the arrangement, the U.S. company leases to the Indian company a piece of equipment which allows the Indian company to measure the level of bacterial deposits on its machinery in order for it to known when cleaning is required. Are the payments for the services fees for included services?

Analysis:

In this example, the provision of cleaning services by the U.S. company and the rental of the monitoring equipment are related to each other. However, the clearly predominant purpose of the arrangement is the provision of cleaning services. Thus, although the cleaning services might be considered technical services, they are not "ancillary and subsidiary" to the rental of the monitoring equipment. Accordingly, the cleaning services are not "included services" within the meaning of paragraph 4(a).

The Mumbai Tribunal in the case of Lloyd’s Register Asia[9] has held that management services viz. corporate communications, corporate finance and group reporting services, group quality assurance, human resources, information technology, integrated business system, internal audit services, legal services, operational management and reporting, risk management and secretarial services and taxation and treasury services are not to be considered as taxable as FTS/FIS by stating that such services are ancillary and subsidiary to the application or enjoyment of right, property or information.

However, Delhi Tribunal in the case of H.J. Heinz Company[10], in the context of provision of services in the area of supply chain Human Resources, Strategic Planning and marketing, Finance and information systems, has rejected the assessee claim wherein the assessee has contended that those services could not be considered as ‘ancillary and subsidiary’ to enjoyment or application of right. Further, Mumbai Tribunal in the case of Aktiebolaget SKF[11] has held that IT services has to be considered as ‘ancillary and subsidiary’.

Recently, the Delhi Tribunal in the case of Russell Reynolds Associates Inc [12] has held that managerial services are not covered under the definition of FIS, the concept of invoking para 4(a) to Article 12 i.e., services which are ancillary and subsidiary to the application or enjoyment of right does not arise.

Considering the above judicial precedents and memorandum to the India – USA treaty, whether a particular service is ancillary and subsidiary nature has to be tested with the facts of each case. However, considering the above trend of litigation, revenue may question the payment to non-resident persons even though such services are managerial in nature and treaty does not have such term in FTS/FIS definition.

Further, when treaty contains the term ‘managerial’ in its FTS/FIS definition and assessee is paying license fee along with fee for support services, it would be difficult to defend the tax liability. In such a situation, assessee has to substantiate that payment for various support services are not linked with license fee and both are different in nature.

Delhi Tribunal in the case of Russell Reynolds Associates Inc (Supra) has found that payment for services is not insubstantial amount and license agreement is entered after the entering to the agreement for services. Accordingly, Tribunal has held that such services are not ancillary and subsidiary to the application or enjoyment of right, property or information.

Conclusion:

The term managerial services are not expressly defined in the ITA or treaty. Hence, considering the frequent litigation by the revenue, it is advisable to maintain robust documentation and information in order substantiate that the service would fall under the definition of managerial in nature.

Further, it is required to analyse treaty before concluding whether managerial services would qualify as FTS/FIS or not. For example, treaty with Singapore contains the term ‘managerial’ in its definition. However, unlike other treaty which contains managerial services, Singapore treaty additionally contains additional conditions. Hence, it is required to pass either of the two conditions under Singapore treaty even though such services are managerial in nature.

Further, some of the treaties with India contains MFN clause which may change the entire concept of FTS/FIS. The Delhi Courtin the case of Steria (India) Ltd.[13] has held that restrictive scope of FTS under India – UK treaty is applicable for India- France treaty as treaty with France contains MFN Clause. Accordingly, High Court has held that management services are not taxable even under India - France treaty. Same view has been upheld by various tribunals. Hence, while analysing the treaty regarding management services, above factors needs to be considered. However, taxability services may not be judged without analysing the make available clause as treaty states that either of the conditions is required to be satisfied in order to treat particular service as FTS/FIS. Hence, as a last check, it is required to understand whether such services satisfy test of make available.

Whether such services satisfy make available clause?

This clause needs to be tested only when services provided by the non-resident covered under technical or consultancy services and does not satisfy the additional condition 1 i.e., ‘ancillary and subsidiary’ clause. This is because, FTS/FIS definition states that either of the two additional conditions needs to be satisfied in order to treat particular services as FTS/FIS.

There are multiple jurisprudences on this issue whether managerial services satisfy the test of make available.

