A person in India may remit amount to outside India under various situations. In order to regulate such remittances, various regulations have been inserted under Foreign Exchange Management Act, 1999 (‘FEMA’) and Income Tax Act, 1961 (‘ITA’). In this article, the concept of remittance of amount to outside India by Individual has been discussed in detail.

An Individual may remit amount to outside India for various purposes viz. foreign trip, foreign education, medical facilities, investment in abroad, sale proceeds of investments in India, income earned in India etc.,

Before proceeding to understanding the provisions relating to remittance of amount to outside India, it is required to understand the residential status under FEMA and ITA. This is because, an individual being a resident in India may remit the amount to outside for above mentioned purposes under Liberalized Remittance Scheme (‘LRS’). However, non-residents in India are not permitted to remit the amount under LRS but they may remit the amount to abroad under remittance of assets regulations subject to other conditions.

Under FEMA, concept of resident in India has been defined under section 2(v) of FEMA and such residential status has to be determined based on the intention and purpose of leaving India/coming to India. However, residential status under section 6 of ITA has to be determined based on number of days of stay in India.

Further, once number of days of stay in India has been determined, individual may become resident/non-resident for entire year under ITA, whereas under FEMA, such person may be treated as resident/non-resident from the date of coming to India/leaving India, as the case may be. This drives home a point that determination of residential status under FEMA and ITA are independent to each other, and such person has to be considered as resident/non-resident according to provisions of respective Acts.

