Introduction:

Transfer price provisions have been incorporated into tax laws by various countries in order to reduce tax avoidance by artificial shifting of profits from high tax jurisdiction to low/nil tax jurisdiction. Under these provisions, when an entity enters into any transaction with its AE[1], the tax authorities of such country may deny the price at which such transaction is entered and compute the price of transaction at arm’s length principle.

For example, ABC Ltd has availed certain services from its AE viz. ABC Inc for an amount of USD 1,000 but income tax authorities may determine the arm’s length price (‘ALP’) of such services at USD 800 and disallow the expense of USD 200 by making transfer price adjustment. However, as ABC Inc raises invoice for USD 1,000, ABC Ltd remits the same to its AE, ABC Inc.

In this scenario, though the adjustments proposed under the transfer price provisions under tax law aim to reduce artificial shifting of profits, such adjustment is not effective enough to reduce the shifting of cash profits to another country.

In order to tackle the above issue, OECD has provided guidance to insert secondary adjustment provisions under the tax laws.

In this article, the concept of transfer price adjustments viz. primary adjustments and secondary adjustments have been discussed in detail.

OECD Guidance:

Before understanding the concept of secondary adjustment in detail, it is required to understand what a transfer price adjustment is and how it effects the tax of corresponding entity in another jurisdiction.

As discussed above, tax laws of particular country may impose transfer price regulations under which any income/expense with the AE has to be computed having regard to the ALP.

Para 1 of Article 9 of tax convention[2] states that where, by virtue of special relation between the enterprises, any profits have not accrued to an enterprise, which would have been accrued had it been entered between independent enterprises, then, such profits may be included in the profits of that enterprise and taxed accordingly.

It means that profits of the enterprise have to be revised to make adjustment in relation to transfer price between the enterprise and its AE. This adjustment is to be considered as primary adjustment or transfer price adjustment while computing the taxable income of the enterprise.

Then the question arises, what about the corresponding adjustment in the books of the AE as it leads to economic double taxation.

Para 2 of Article 9 deals with corresponding adjustment in books of AE which states that other jurisdiction may make corresponding adjustment under MAP[3] as provided in Article 25 of treaty.

When the corresponding adjustment is made in another jurisdiction, taxable income of the AE gets reduced and taxed accordingly.

However, concept of corresponding adjustment is different from secondary adjustment. As discussed above, under the transfer price adjustment (primary adjustment) or under the corresponding adjustment, profits of the enterprise would be revised to make adjustments. However, these adjustments do not deal with cash adjustment viz. realization of excess amount from AE but deal with revision of profit.

In order to deal with such an issue, it has been proposed to insert secondary adjustment provisions under the domestic laws of a country.

OCED has recommended three ways to deal with secondary adjustment:

- Constructive Dividends:

Under which excess profit lies with the AE would be considered as distribution of dividend by the enterprise to such AE. As amount is considered as dividend, withholding tax obligation triggers in the hands of the enterprise.

- Constructive Equity Contributions:

Under this approach, excess amount lies with the AE would be considered as equity contribution to such AE. As amount is considered as equity contribution, enterprise has to repatriate amount which becomes due to a shareholder.

- Constructive Loans:

Under this approach, excess amount lies with the AE would be considered as loan given by the enterprise to such AE. In this approach, as amount is considered as loan, enterprise has to realise interest on such loan on timely manner.

However, secondary adjustment may result in double taxation unless corresponding credit for the additional tax liability that may result from the secondary adjustment is provided in the other country. Further, commentary[4] on para 2 of Article 9 of Model Tax Convention states that Article does not deal with secondary adjustments which means that a person may not claim relief of under Article 9 as well.

India’s Approach:

Considering the recommendations of OECD, Government of India has incorporated secondary adjustment provisions into the Income Tax Act, 1961 (‘ITA’) in the form of constructive loans. Section 92CE has been inserted into ITA through the Finance Act, 2017.