Ahmedabad Tribunal in the case of Bombardier Transportation India (P.) Ltd[14] has held that as the management support services does not satisfy the test of make available, such services would not be considered as FIS. In this case, the assessee has obtained various management support services viz. finance an accounting, group taxation, engineering, human resources, marketing and strategic planning, management support, HR back office, legal etc. The Tribunal has point outed that the services received by the assessee were simply management support or consultancy services which did not involve any transfer of technology.

The Mumbai Tribunal in the case of Exxon Mobil Company India (P.) Ltd.[15] has held that administrative service in the nature of controller, treasurers, public affairs, tax, human resources, law, safety, health and environment services, medical security, business procurement, business line, etc., does not satisfy the test of make available and same is not taxable under Article 12 of India – Singapore DTAA. The Tribunal has pointed out that, to satisfy the test of make available, the technical knowledge, experience, skill, etc., must remain with the service recipient even after the rendering of the services has come to an end.

The Mumbai Tribunal in the case of Edenred Pte. Ltd.[16], in the context of consultancy services, legal services, financial advisory services and human resources assistance, has held that the management services are provided only to support the assessee in carrying on its business efficiently and running the business in line with the business model, policies and best practices followed by the group. These services do not make available any technical knowledge, skill, know-how or processes to assessee. While adjudicating the matter, the Tribunal has relied on various judgements on ‘make available’ and provided the judgement.

The Mumbai Tribunal in the case of Dimension Data Asia Pecific Pte. Ltd.[17] has held that advisory services in the field of management, sales, marketing, finance and administrative, human resources and information technology etc are not taxable as FTS under India – Singapore DTAA as they do not satisfy the test of make available.

The Kerala High Court in the case of US Technology Resources (P.) Ltd.[18] has held that advisory services in respect of management decision making, financial decision making, legal matters and public relation activities, treasury services and risk management services for making correct decision does not satisfy the test of make available.

Judicial fora have given above judgements as alternate remedy to managerial services. Courts in the first instant have held that as such services are managerial in nature and such term is absent in treaty, services are not taxable as FTS/FIS. Alternatively, courts have held that even under Article 12(4)(b) as those services do not satisfy the test of make available, such services are not taxable in India. Hence, it can be concluded that MSS in the absence of ‘managerial’ in FTS/FIS definition, may not be taxable in India even though services satisfy additional condition i.e., ancillary and subsidiary to the application or enjoyment of right, property or information.

Which means that MSS is taxable only when FTS/FIS definition contains managerial and such services satisfy either of the two additional conditions. As many Tribunals have held that MSS does not satisfy the test of make available, MSS is taxable only when such services satisfy ancillary and subsidiary clause subject to having such term in the definition of FTS/FIS (ex: India-Singapore treaty).

[1]Ancillary and subsidiary to the application or enjoyment of right, property or information in respect of which royalty is made and make available clause.

[2] By virtue of MFN Clause, scope of FTS/FIS to be restricted to that of India – UK/USA treaty. For detailed analysis of MFN clause, read our article at here

[3] By virtue of MFN Clause, scope of FTS/FIS to be restricted to that of India – UK/USA treaty subject to other conditions.

[4] [2018] 99 taxmann.com 23 (Kolkata - Trib.)

[5] [2016] 65 taxmann.com 247 (AAR - New Delhi)

[6] [2015] 60 taxmann.com 1 (AAR - New Delhi)

[7] [2003] 86 ITD 791 (MUM.)

[8] [2012] 18 taxmann.com 302 (Mum.)

[9] [2021] 133 taxmann.com 286 (Mumbai - Trib.)

[10] [2019] 108 taxmann.com 473 (Delhi - Trib.)

[11] [2020] 114 taxmann.com 734 (Mumbai - Trib.)`

[12] TS-337-ITAT-2022(DEL)

[13] [2016] 72 taxmann.com 1 (Delhi)

[14] [2017] 77 taxmann.com 166 (Ahmedabad - Trib.)

[15] [2018] 92 taxmann.com 5 (Mumbai - Trib.)

[16] [2020] 118 taxmann.com 2 (Mumbai - Trib.)

[17] [2019] 107 taxmann.com 418 (Mumbai - Trib.)

[18] [2018] 97 taxmann.com 642 (Kerala)