Background:

The concept of ‘thin capitalization’ draws utmost attention in the modern group structuring of MNE[1]. Many multinational groups resort to thin capitalization model in order to minimize group’s net tax liability. A company is said to be thinly capitalized when such company is having more debt-equity ratio. Having more debt-equity ratio may cause shifting of profits from one country to other in order to reduce tax liability of the entire group.

The Indian avatar of elimination of abusive strategy of ‘thin-capitalization’ can be seen in the form of Section 94B of ITA[2], which we will be detailing at length at appropriate place. In these series of articles, we intend to cover the background of introduction of thin-capitalization, reasons for introduction of Section 94B and the various issues springing out of inadequate language of Section 94B. In this part, we cover the background and overview of Section 94B and the subsequent parts, the issues will be covered in much detail.

Before proceeding further, lets take a step back and understand the abusive strategy adopted by MNEs by structuring the capital in a high debt-equity ratio. In other words, let us understand, how MNEs shift profits from high tax jurisdiction to low tax jurisdiction with the following example:

Example 1:

‘A Co’ is a company incorporated in country A in which corporate tax rate is 15%. ‘A Co’ has incorporated wholly owned subsidiary ‘B Co’ in country B in which corporate tax rate is 35%. ‘B Co’ has earned net profit, after payment of third party interest of INR 50 on which tax at the rate of 35% is payable. In this scenario, assuming that there are no other transactions in ‘A Co’ during the year, group is liable to pay tax of INR 17.50 and group arrived at net after tax profit of INR 32.50.

|

Particulars |

A Co |

B Co |

Group Level |

|

Corporate Tax Rate |

15% |

35% |

- |

|

Operating Profit |

- |

150 |

150 |

|

Profit Before Interest and Tax |

- |

150 |

150 |

|

Interest paid to Third Party |

- |

100 |

100 |

|

Interest paid to A Co |

- |

- |

- |

|

Profit Before Tax |

- |

50 |

50 |

|

Corporate Tax |

- |

17.50 |

17.50 |

|

Profit After Tax |

- |

32.50 |

32.50 |

Continuing with the above example, by deploying the abusive strategy of thin capitalization, let us assume ‘A Co’ has planned to give loan of INR 1,000 to ‘B Co’ instead of investing completely though equity. ‘A Co’ has provided loan to ‘B Co’ at an interest rate of 10% which is deductible in country B while computing tax in the hands of ‘B Co’. In such scenario, let us see the numbers:

|

Particulars |

A Co |

B Co |

Group Level |

|

Corporate Tax Rate |

15% |

35% |

- |

|

Operating Profit |

- |

150 |

150 |

|

Interest Income from B Co |

100 |

- |

100 |

|

Profit Before Interest and Tax |

100 |

150 |

250 |

|

Interest Paid to Third Party |

- |

100 |

100 |

|

Interest paid to A Co |

- |

100 |

0 |

|

Profit Before Tax |

100 |

(50) |

50 |

|

Corporate Tax |

15 |

(17.5) |

(2.5) |

|

Profit after Tax |

85 |

(32.5) |

52.5 |

By proving loan to ‘B Co’, ‘A Co’ has leveraged the investment in ‘B Co’ by which group tax liability is reduced to INR (2.50) and net after tax profit is increased to INR 52.50. This leveraged investment option by MNEs has created concern to tax administrations across the world. By adopting this strategy, MNEs were able to lower their group level taxes, thereby increasing the post-tax cash reserves. Though, whether to invest in a subsidiary vide equity or loan is a commercial decision, tax authorities thought it would be necessary to interfere into such decision making, especially, in situations where there is a complete lack of commercial justification. To curb this abuse of tax planning, OECD[3]/G20 through BEPS[4] inclusive framework has recommended to insert best practice approaches to limit the interest deductions as elucidated in Action Plan-4.

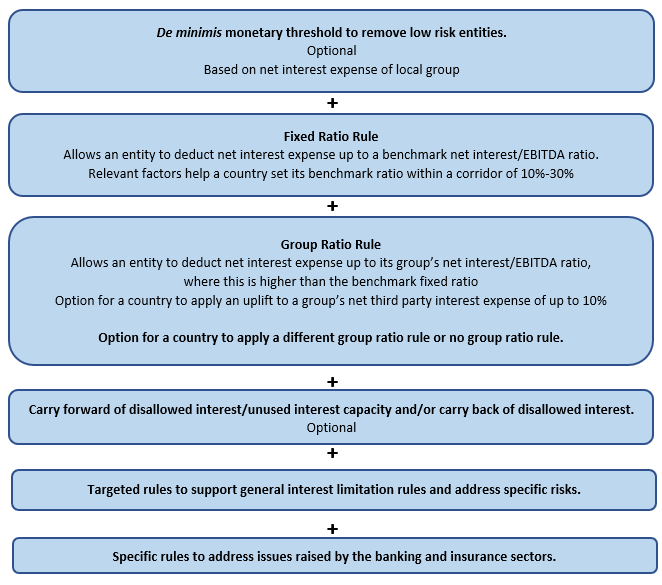

BEPS Action Plan - 4 provides various options to countries in order to implement best practice approaches to limit the interest deduction while computing the tax liability in a particular jurisdiction. The best practice approach is based around a fixed ratio rule which limits an entity’s net interest deductions to a fixed percentage of its profit, measured using earnings before interest, tax, depreciation and amortization (EBITDA). This is a straightforward rule to apply and ensures that an entity’s interest deductions are directly linked to its economic activity. It also directly links these deductions to an entity’s taxable income, which makes the rule reasonably robust against tax planning.