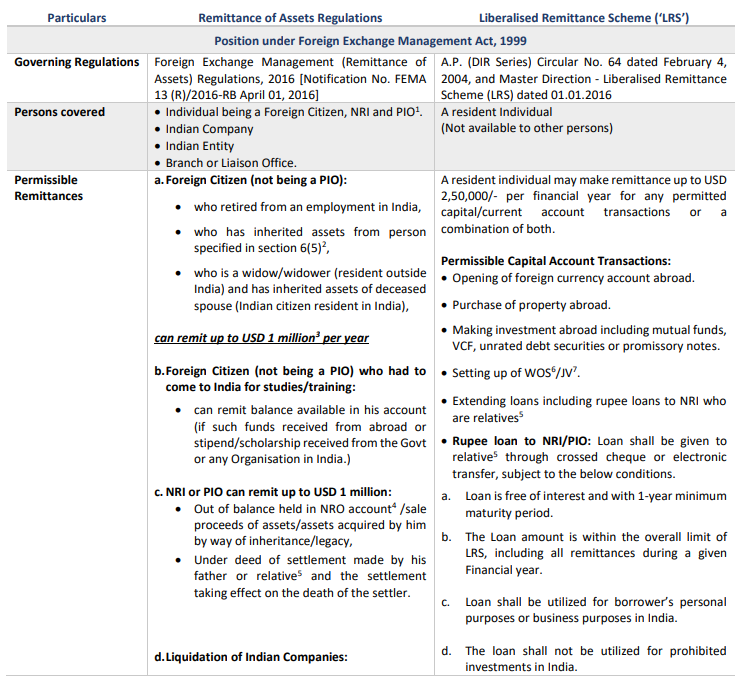

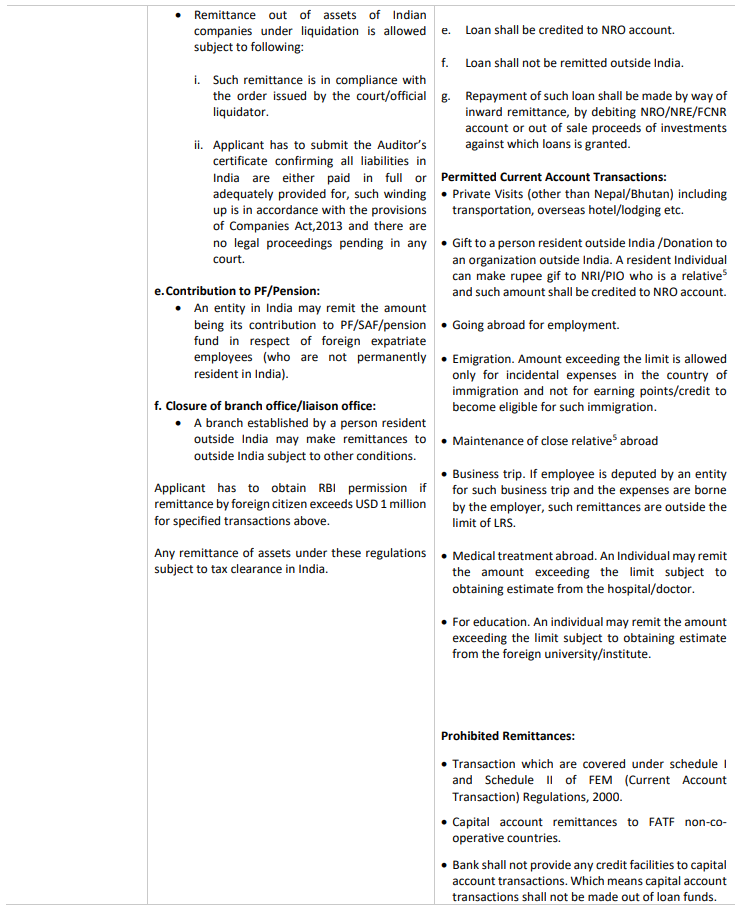

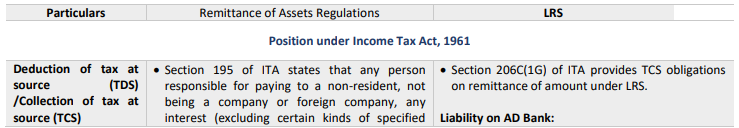

If such person is considered as a non-resident in India under the provisions of ITA, amount paid to such person may be chargeable to tax in India and tax may have to be withheld on such payment under Section 195 of ITA. Further, through the Finance Act, 2020, a new sub section has been inserted in section 206C(1G) in order to make tax collection at source (for brevity ‘TCS’) provisions applicable to foreign remittances under LRS. In this article, a comparative analysis has been made between remittance of assets regulations and LRS under the provisions of FEMA and ITA.

Author’s Comments:

- While there are many differences between both the regulations, the common connecting factor between the two regulations is ‘remittance outside India’. However, both the regulations deal with different type of persons. While remittance of assets regulations are applicable to non-resident individual (foreign citizen/NRI), specified companies/entities in special circumstances, the LRS scheme is applicable only with respect to resident individual.

- Even though the transfer of immovable property is covered under ‘remittance of assets regulations’ above, there are certain transactions which are not specifically dealt with by such regulations.

- Foreign Exchange Management (Acquisition and Transfer of Immovable Property in India) Regulations, 2018 also needs to be analysed in order to understand repatriation of amount when foreign currency is brought-in for the purpose of acquisition of immovable property in India.

FAQs

- A person being an Individual went abroad from India for the purpose of employment outside India long back, can such individual utilize LRS provisions for remittance of fund?

No, LRS provisions are available only to resident Individual. A person who has gone outside India for the purpose of employment may be considered as non-resident under section 2(v) of FEMA. However, a resident leaving India for the purpose of employment outside India may remit amount LRS.

- The above person after a long term returned to India for the purpose of employment and continued to stay in India for such employment. Can such individual remit the sale proceeds of immovable property in India which was acquired by way of inheritance?

No, as such person returned to India for the purpose of employment, he may be considered as resident in India and provisions of remittance of assets regulations may not be applicable.

- A person resident in India has gone outside for the purpose of site visit and amount has been spent via debit/credit card. Whether such amount should be reckoned for the purpose of limit under LRS?

Yes, as spending money via card involves foreign exchange outgo, same may be considered for the purpose of computation of limit under LRS.

- A student has gone outside India for the purpose of education. Can his father send him money borrowed from banks in India?

Yes, LRS provisions provides restrictions only on obtaining loans for the purpose of capital account transactions. As remittance of money for the purpose of education is not considered as capital account transaction, he can remit the amount to outside India.

Author’s Comments:

The definition of non-resident under the ITA is different from the definition of non-resident under FEMA. A person may be a non-resident under FEMA, but such person may become resident under the ITA. In such a situation, provisions of section 195 may not be applicable but other provisions of the ITA may be applicable.

