Introduction:

In our previous article[1], the concept of taxability of management support services (for brevity ‘MSS”) under fee for technical services (for brevity ‘FTS’ or ‘FIS’) clause has been analyzed in detail.

We have concluded that MSS is not taxable under Article 12, since the term ‘managerial’ is not included in the definition of FTS/FIS. However, we cannot conclude the non-taxability of such income only on examining Article 12. The examining of taxation of such income will not be completed without analyzing the taxability of such services under Articles which deals with ‘Other Income’.

|

ABC Inc a company incorporated in USA has entered into license agreement with ABC India Private Limited for manufacturing of goods in India. Subsequent to such license agreement, ABC Inc has entered into another agreement for providing various MSS. Now, let us proceed, to understand taxability of such MSS in India in the context of treaty between India – USA. |

Let us proceed to continue with the same example considered in the previous Article.

When the above services are not taxable under FTS/FIS clause, whether management support services would be taxable under Articles which deals with ‘Other Income’?

India -USA:

- Subject to the provisions of paragraph 2, items of income of a resident of a Contracting State, wherever arising, which are not expressly dealt with in the foregoing Articles of this Convention shall be taxable only in that Contracting State.

- The provisions of paragraph 1 shall not apply to income, other than income from immovable property as defined in paragraph 2 of Article 6 [Income from Immovable Property (Real Property)], if the beneficial owner of the income, being a resident of a Contracting State, carries on business in the other Contracting State through a permanent establishment situated therein, or performs in that other State independent personal services from a fixed base situated therein, and the income is attributable to such permanent establishment or fixed base. In such case the provisions of Article 7 (Business Profits) or Article 15 (Independent Personal Services), as the case may be, shall apply.

- Notwithstanding the provisions of paragraphs 1 and 2, items of income of a resident of a Contracting State not dealt with in the foregoing articles of this Convention and arising in the other Contracting State may also be taxed in that other State.

From the above, it is evident that, Para 1 of Article 21 gives exclusive rights to Country of Residence (‘CoR’) to tax ‘other income. Further, the term ‘wherever arising’ has significant importance to include incomes arising in third state and not only restricting the scope to incomes arising in either of contracting states (CS).

Further, the Para 2 gives the Country of Source (CoS), right to tax such income, when such income is effectively connected with permanent establishment (PE).

Further, Para 3 gives the taxing rights to CoS as well provided such income arises in the CoS.

In simple words, Para 1 of Article 23 has given exclusive rights to CoR to tax ‘other income’ however, as Para 3 of Article 23 has non-obstante clause, other income may also be taxed in CoS if such income has arisen in the CoS.

Considering the scope of Article 21, the question that arises is, whether MSS, though not taxable under Article 12, will be subjected to tax under the residuary clause, that is Article 21 or similar article?

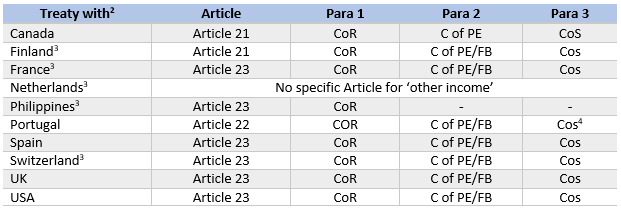

Further, majority of treaties entered into by India with other countries are based on UN MC, such treaties have different treatment in respect of ‘other income’. Hence, it is required to analyse the Article which deals with ‘other income’.

From the above Table, treaties entered into by India can broadly be categorized into three categories.

- Treaty which gives taxing rights to CoS in respect of ‘other income’.

- Treaty which restricts the scope of ‘other income’ in CoS.

- Treaty which does not have ‘other income’ Article.

As this article is limited to ‘managerial’ services, analysis has been restricted taxation of ‘managerial’ services under ‘other income’.