When the interest deduction is directly linked with earnings of a company, the risk of shifting interest to other tax jurisdictions comes down. If a company to wish to claim more interest in a particular jurisdiction, it has to book more earnings in such jurisdiction. When earnings come down, amount of interest deduction also comes down automatically.

However, OCED has felt that fixed ratio rule does not take into consideration the fact that group operating in particular sector may require high leveraged investment and even some groups are highly leveraged for non-tax reasons. Hence, Action Plan – 4 has recommended the countries to implement best practice approaches with the following options:

Overview of the best practice approach

Back In India:

Following the recommendation made under Action Plan - 4, through Finance Act, 2017, a new section vide 94B was inserted to limit the interest deduction. The said section is as under:

(1) Notwithstanding anything contained in this Act, where an Indian company, or a permanent establishment of a foreign company in India, being the borrower, incurs any expenditure by way of interest or of similar nature exceeding one crore rupees which is deductible in computing income chargeable under the head "Profits and gains of business or profession" in respect of any debt issued by a non-resident, being an associated enterprise of such borrower, the interest shall not be deductible in computation of income under the said head to the extent that it arises from excess interest, as specified in sub-section (2) :

Provided that where the debt is issued by a lender which is not associated but an associated enterprise either provides an implicit or explicit guarantee to such lender or deposits a corresponding and matching amount of funds with the lender, such debt shall be deemed to have been issued by an associated enterprise.

(1A) Nothing contained in sub-section (1) shall apply to interest paid in respect of a debt issued by a lender which is a permanent establishment in India of a non-resident, being a person engaged in the business of banking.

(2) For the purposes of sub-section (1), the excess interest shall mean an amount of total interest paid or payable in excess of thirty per cent of earnings before interest, taxes, depreciation and amortisation of the borrower in the previous year or interest paid or payable to associated enterprises for that previous year, whichever is less.

(3) Nothing contained in sub-section (1) shall apply to an Indian company or a permanent establishment of a foreign company which is engaged in the business of banking or insurance.

(4) Where for any assessment year, the interest expenditure is not wholly deducted against income under the head "Profits and gains of business or profession", so much of the interest expenditure as has not been so deducted, shall be carried forward to the following assessment year or assessment years, and it shall be allowed as a deduction against the profits and gains, if any, of any business or profession carried on by it and assessable for that assessment year to the extent of maximum allowable interest expenditure in accordance with sub-section (2):

Provided that no interest expenditure shall be carried forward under this sub-section for more than eight assessment years immediately succeeding the assessment year for which the excess interest expenditure was first computed.

(5) For the purposes of this section, the expressions—

(i) "associated enterprise" shall have the meaning assigned to it in sub-section (1) and sub-section (2) of section 92A;

(ii) "debt" means any loan, financial instrument, finance lease, financial derivative, or any arrangement that gives rise to interest, discounts or other finance charges that are deductible in the computation of income chargeable under the head "Profits and gains of business or profession";

(iii) "permanent establishment" includes a fixed place of business through which the business of the enterprise is wholly or partly carried on.

Understanding of Section 94B:

Section 94B has been inserted in order to tackle the issue of shifting of profits to reduce tax liability of a group. Section 94B was inserted through Finance Act, 2017. Explanatory Memorandum to Finance Bill, 2017 states that -

Under the initiative of the G-20 countries, the Organization for Economic Co-operation and Development (OECD) in its Base Erosion and Profit Shifting (BEPS) project had taken up the issue of base erosion and profit shifting by way of excess interest deductions by the MNEs in Action plan 4. The OECD has recommended several measures in its final report to address this issue.

In view of the above, it is proposed to insert a new section 94B, in line with the recommendations of OECD BEPS Action Plan 4, to provide that interest expenses claimed by an entity to its associated enterprises shall be restricted to 30% of its earnings before interest, taxes, depreciation and amortization (EBITDA) or interest paid or payable to associated enterprise, whichever is less.