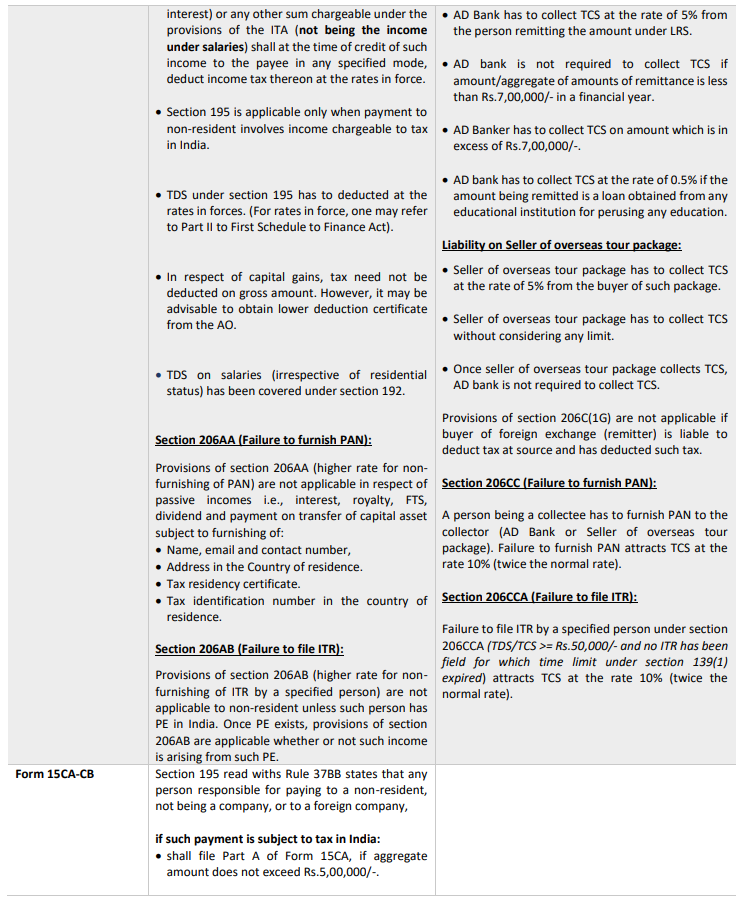

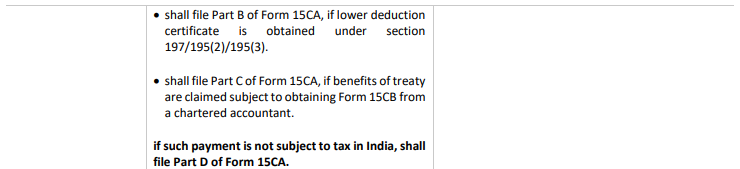

Further, requirement to furnish Form 15CA/CB arises only when a person making any payment to non-resident under ITA. However, Rule 37BB provides relaxation from submitting Form 15CA/CB in a case transaction is covered under Schedule III to the Foreign Exchange (Current Account Transaction) Rules, 2000 or transactions specified under Rule 37BB.

FAQs:

- A person being a non-resident under FEMA has acquired immovable property in India when such person was a resident. Now such person wishes to transfer such immovable property in India. whether TDS under section 195 is applicable for such transaction?

If such person is a non-resident also under the provisions of ITA then, provisions of section 195 is applicable and tax has to be withheld at 20%. Otherwise, provisions of section 194-IA are applicable subject to threshold specified therein, and tax has to be deducted at the rate of 1%.

- If the above person become resident under FEMA and non-resident under ITA, how to comply with TDS provisions and how to remit the amount to outside India?

As such person is a non-resident under ITA, tax has to be withheld under section 195 of the ITA at the rate of 20%. However, as such person is a resident under FEMA, remittance of asset regulations may not be applicable. As such person is a resident in India under FEMA, such person may remit the amount under LRS.

- A person being a resident remitting the amount to outside India for his family maintenance. Whether TCS under section 206C(1G) is applicable?

As such person is remitting the amount under LRS, TCS provisions under section 206C(1G) are applicable if amount of remittance exceeds Rs.7,00,000/-.

- The above person has remitted Rs.5,00,000/- in the month of April. During the month of July, such person is remitting another Rs.6,00,000/- to outside India under LRS. Whether TCS is applicable?

Yes, TCS under section 206C(1G) is applicable if aggregate amount of remittance exceeds Rs.7,00,000/- during the financial year. However, TCS will be collected on Rs.4,00,000/- (Rs11 lakhs- Rs.7 lakhs).

- A person is going outside India for holiday trip and arranged his trip under a package and the price of the package is Rs.3,00,000/-. Whether TCS is required?

Yes, the limit of Rs.7,00,000/- is not applicable for purchase of overseas tour package. Hence, seller of such tour package has to collect TCS under section 206C(1G).

