- Introduction to MSME:

- The Micro, Small and Medium Enterprises (MSME) sector has emerged as a highly vibrant and dynamic sector of the Indian economy over the last five decades. It contributes significantly in the economic and social development of the country by fostering entrepreneurship and generating largest employment opportunities at comparatively lower capital cost, next only to agriculture. MSMEs are complementary to large industries as ancillary units and this sector contributes significantly in the inclusive industrial development of the country. The MSMEs are widening their domain across sectors of the economy, producing diverse range of products and services to meet demands of domestic as well as global markets.

- As per the National Sample Survey (NSS) 73rd round, conducted by National Sample Survey Office, Ministry of Statistics & Programme Implementation during the period 2015-16, there were 633.88 lakh unincorporated non-agriculture MSMEs in the country engaged in different economic activities (196.64 lakh in Manufacturing, 230.35 lakh in Trade and 206.84 lakh in Other Services and 0.03 lakh in Non-captive Electricity Generation and Transmission,) excluding the MSMEs registered under (a) Sections 2m(i) and 2m(ii) of the Factories Act, 1948, (b) Companies Act, 1956 and (c) Construction activities falling under Section F of National Industrial Classification (NIC) 2008.

- As per the report, it is seen that 31% MSMEs were found to be engaged in Manufacturing activities, while 36% were in Trade and 33% in Other Services. Again, out of 633.88 estimated number of MSMEs, 324.88 lakh MSMEs (51.25%) were in rural area and 309 lakh MSMEs (48.75%) were in the urban areas. The Micro sector with 630.52 lakh estimated enterprises accounts for more than 99% of total estimated number of MSMEs. Small sector with 3.31 lakh and Medium sector with 0.05 lakh estimated MSMEs accounts for 0.52% and 0.01% of total estimated MSMEs, respectively.

- Legal Background:

- In accordance with the Section 7 (1) of Micro, Small & Medium Enterprises Development (MSMED) Act, 2006 the Micro, Small and Medium Enterprises (MSME) are classified as below:

|

Manufacturing Sector |

|

|

Enterprise Category |

Investment in Plant & Machinery |

|

Micro |

does not exceed INR 25 lakhs |

|

Small |

is more than INR 25 lakhs and does not exceed INR 5 Crore |

|

Medium |

is more than INR 5 Crore but does not exceed INR 10 Crore |

|

Service Sector |

|

|

Enterprise Category |

Investment in Equipment |

|

Micro |

does not exceed INR 10 lakhs |

|

Small |

is more than INR 10 lakhs but does not exceed INR 2 Crore |

|

Medium |

is more than INR 2 Crore but does not exceed INR 5 Crore |

It may be interesting to note that vide PIB Press Release dated 07-02-2018, the Union Cabinet chaired by the Prime Minister Shri Narendra Modi has approved change in the basis of classifying Micro, Small and Medium enterprises from ‘investment in plant & machinery/equipment’ to ‘annual turnover’. The proposed limits are given below:

|

Enterprise Category |

Annual Turnover |

|

Micro |

does not exceed INR 5 Crores |

|

Small |

is more than INR 5 Crore but does not exceed INR 75 crore |

|

Medium |

is more than INR 75 Crore but does not exceed INR 250 crore |

Additionally, the Central Government may, by notification, vary the aforesaid proposed turnover limits, which shall not exceed thrice the limits specified in Section 7 of the MSMED Act.- Section 15-24 of The Micro, Small and Medium Enterprises Development (MSMED) Act, 2006 deal with the issues relating to the Delayed Payments to Micro and Small Enterprises (MSEs) by the buyers to the MSE supplier. In the case of delay in payment beyond 45 days, MSE suppliers may approach the Micro and Small Enterprises Facilitation Council (MSEFC) constituted under the Act in all States/UTs. Under Section 16 of the MSMED Act, delayed payment to supplier units, attracts compound interest with monthly rests at three times of the bank rate notified by the Reserve Bank.

- It may also be interesting to note that RBI has also constituted Expert Committee on MSMEs vide its press release No. 2018-2019/1540, dated 2nd January, 2019. RBI in its Press Release stated that considering the importance of the MSMEs in the Indian economy, it is essential to understand the structural bottlenecks and factors affecting the performance of the MSMEs. It has, therefore, been considered necessary that a comprehensive review is undertaken to identify causes and propose long term solutions, for the economic and financial sustainability of the MSME sector. For further details, the reader may please refer to the said Press Release.

- Genesis of TReDS

- MSMEs continue to face constraints in obtaining adequate finance, particularly in terms of their ability to convert their trade receivables into liquid funds.

- The concept for setting up of electronic bill factoring exchange was recommended by Financial Sector Reforms (FSR) Committee in 2008 in their report “Hundred Small Steps”. Based on the FSR Committee recommendations, SIDBI in collaboration with NSE, had taken the initiative to set up an e-discounting platform to support financing of MSME receivables. The platform was named as NTREES (Trade Receivables Engine for E-discounting, Prefix ‘N’ stands for NSE and Suffix ‘S’ stands for SIDBI). The NTREES platform was based on the reverse factoring model, where credit exposure was taken by large Purchaser / Corporates, who offered the invoices drawn by its MSME suppliers for discounting and SIDBI as the Financier discounted the same and credited the proceeds to MSME bank accounts through RTGS. The platform was based on the Mexican model (National Financiers – NAFIN) for bidding of MSME receivables.