From the above comments in Memorandum to Finance Bill, it is evident that the Government has inserted Section 94B in line with the recommendations made under Action Plan-4. If there is any ambiguity while interpreting the provisions of Section 94B, it is naturally that attention may be drawn to OECD’s report on Action Plan-4.

|

Descriptions of Significant Expressions used under Section 94B |

|

|

Expression |

Description |

|

Disallowance of interest |

Interest or similar nature payable to non-resident associated enterprise (AE) is not deductible while computing income chargeable under the head PGBP, if such interest is arising from excess interest. The provisions of Section 94B shall not be applicable if such interest payable to non-resident AE does not exceed INR One Crore. |

|

Borrower |

The borrower should be either an Indian company or PE of foreign company. Apart from the said borrowers, the provisions of Section 94B does not apply to any other persons in India. |

|

Exception to borrower |

The provisions of section 94B do not apply to a borrower being an Indian company or PE of foreign company which is engaged in the business of banking or insurance. |

|

Lender |

Non-resident AE of the borrower. Further, if lender is a third party and AE has provided explicit or implicit guarantee to such lender or AE deposits a corresponding and matching amount of funds with the lender, such debt is deemed to have been issued by AE. |

|

Exception to lender |

The provisions of section 94B do not apply to a lender being a PE of non-resident in India which is engaged in the business of banking. |

|

Nature of Expenditure |

Any expenditure by way of interest or similar nature. The word ‘interest or similar nature’ is not defined under section 94B of the Act. |

|

Nature of Borrowing |

Any debt issued by a non-resident AE, which means that lender shall be AE of the borrower and such AE is a non-resident in India. The word debt is defined under section 94B to mean any loan, financial instrument, finance lease, financial derivative, or any arrangement that gives rise to interest, discounts or other finance charges that are deductible in the computation of income chargeable under the head "Profits and gains of business or profession. |

|

Excess Interest |

Excess interest means total interest minus 30% of EBITDA or interest payable to AE whichever is less. |

|

Carry Forward |

Assessee can carry forward disallowed interest to following assessment years and get deductions within the limits as specified. However, such carry forwarding is allowed up to 8 assessment years and not beyond that. |

With the above remarks, let us proceed to analyse the applicability of provisions of section 94B under various scenarios.

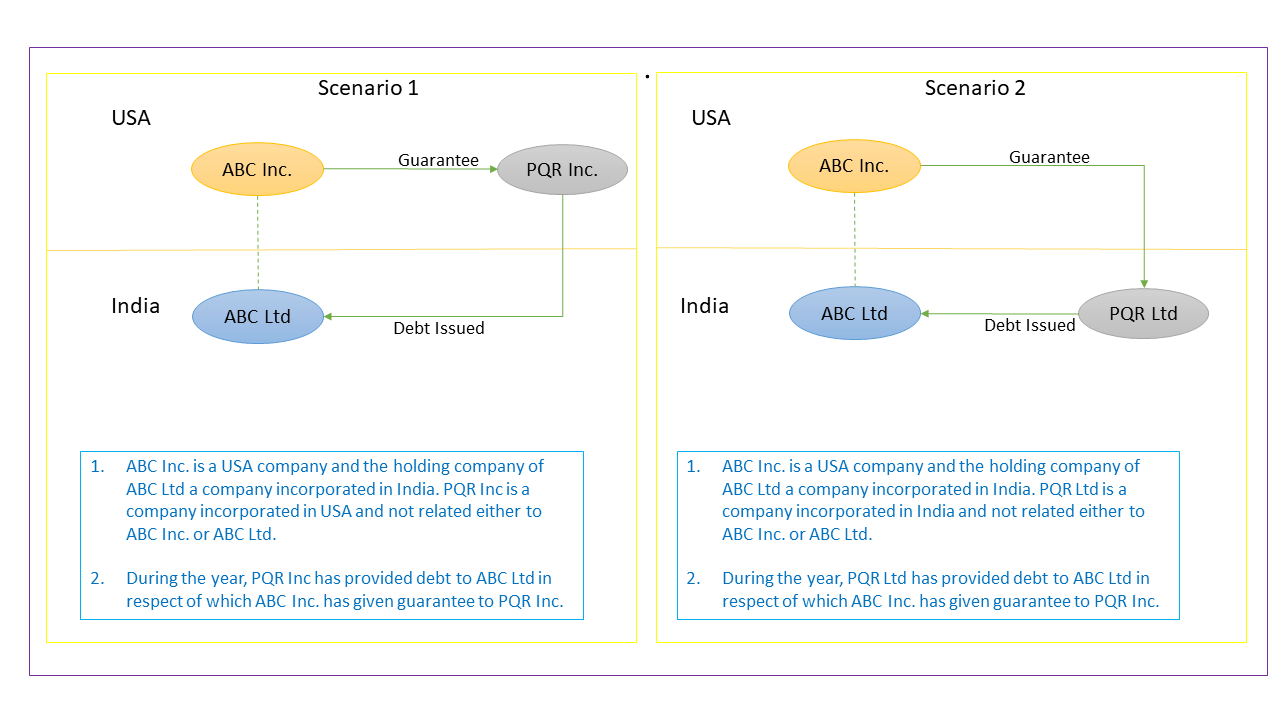

Issue #1 – Guarantee issued by Non-Resident AE to Resident and Non-Resident Lender:

As described earlier, Section 94B triggers only when the debt is issued by a non-resident being an AE of the borrower. However, proviso to Section 94B(1) states that when the debt is not issued by the AE but an AE either provides an explicit or implicit guarantee to such lender or deposits corresponding and matching amount of funds with the lender, such debt is deemed to have been issued by an AE.