Treaty which gives taxing rights to CoS in respect of ‘other income’:

Treaties with Canada, Finland, France, Portugal, Spain, Switzerland, UK or US provides taxing rights to CoS in respect of ‘other income’. Hence, it is required to analyse whether managerial services are taxable under these treaties as ‘other income’.

Article 21 states that items of income of a resident of a CS not dealt with in the foregoing articles of this Convention and arising in the other Contracting State may also be taxed in that other State.

The Hon’ble Mumbai Tribunal in the case of Mediterranean Shipping Co., S.A.[5] has analysed the term ‘not dealt with in the foregoing article’ in the context of taxability of shipping income under India- Swiss DTAA. The Tribunal has held that in order to say that a particular item of income has been dealt with, it is necessary that the relevant article must state whether Switzerland or India or both have a right to tax such item of income. Vesting of such jurisdiction must positively and explicitly stated and it cannot be inferred by implication. The expression "dealt with" contemplates a positive action and such positive action in the present context would be when there is an article categorically stating the source of country or the country of residence or both have a right to tax that item of income. The fact that the expression used in Article 22(1) of the Indo-Swiss treaty is "dealt with" viz-a-viz the expression "mentioned" used in some other treaties clearly demonstrates that the expression "dealt with" is something more than a mere mention of such income in the article and as rightly contended by the learned counsel for the assessee, the international shipping profits can at the most be said to have mentioned in Article 7 but the same cannot be said to have been dealt with in the said article.

However, the Chennai Tribunal in the case of TVS Electronics Ltd.[6] has opines that when treaty is silent about particular income, provisions of domestic laws shall apply.

The Madras High Court in the case of Bangkok Glass Industry Co. Ltd.[7], has held that since the consultancy income does not fall as miscellaneous income, the same cannot be brought under Article 22. Tribunal has held in the absence of any material to show that the same is not related to the business of the assessee, it cannot be argued that income does not fall under Article 7. Even assuming for a moment that the assessee is an Indian company, given the nature of business of the assessee, if the income earned would qualify for consideration on the normal computation as business income, we do not find that the said character would undergo a change merely on the score that the assessee is not an Indian company.

The Bangalore Tribunal in the case of ABB FZ-LLC[8] has held that the absence of the provision in the DTAA is not an omission but is a deliberate mutual agreement between the contracting States not to recognize/classify any income as Fees for Technical Services for taxation and such income cannot be taxed under the provisions of domestic law. Accordingly, the Tribunal opined that in the absence of the provision in the DTAA to tax Fees for Technical Services the same would be taxed as per the article 7 of the DTAA applicable for business profit and in the absence of PE in India, the said income is not chargeable to tax in India.

The Bangalore Tribunal in the case of IBM India (P.) Ltd.[9] has held that even though the India-Philippines DTAA does not have an Article dealing with 'FTS', its taxation would be governed by Articles 7 or Article 23 as the case may be, depending on the facts and circumstances of each case and not under domestic laws.

The Tribunal further held that it is not the fact of taxability under article 6-22 which leads to taxability under article 23, but the fact of income of that nature being covered by article 6-22 which can lead to taxability under article 23. Article 23 does not apply to items of income which can be classified under sections 6-22 whether or not taxable under these articles.

Following the decision of Bangalore Tribunal, the Visakhapatnam Tribunal in the case of Paramina Earth Technologies Inc[10] has held that there is no dispute that the payment made was in the nature of FTS and there is no article in DTAA for taxing the FTS separately. Therefore, the payment made to the non-resident required to be taxed under article 7 under the head 'business profits'.

Further, Kolkata Tribunal in the case of Andaman Sea Food (P.) Ltd.[11] has held that when a tax treaty does not assign taxability rights of a particular kind of income to the source state under the treaty provision dealing with that particular kind of income, such taxability cannot be invoked under the residuary provisions of article 23 either.

However, Bangalore Tribunal in the case of Electrical Material Center Co. Ltd.[12] has held that are some exceptions provided in Article 22(2) where Article 22(1) is not applicable but those exceptions do not include FTS. Accordingly, Tribunal has held that service income would fall under ‘other income’.