- In the above case, instead of purchasing tour package, the person him self has bought flights tickets and arranged his hotel stay on his own. Whether TCS is applicable.

No, as the person is not purchasing any overseas tour package, limit of Rs.7,00,000/- would be applicable and as the amount of remittance is Rs.3,00,000/-, TCS provisions under section 206C(1G) may not be applicable.

- A person has gone abroad and spent amount through debit/credit card, whether TCS is applicable on such transaction?

As such amount is considered as remittance of money under LRS, provisions of section 206C(1G) are applicable subject to limit of Rs.7,00,000/-

- A person is receiving pension income and is earning interest from fixed deposits on which tax is deducted by bank amounting to Rs.60,000/- and such person has not filed return of income for the year. What is the rate of TCS under section 206C(1G)?

As the person is considered as ‘specified person’ under section 206CCA for default in filing return of income for which time limit under section 139(1) has expired, TCS has to be collected at the rate of 10% while remitting the amount to outside India.

- If the above person is at the age of 76 years and does not have another income. what is the rate of TCS under section 206C(1G)?

Section 206CCA defines the term ‘specified person’ to mean a person who has not furnished the return of income for the assessment year relevant to the previous year immediately preceding the financial year in which tax is required to be collected, for which the time limit for furnishing the return of income under sub-section (1) of section 139 has expired and the aggregate of tax deducted at source and tax collected at source in his case is rupees fifty thousand or more in the said previous year.

As per the above definition, a person is treated as specified person if such person fails to file return of income in India. As per section 194P specified senior citizen is not required to file ITR subject to other conditions. However, section 206CCA does not provide any relaxation for persons covered under section 194P.

- A person has purchased overseas tour package worth Rs.5,00,000/- during the month of April and TCS has been collected on such package. During the month of July, he is going abroad for another trip, but such person has arranged tickets and stay on his own and amount incurred for such trip is Rs.3,50,000/-. Whether TCS is applicable for such transaction.

Section 206C(1G) states that authorised dealer shall not collect the sum, if the amount or aggregate of the amounts being remitted by a buyer is less than Rs.7,00,000/- in a financial year and is for a purpose other than purchase of overseas tour program package. In the second trip, as there is no remittance of money for purchase of overseas tour package, limit of Rs.7,00,000/- would be applicable.

- A person is purchasing overseas tour package from non-resident who does not have any business connection in India, who is required to collect TCS?

In such situation, as such non-resident does not have business connection in India, TCS provisions may not be applicable on such non-resident. The next question that arises is whether the AD bank is required to collect TCS on such remittance. On plain reading of section 206C(1G), as amount is being remitted for the purpose of purchase of overseas tour package, provisions of TCS under section 206C(1G) may not applicable to AD Bank.

- A person being a Citizen of India is going abroad during the year 2020-21 (in December 2020) for the purpose of employment. In January 2021, such person has sold immovable property in India (which is acquired by inheritance) and wishes to remit the sale proceeds to outside India. Whether TCS provisions under section 206C(1G) are applicable?

As such person stayed in India for period more than 182 days, he would be considered as resident in India under the provisions of ITA. However, as such person left India for the purpose of employment, he may be considered as non-resident from December 2020. As such person is considered as non-resident under FEMA, sale proceeds can be remitted to outside India under remittance of assets regulations (to the extent of USD 1 million).

As such person is not remitting the amount under LRS, provisions of section 206C(1G) may not be applicable. Further, such person is considered as resident under the provisions of ITA, provisions of section 195 also may not applicable. In such a situation provisions of section 194-IA of ITA may be applicable if value of such property is Rs.50 lakhs or more.

- A person being a citizen of India has gone abroad long back and returned to India for the purpose of employment during the FY 2020-21 (in December 2020). In January 2021, such person has sold immovable property in India and wishes to remit the sale proceeds of immovable property to outside India. whether TCS provisions under section 206C(1G) are applicable?

Even though such person is considered as resident under FEMA (residential status is determined based on intention of such person), such person may become non-resident in India as stay in India during the year is less than 182 days under ITA.

As such person is a non-resident under ITA, provisions of section 195 are applicable, and tax has to be deducted by the buyer. Further, as such person is a resident in India under FEMA, remittance of assets regulations may not be applicable to such person. Accordingly, such person may utilize LRS route for remittance of amount. As such person is remitting the amount to outside India under LRS, provisions of section 206C(1G) of ITA may also be applicable.