From the facts of the case study, it is evident that in Scenario 1, the debt is issued by non-resident entity, which is not an AE to ABC Limited, but the guarantee for such debt is provided by ABC Inc which is AE of ABC Limited. However, in Scenario 2, the debt is issued by resident entity to ABC Limited, which is guaranteed by ABC Inc.

The question that now arises is, whether the interest payment made by ABC Limited to PQR Inc in Scenario 1 and PQR Limited in Scenario 2 would attract the obligations under Section 94B. Let us proceed, to examine the same.

Case Study #1

As stated earlier, the proviso to Section 94B(1) states that if the debt is not issued by AE but a guarantee is provided by AE, then such debt is deemed to be given by AE to the Indian company, that is ABC Limited in this case study. However, the question, which arises is, to what extent the deeming fiction would apply. Whether the deeming fiction of treating the loan extended by non-AE would be deemed to be given by AE, thereby irrespective of the fact that the actual lender is resident or non-resident, the interest payment would trigger obligations under Section 94B? There are two views for the said issue.

|

Views |

Description |

|

View #1 |

In both the scenarios, even though the debt is issued by the third party, by virtue of proviso to section 94B (1), such debt is becoming the debt issued by the original AE i.e., ABC Inc. Hence, in the both the scenarios, interest payable on debt borrowed by ABC Ltd is treated as interest payable to non-resident AE and hence, such interest shall be deductible subject to the limits specified under section 94B. |

|

View #2 |

Even though the debt issued by the third party is becoming the debt issued by AE, such deeming fiction shall be restricted only to treat that such debt is deemed to have been issued by AE and shall not treat that such debt is issued by original AE i.e., ABC Inc. Hence, in scenario 1, as PQR Inc is a non-resident, interest payable on such debt is covered under section 94B. However, in Scenario -2, even though the debt is deemed to be issued by AE, as PQR Ltd is not a non-resident and hence, interest payable to PQR Ltd is not covered under Section 94B. |

The above view #2 is also garnering support from the recent changes to the Section 94B through Finance Act, 2020. Vide the amendment, an exception is created to make it clear that the provisions of Section 94B shall not be applicable when interest payment is made by borrower for a debt issued by PE of a foreign banking company, guaranteed by non-resident AE.

The explanatory memorandum to the Finance Bill 2020 states that ‘Representations have been received to carve out interest paid or payable in respect of debt issued by a PE of a non-resident in India, being a person engaged in the business of banking for the reason that as per the existing provisions a branch of the foreign company in India is a non-resident in India.’

From the above explanation to Finance Bill, 2020, it can be understood that intention of legislature is to apply Section 94B only with respect of non-resident AE or third party non-resident, when AE provides guarantee or deposits amount with such third party.

That is the reason why, as loan given only by PE of non-resident bank is subject to limitation under section 94B, Section 94B has been amended through Finance Act, 2020 to exclude such transaction from the ambit of Section 94B. If that is not the intention of legislature, loans given by Indian Bank would also have been excluded from the ambit of Section 94B. As Section 94B is not applicable to third party located in India, no need to specifically excluded from the ambit of section 94B.

Hence, by reading of explanatory memorandum to Finance Bill 2020, it can be understood that when third party is located in India and non-resident AE provides guarantee to such third party, loan given by such third party located in India shall not be covered under section 94B.

Even though both views are having strong arguments, View #1 may be the appropriate view as loan given by third party is backed by another AE. However, View #2 is supported by the memorandum of explanation to Finance Bill, 2020. Hence, it is required to provide appropriate clarifications/explanations by the legislature to avoid unwanted litigation.

|

Summary of Outcome in Various Scenarios |

||||

|

Scenario |

Debt by |

Guaranteed by |

View 1 |

View 2 |

|

Scenario 1 |

NR Third Party |

NR AE |

Applicable |

Applicable |

|

Scenario 2 |

Resident Third Party |

NR AE |

Applicable |

Not Applicable |

|

Scenario 3 |

NR Third Party bank having PE in India |

NR AE |

Not Applicable |

Not Applicable |

|

Scenario 4 |

Resident Third Party Bank |

NR AE |

Applicable |

Not Applicable |

|

Scenario 5 |

NR Bank |

Resident AE |

Not Applicable |

Applicable |

|

Scenario 6 |

NR Third Party |

Resident AE |

Not Applicable |

Applicable |

|

Scenario 7 |

Resident Third Party |

Resident AE |

Not Applicable |

Not Applicable |

In the earlier part of the article, we have discussed background of Section 94B and basic interpretation of various terms defined thereunder. In this part, we have dealt with specific issues while computing the interest limitation under Section 94B.

|

Issue |

Analysis |

Conclusion |

|

Forex fluctuation on deferred payment on interest |

· The starting point for the response would be from understanding the term ‘interest or similar nature’. The exact phrase has not been defined either under IT Act or under Section 94B. Hence, in order to understand whether the foreign exchange (for brevity ‘forex’) gain or loss is to be taken into consideration while arriving the quantum under Section 94B, it is important to understand whether such forex gain/loss can also be said ‘interest’ or at least would qualify to fall under the ambit of ‘similar nature’. Now, let us proceed to examine, the ambit of ‘interest or similar nature’ separately or jointly.