Manner of Computation of Notional Interest:

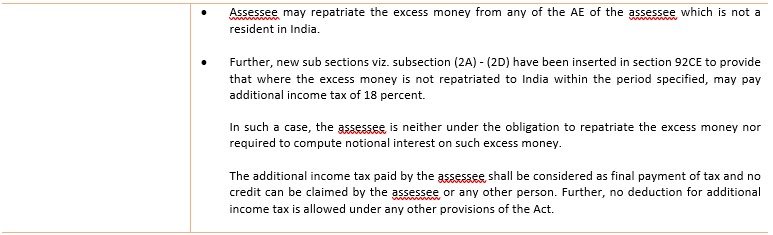

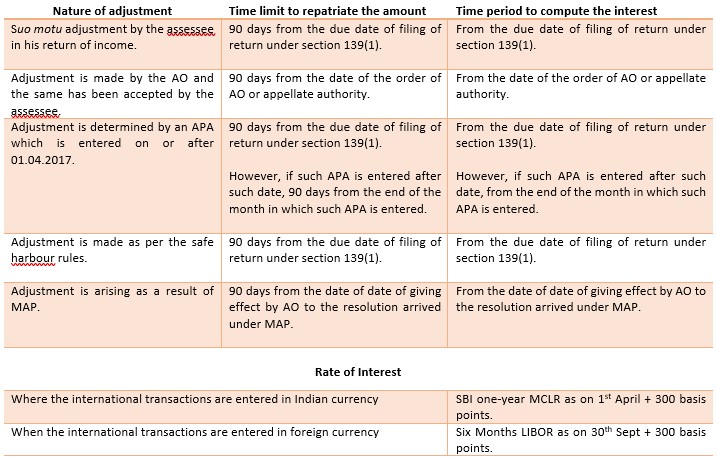

As stated in section 92CE (2), as excess amount has to be repatriated to India within the time prescribed otherwise, such amount is considered as loan given by the assessee to its AE and notional interest on loan has to be computed at the rate prescribed. In this regard, Rule 10CB has been inserted to compute the notional interest on deemed loan.

Reporting Requirements:

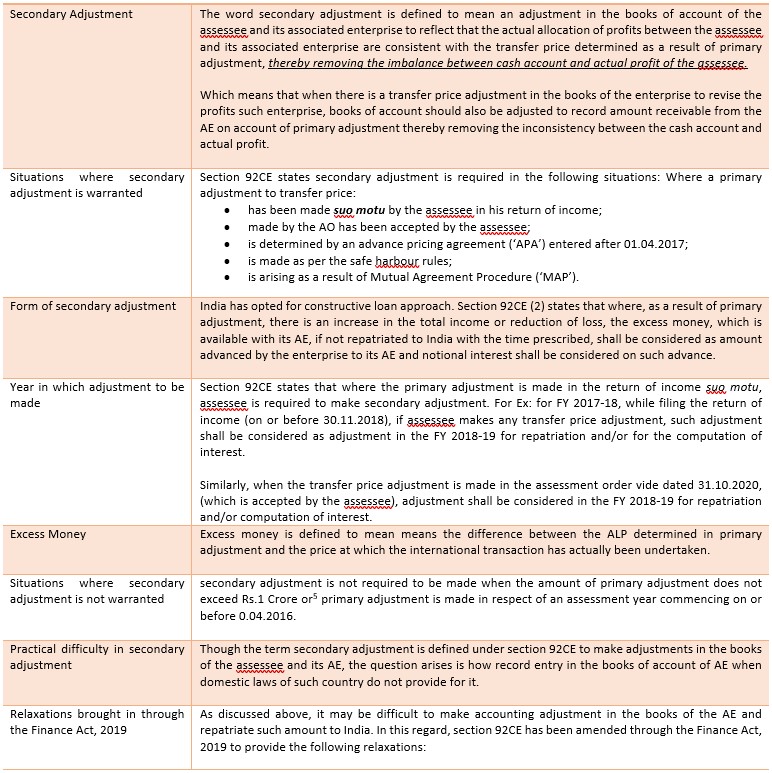

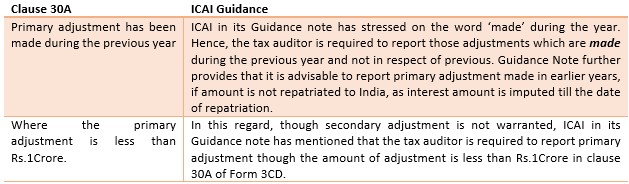

Clause 30A of Form 3CD deals with reporting requirements for secondary adjustments made under section 92CE of the Act. ICAI Guidance Note on Tax Audit provides certain guidelines for reporting of secondary adjustment in clause 30A of Form 3CD.