The AAR in the case of Lanka Hydraulic Institute Ltd., In re [2011] 11 taxmann.com 97 (AAR) has held that in the absence of FTS clause, such income would cover under Article 22 (other income) and not under Article 7 (Business profits).

The Chennai Tribunal in the case of Ford India Ltd.[13] has explained this concept in detail. The Tribunal after quoting Madras High Court has held that

- Business income is not taxable in India in the absence of PE. However, as such income is not taxable under Article 7, revenue shall not tax such income under ‘other income’. Similar case with the independent personal services.

- Article 22 does not apply to items of income which can be taxed in any situations under article 6-21 whether or not such an income is actually taxable under these Articles.

- Profits earned by rendering fees for technical services are only a species of business profits just as the profits any other economic activity.

- Fee for technical services is dealt with separately in some treaties for the reason because, under those treaties the related contracting states proceed on the basis that even in the absence of the permanent establishment or fixed base requirements, the receipts of this nature can be taxed, on gross basis, at the agreed tax rate, and, to that extent, such receipts does not fall in line with the scheme of taxation of business profits under art. 7 and professional income under 14.

- When there is an FTS clause, the FTS gets taxed even in the absence of the PE or the fixed base, but the character of FTS receipt is the same, i.e., business income or professional (independent personal) income, in the hands of the same.

As sees from the above precedents, there are diversified views on taxability of an income which is not expressly mentioned in Article 12. In such a case it is ideal to consider Article 7 of the treaty as rightly pointed out by Madras High Court in the case of Bangkok Glass Industry Co. Ltd. (supra) and Chennai Tribunal in the case of Ford India Ltd (supra). As managerial services fall under the limb of business income or professional income, such income may not be covered under Article 21/22 in the absence of PE in the CoS. Further, judicial precedent which are discussed in the previous Article1 have held that such income is not taxable in India. However, considering the trend in the litigation, more clarification from higher judicial is required.

Treaty which restricts the scope of ‘other income’ in CoS:

Treaty with Portugal, Sweden, Hungary limits the scope of income taxable in the CoS (only such income as provided in section 115BB). Hence, effectively, managerial services may not be taxable in India even under ‘other income’ in respect of these treaties.

Treaty which does not have ‘other income’ Article:

Treaty with Netherland does not contain ‘other income’. The question that arises is whether in the absence of ‘other income’, what is the treatment of such income?

Whether it is not taxable in CoS or taxable under domestic laws of such CoS?

In such a case, revenue may argue that the treaty is not negotiated in respect of ‘other income’, taxing rights have been left to CSs as per domestic laws.

Further, if such income is taxable in accordance with domestic laws of both CSs, the question of taking credit of taxes paid in CoS may become hurdle as tax credit is available only with respect to taxes paid under treaty. Whether the issue of managerial services ends with Article 21? No,

[1] Management Support Services vis-à-vis Ancillary and Subsidiary Clause–An Analysis on position under Treaties - Taxmann

[2] Treaties which do not have the term ‘managerial’ in FTS/FIS scope are only considered.

[3] By virtue of MFN Clause, scope of FTS/FIS must be restricted (akin to India-US/UK). For detailed analysis of MFN clause click here

[4] limited scope - akin to section 115BB

[5] [2012] 27 taxmann.com 77 (Mum.)

[6] [2012] 22 taxmann.com 215 (Chennai)

[7] [2013] 34 taxmann.com 77 (Madras)

[8] [2016] 75 taxmann.com 83 (Bangalore - Trib.)

[9] [2018] 100 taxmann.com 230 (Bangalore - Trib.)

[10] [2020] 116 taxmann.com 347 (Visakhapatnam - Trib.)

[11] [2012] 22 taxmann.com 400 (Kol.)

[12] [2017] 86 taxmann.com 222 (Bangalore - Trib.)

[13] [2017] 78 taxmann.com 5 (Chennai - Trib.)