· Section 2(28) of ITA defines ‘interest’ to mean interest payable in any manner in respect of any moneys borrowed or debt incurred (including a deposit, claim or other similar right or obligation) and includes any service fee or other charge in respect of the moneys borrowed or debt incurred or in respect of any credit facility which has not been utilised. However, the definition of ‘interest’ under Section 2(28) has to be taken with a pinch of salt. This is for the reason that Section 2 opens with a caveat that ‘In this Act, unless the context otherwise requires’. In other words, what is laid in Section 2 is not sacrosanct and cannot be universally applied. However, for the sake of taking this forward, let us assume the context in which ‘interest’ is defined under Section 2(28), applies equally to the context under Section 94B.

· OECD in its report on ‘Limiting Base Erosion Involving Interest Deductions and Other Financial Payments - Action 4’ has provided detailed discussion about ‘interest and payments economically equivalent to interest’. Under OECD’s report, interest shall also include any other expenses incurred in connection with the raising of finance, including arrangement fee and guarantee fees. OCED has recommended that the interest shall include interest on all forms of debt, payment economically equivalent to interest and expenses incurred in connection with raising of finance.

· By juxtaposing the above definition and recommendation of OCED, we can conclude that interest deduction as specified under Section 94B is in line with the recommendations of OECD. Now, with this understanding of the ambit of ‘interest or similar nature’, let us proceed to examine the issue.

· As discussed above, to include the forex gain or loss within the purview of section 94B, such amount should fit within the phrase ‘interest or similar nature’.

· On a strict reading of the definition of ‘interest’, OECD commentary and the general understanding of ambit of ‘similar nature’, we can argue that the payments that would fit under the description of the ‘interest or similar nature’ is certainly such amounts which the borrower should be benefitted.

· In case of forex loss or gain, the borrower would absorb such loss or enjoy the gain and the lender cannot be said to be effected in anyway and a view can be taken that forex gain or loss should not enter into the ambit of ‘interest or similar nature’ to fall under the threshold of Section 94B.

· It is important to understand that the tax payer would definitely like to keep the forex loss outside the purview of Section 94B since addition of same would lower the threshold of deduction.

· As a contrary, the tax authorities would definitely try to include the forex loss stating that such forex loss is directly linked to the interest amount paid to AE and accordingly it should enter the threshold calculations and thereby propose to disallow the interest qua forex loss.

· There are number of judgments including those of apex courts wherein it was held that, the colour of forex gain or loss would be the same as the source transaction and it would not be ascribed a different or new colour. The tax authorities might use all these judgments to support their view that forex loss stands included for arriving the maximum amount allowed as deduction under Section 94B. Some of the judgments are as under: Universal Radiators[1] Sutlej Cotton Mills Limited[2] Pentasoft Technologies Limited[3] Infosys Technologies Limited[4] Novell Software Development (I) (P) Limited[5] Westfalia Seperator India Private Limited[6]

· However, the tax payer can take a stand that the rationale delivered by the above judgements would not be applicable under the context of Section 94B. The tax payers can also take a stand that the basic requirement that is satisfaction of an amount as ‘interest or similar nature’ could not be satisfied with the case of forex fluctuation and accordingly get him distinguished from the above judgments.

· The tax payer can also use the judgments like the Bombay High Court in the matter of Ballarpur Industries Limited[7], wherein it was held that gain arising on realisation of income in subsequent year cannot be equated with original income but same would be considered as other income to take home the point that the forex gain or loss emanating from actual interest paid should be seen in a different hue but not the same as the interest. |

· In our view, the tax payer’s stand has to win because of the fact that the benefit of forex fluctuation is not passed on to the lender to qualify such amounts as ‘interest or similar nature’.

· However, there is a possibility for the courts to state that the forex gain or loss should be seen in the same colour of the source and accordingly may hold to include the forex fluctuation in the ambit of ‘interest or similar nature’ given the jurisprudence evolved in different areas dealing with forex fluctuation.

· We advise that whatever stand taken by the tax payer, it has to be consistently maintained, at least to plead on such ground. |

|

Forex Fluctuation on Outstanding Loan |

· As discussed above, an amount would fit under Section 94B, if assessee incurs any expenditure by way of interest. In all cases, where the expenditure does not satisfies the conditions mentioned in Section 94B, then such expenditure is not deductible while computing the income. Now, let us proceed to examine the nature of forex fluctuation on outstanding loan.

· In this regard, we need to understand the provisions of AS - 16 (Ind AS-23) which states that exchange difference on outstanding amount to the extent of difference between the cost of borrowing in functional currency and in foreign currency shall be adjusted to interest expense.

· In other words, that foreign exchange difference on principle outstanding to some extent shall be treated as interest expense in the books of account in accordance with the Indian GAP. Now the question is whether the additional amount which is recognized as interest expenses in books of account in compliance with Indian GAP also enters the ambit of Section 94B.