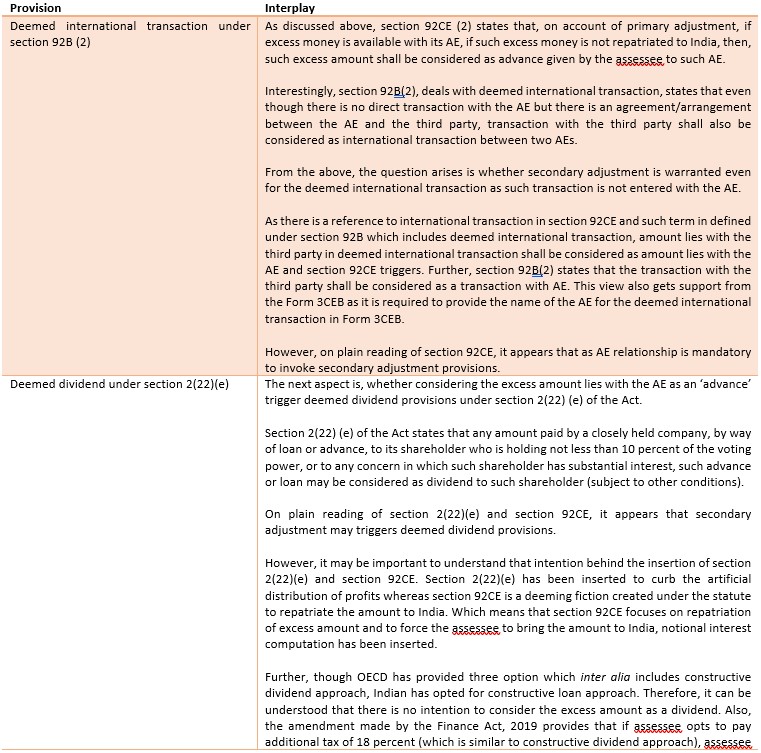

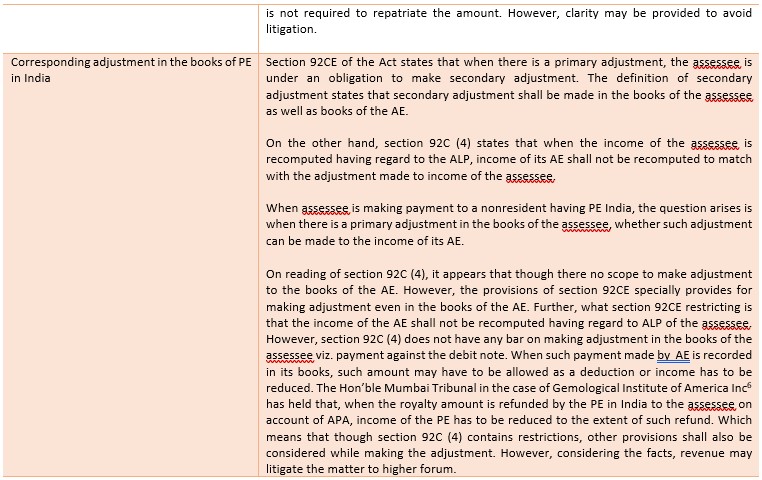

Interplay with other provisions of the Income Tax Act:

[1] Associated Enterprise

[2] Reference to OECD Model Tax Convention on Income and on Capital

[3] Mutual Agreement Procedures

[4][4] OECD commentary on Model Tax Convention on Income and on Capital

[5] The word ‘and’ has been substituted with word ‘or’ through Finance Act,2019 retrospective to provide more clarity on applicability of section 92CE.

[6] [2021] 127 taxmann.com 167 (Mumbai - Trib.)