· On a plain reading of Section 94B, the tax payer has to incur expenditure to fall under the ambit of Section 94B and in case of interest expense being recognized in compliance with accounting standards, the tax payer does not incur any expenditure. It is only a mere recognition of certain part of forex fluctuation as interest expense and not an actual outgo of interest.

· Further, IT Act does not contain any such provisions to treat certain portion of forex fluctuation on outstanding amount as interest. The treatment prescribed in AS-16 cannot be applied to the tax computation since the said standard do not have any applicability for computing the income under the IT Act.

· The treatment of forex fluctuations under the provisions of IT Act are majorly dealt by Section 43A, Section 43AA and ICDS-VI. The treatment prescribed by AS-16 is not specified anywhere in Section 43A, Section 43AA or ICDS – VI. Hence, we can conclude that such forex fluctuation which is treated as interest expense as per AS-16, would not enter into the ambit of Section 94B.

· Further, provisions of Section 94B or section 2(28) does not contain any such treatment. In the absence of specific adjustment in relation to foreign exchange difference on outstanding amount, it may not be possible to hold that such exchange difference as interest expense.

· Further, Action Plan – 4 states that certain foreign exchange gains and losses on borrowings and instruments connected with the raising of finance shall be treated as interest for deduction. |

· The portion of forex fluctuation which is to be treated as interest expense in accordance with AS-16 would not enter into the ambit of Section 94B. |

|

Interest paid for Trade Credit also fall under Section 94B? |

· It is common in businesses, to obtain trade credit on import of goods or services from related parties. The buyer would pay certain interest to the vendor/banker for the extended period of payment of purchase consideration.

· Trade Credit in ordinary terms means extension of time by the provider of goods or services for payment of consideration against such supply. Trade credit is defined under FEMA Regulations to mean credit extended by overseas supplier or banks / financial institution subject to satisfaction of other conditions.

· The question that arises is whether payment of interest against trade credit facility granted by the supplier would also fall under the ambit of Section 94B on an assumption that all other conditions laid out therein are satisfied.

· It is beyond doubt that interest paid against trade credit falls under the ambit of ‘interest or similar nature’. However, the question that has to be raised is whether such interest is arising from a ‘debt’ as defined in Section 94B. Now, let us proceed to examine the ambit of ‘debt’.

· Under Section 94B, ‘debt’ includes any loan, financial lease, financial instrument, financial derivate or any such arrangement. Trade credit is nothing but a financial arrangement between the supplier and buyer for making payment against the supply of good or material by charging a fixed rate of interest on outstanding amount.

· Hence, we can conclude that the payment of interest against trade credit facility would fall under the ambit of Section 94B.

· However, it is not out of place to mention that for withholding tax on interest paid on trade credit, the provisions of Section 194LC would not be applicable and the other provisions would apply. This is for the reason that Section 194LC deals with interest pay-outs arising from monies borrowed and not other arrangements.

· Hence, for withholding obligations for interest on trade credit, the provisions of Section 194LC would not apply and this should not be treated as basis for not taking into account for the purposes of Section 94B. |

· Interest paid towards facility of trade credit also enters into the mechanism of Section 94B. |

|

Interest Paid to Third Party |

· Section 94B(2) defines the word excess interest to mean total interest minus thirty percent of EBITDA or interest payable to associated enterprise whichever is less. · On reading of the above, a question that may arise is while computing the ‘excess interest’, whether interest payable to third party shall be considered in total interest or interest payable only to associated enterprise alone is to be considered?

· As usual there is no single answer for this. There are two views which are discussed as under.

· The memorandum explaining the Finance Bill, 2017 states that ‘to provide that interest expenses claimed by an entity to its associated enterprises shall be restricted to 30% of its earnings before interest, taxes, depreciation and amortization (EBITDA) or interest paid or payable to associated enterprise, whichever is less.’

· Further, while making amendment to Section 94B thorough Finance Act 2020, memorandum to Finance Bill 2020 states that ‘Section 94B of the Act, inter alia, provides that deductible interest or similar expenses exceeding one crore rupees of an Indian company, or a permanent establishment (PE) of a foreign company, paid to the associated enterprises (AE) shall be restricted to 30 per cent. of its earnings before interest, taxes, depreciation and amortisation (EBITDA) or interest paid or payable to AE, whichever is less.’

· From the reading above memorandums, it is clear that interest payable to associated enterprise shall alone be considered for computing excess interest.

· However, there can be another view basis that since Section 94B has been inserted in line with the OECD recommendations and OECD in its report on Action Plan -4 in various occasions mentions that total interest including third party interest shall be restricted to certain percentage of EBITDA.

|

· We are of the view that the interest paid to third parties should not enter into the ambit of Section 94B. This is for the reason there is no specific language to suggest the same in Section 94B. |

|

Determination of EBITDA |

· For this issue, we try to raise three sub-issues. The first one is whether EBITDA has to be calculated based on tax numbers or accounting numbers? Let’s try to analyse the same: Tax EBITDA vs. Accounting EBITDA: · ‘EBITDA’ is not defined under Section 94B of Act. There is always a difference between the tax EBITDA and accounting EBIDTA for a simple reason that expenditure claimed under income tax is different from that of accounting principle viz. non-deduction of tax at source disallows the expenditure under income tax whereas the same is considered as expense for accounting purpose, depreciation under income tax is different from depreciation under accounting principles, foreign exchange loss on outstanding loan is treated as expenditure under accounting principles whereas same is to be adjusted to outstanding balance under income tax etc.

· BEPS Action Plan-4 aims to reduce the shifting of profits by group companies which resort to thin capitalisation. One of the primary reasons to directly link the interest expense to EBITDA is to compel the tax payer to book more profits in a particular jurisdiction in order to claim more interest deduction. Hence, it is more appropriate to consider tax EBITDA for the purpose of computing the interest disallowed under Section 94B. Further, the definition of term ‘interest’ is different from accounting principles and income tax. If one consider accounting EBITDA, computation of interest may not be correlated with taxing profits in a particular jurisdiction which is the ultimate reason for inserting Section 94B.

· However, the argument of accounting EBITDA also has a base as EBITDA is directly related to accounting principle and EBITDA is not defined in IT Act. Whenever there is a requirement to compute any deduction based on the profits/income, respective provisions have defined those terms for example profits under Section 40(b), book profits under section 115JB etc.

· In view of above analysis, in our view, even though the term is not defined under the provisions of IT Act, invoking such term from accounting principles may not be appropriate. If one goes with accounting principles, it is hardy difficult to match the computation of interest limitation with booking appropriate profits in India for the purpose of tax which is the ultimate objective of Section 94B.

Treatment of Exempt Income from EBITDA: · The second issue would be whether exempt income is to be included while computing EBITDA? Let us proceed to examine the same.

· Under Section 14A of the Act, any expense which is incurred for the purpose of earing exempt income is not deductible while computing the total income. When such exempt income is included in EBITDA computation, tax payer will get more deduction of interest expense despite the fact that no expense is deductible from exempt income. Further, as Section 94B specifically applies to income computed under the head profits and gains from business or profession, other income which is chargeable under other heads should also not form part of EBITDA computation. Further, OECD also in its reports mentioned that exempt income shall not be included while computing EBITDA.

Expenses disallowed under other provisions Act: · In the earlier para, it is concluded that exempt income shall not form part of EBITDA. Now, the next question is what it is the treatment of expenses which are disallowed under other provisions of the Act. If one takes the view that tax EBITDA is to be considered for the purpose of disallowing the excess interest, expenses disallowed under other sections shall not be considered as expense for determination of EBITDA. However, if such expense is subsequently allowed as expense, same can be considered while computing EBITDA in the year in which such disallowed expense is allowed.

|

- |

|

Interest which is capitalised |

· The next issue while dealing with Section 94B is that what would be the treatment of interest which is capitalised instead of debiting the same to profit and loss account. Section 36(1) (iii) read with Section 43(1) states that interest on borrowed capital for the purpose of acquisition of capital asset shall be capitalised up to the point in time such asset is put to use.

· In such a circumstance, even though the tax payer has incurred interest expense, as such interest is not deductible for the purpose of computation of income under the head profits and gains from business or profession, would not be covered under the limits specified in Section 94B.

· Further, once the interest is capitalised, depreciation allowance on capitalised interest cannot be brought under Section 94B as such expense has changed its characterisation from interest to depreciation allowance.

· A strict interpretation needs to be given to Section 94B which is applicable only with respect to interest expense which is deductible while computing the income from profits and gains from business or profession. Once the characteristics of the expenses have been changed, bringing the amount of such depreciation allowance within the ambit of Section 94B is hard. |

- |

|

Gross Interest or Net Interest

(For illustration, see Case Study #1 at the end of the article) |

· Section 94B requires the tax payer to disallow the excess interest paid to non-resident associated enterprise. The reason behind disallowing the excess interest is that international group to eliminate potential shifting of profits to low tax jurisdictions as interest is tax deductible expenditure.

· OECD in its report on Action Plan-4 has recommended the countries to apply net interest approach for limiting the interest deduction. The reason behind the OECD’s recommendation is that when a company has borrowed an amount from AE1 to provide loan to another AE2, interest payable to AE1 on loan borrowed is restricted under Section 94B in addition to that interest income on loan given to AE2 is subject to tax which results in double taxation. Hence, OECD has recommended to apply net interest concept.

· However, section 94B does not specifically provides for such type of relief. Hence, in the absence of specific provision in section 94B, it is prudent to consider gross interest while limit the interest deduction. |

- |

|

Disallowance of interest under other provisions

|

· When the interest paid to non-resident AE is disallowed under other provisions of the Act, a question arises as to whether such interest is to be considered again for limiting the interest deduction Section 94B of the Act.

· For example, interest paid to non-resident AE is not at arm’s length principle and such interest is disallowed under Section 92 of the Act. Section 94B uses the word ‘which is deductible in computing income chargeable under the head profits and gains from business or profession.’ When such interest expense is already disallowed under other provisions of the Act, it may not be appropriate to consider such interest under Section 94B.

· However, Section 94B(2) states that excess interest shall mean total interest paid or payable in excess of 30 percent of EBITDA or interest payable to AEs whichever is less. By reading the Section 94B(2), it appears that for the purpose computing the excess interest, total interest needs to be considered whether or not such interest is allowed under other provisions of the Act.

· By following the above principle, after the computation of excess interest, one needs to go back to Section 94B(1) and limit the interest payable to non-resident AE only if such interest in not disallowed under other provisions of the Act.

· Further, if such expense which is disallowed under other provisions is subsequently allowed as expense then, it needs to be evaluated whether such interest is to be allowed subject to the limits specified in Section 94B. Section 94B states that where an Indian company or PE of a foreign company ‘incurs any expense by way of interest or similar nature’ and ‘which is deductible in computing income chargeable...’

· Expense which was disallowed in one year and subsequently allowed in another year would has the same characteristics of ‘interest’ and as the tax payer has incurred such expense hence, same may needs to be covered within the limits specified under Section 94B.

· The argument that the tax payer has not incurred such interest ‘during the year’ in which such expense is subsequently allowed does not bear any base as Section 94B does not warrant the tax payer to incur the interest expense during the previous year. Such requirement to incur expense during the previous year is provided in Section 94B (2) for the purpose of computation of excess interest.

· Further, the priority in disallowing the interest would be given to other provisions first as the interest limitation under Section 94B is not permanent and tax payer can carry forward and setoff in future. However, disallowance of such interest under other provisions may be permanent in nature. ` |

|

|

Payment of Interest by PE

(For illustration, see Case Study # 2 at end of this article) |

· Section 94B is applicable to an Indian company or PE of a foreign company. The issue revolves around the PE is what would be the treatment of interest paid by PE of foreign company to its head office. Whether such interest payment would cover under Section 94B?

· Before analysing the treatment under Section 94B, it is pertinent to understand the computation of income in respect of branch of foreign company. Income Tax Act states that Income of the branch in India is to be computed as if such branch is an independent entity. However, payments made by the branch to its head office is not allowed as deduction under the Act as it is the payment being made to itself. This view is upheld by many judicial fora and some of them are provided below: Sumitomo Mitsui Banking Corpn[8] Royal Bank of Scotland N.V[9] JP Morgan Chase Bank N.A.[10]

· Given the above, payment made by PE of a foreign company to its head office is not deductible as expenses while computing the income from business under the provisions of IT Act.

· Further, in the context of India -USA DTAA, Para 3 of Article 7 states that while computing the income of a PE, no deduction shall be allowed in respect of payment of expense by branch to head office or other offices which are in the nature of royalties, FIS except in the case of banking business, or by way on interest by such PE. Hence, when such income is not deductible while computing the income under the hear PGBP under the IT Act as wells as DTAA between India and USA, the requirement to invoke Section 94B does not arise. |

|

|

Carry forward of disallowed interest

|

· Section 94B (4) states that where the interest is not wholly allowed as deduction, tax payer can carry forward such disallowed interest to the following assessment years and deduct as expenses subject to the limits specified under section 94B(2).

· In other words, that earlier years’ disallowed interest is to be set off against the current year’s income only if such interest is withing the limit of interest computed under section 94B (2).

· Further, section 94B (4) uses that word ‘any business or profession carried on by it’, means assessee can setoff such disallowed interest against income from any other business or profession not necessarily against business income from which interest expense originates. |

- |

Based on the above discussion, practical approach to claim the deduction under Section 94B would be as follow and this approach is also supported by Action Plan -4:

|

|

|

|

Step 1: Income before tax |

Computation of taxable income under the head ‘profits and gains from business or profession’ without considering the interest under Section 94B. Taxable income is to be computed after disallowing the expense, if any. |

|

Step 2: EBITDA |

EBITDA is to be arrived by adding interest expenses, depreciation and amortisation expenses to income before tax. |

|

Step 3: Excess interest |

(Total interest payable - 30% of EBITDA) or interest payable to associated enterprise whichever is less. |

|

Step 4: Interest disallowed |

Disallowance of interest payable to non -resident AE provided such Interest is arising from excess interest. |

|

Step5: Carry forward |

Such disallowed interest can be carried forward to next assessment year to the maximum of 8 assessment years. |

Case Study #1

Case Study #2

[1] [1993] 68 Taxman 45 (SC)

[2] [1979] 116 ITR 1 (SC)

[3] [2013] 33 taxmann.com 570 (Madras)

[4] [2012] 18 taxmann.com 169 (Karnataka)

[5] [2013] 35 taxmann.com 414 (Karnataka)

[6] ITA No. 4446/Del/2007

[7] [2017] 84 taxmann.com 61 (Bombay)

[8] [2012] 19 taxmann.com 364 (Mum.) (SB)

[9] [2016] 76 taxmann.com 91 (Kolkata - Trib.)

[10] [2020] 114 taxmann.com 700 (Mumbai - Trib.)

[1] Multi National Enterprises

[2] Income Tax Act, 1961

[3] Organisation for Economic Co-operation and Development

[4] Base Erosion Profit Shifting