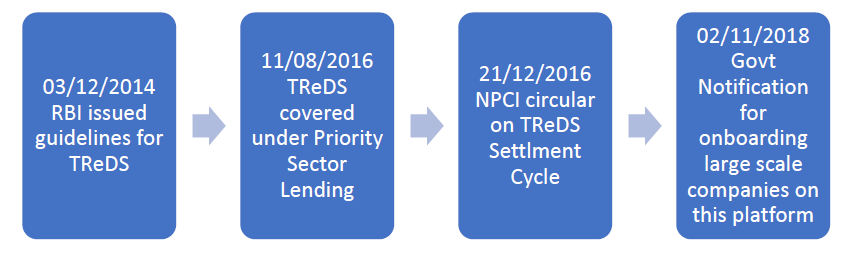

- Bird’s eye view of flow of events is provided herein below

- In its latest attempt to address the concerns of MSMEs, the Ministry of Micro, Small and Medium Enterprises (the Ministry), in exercise of powers conferred by Section 9 of the Micro, Small and Medium Enterprises Development Act, 2006, vide its Notification dated November 02, 2018 has mandated all companies with a turnover more than INR 500 crore and all Central Public Sector Enterprises, to get themselves onboarded on the Trade Receivables Discounting System (TReDS) platform. This measure is expected to enable MSME entrepreneurs to access credit from banks, based on their upcoming receivables and resolve their problems of cash cycle, by transferring the risk from a weak seller to a strong buyer.

- In the aforesaid Notification, the Ministry has not provided any time line for compliance of the same. It has authorised the Registrar of Companies of each state to monitor the compliance of these regulations by the companies. However, the Ministry has not issued any notification for the same and it is still a question that how will the regulator monitor the effectiveness of the same.

- RBI has registered following three exchanges for TReDS purpose

|

Name of the Exchange |

Known as/ website |

Commencement of Operations |

Registration Valid up to |

|

Receivables Exchange of India Limited |

RXIL/ |

1st December, 2016 |

30th June, 2022 |

|

Mynd Solutions Private Limited |

Mynd Online National Exchange/ https://www.m1xchange.com/about-us.php |

April, 2017 |

31st March, 2022 |

|

A. TREDS Limited |

INVOICEMART/ |

29th June, 2017 |

30th June, 2022 |

Brief introduction of the TReDS scheme introduced by RBI

- The scheme for setting up and operating the institutional mechanism for facilitating the financing of trade receivables of MSMEs from corporate and other buyers, including Government Departments and Public Sector Undertakings (PSUs), through multiple financiers will be known as Trade Receivables Discounting System (TReDS).

- The TReDS will facilitate the discounting of both invoices as well as bills of exchange. Further, as the underlying entities are the same (MSMEs and corporate and other buyers, including Government Departments and PSUs), the TReDS could deal with both receivables factoring as well as reverse factoring so that higher transaction volumes come into the system and facilitate better pricing.

- The transactions processed under TReDS will be “without recourse” to the MSMEs.

- Definitions/ References

- Factoring unit - a standard nomenclature used in the TReDS for an invoice or a bill on the system. Factoring Units may be created either by the MSME seller (in the case of factoring) or by corporate and other buyers, including Government Departments and PSUs, (in case of reverse factoring) as the case may be.

- Financier – refers to banks, NBFC Factors and other financial institutions as permitted by the Reserve Bank of India participating in the TReDS and accepting the factoring unit for financing purpose.

- Participants - MSME sellers, corporate and other buyers, including the Government Departments and PSUs, and financiers (banks, NBFC Factors and other financial institutions as permitted by the Reserve Bank of India) will be direct participants in the TReDS. The TReDS will provide the platform to bring these participants together for facilitating uploading, accepting, discounting, trading and settlement of the invoices / bills of MSMEs. The bankers of sellers and buyers may be provided access to the system, where necessary, for obtaining information on the portfolio of discounted invoices / bills of respective clients. The TReDS may tie up with necessary technology providers, system integrators and entities providing dematerialisation services for providing its services.

- How it Works

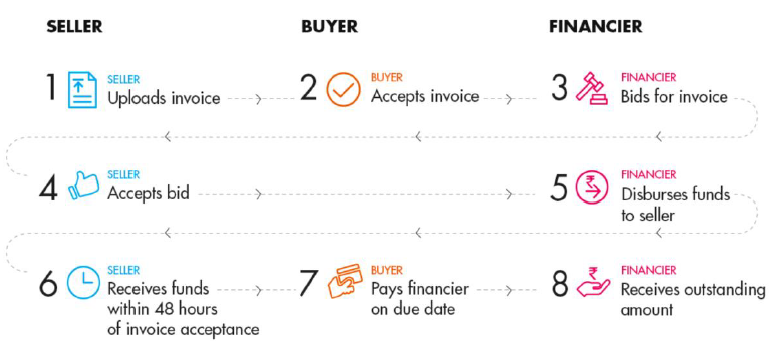

- Factoring:

Source: https://www.invoicemart.com/index.html#factoring

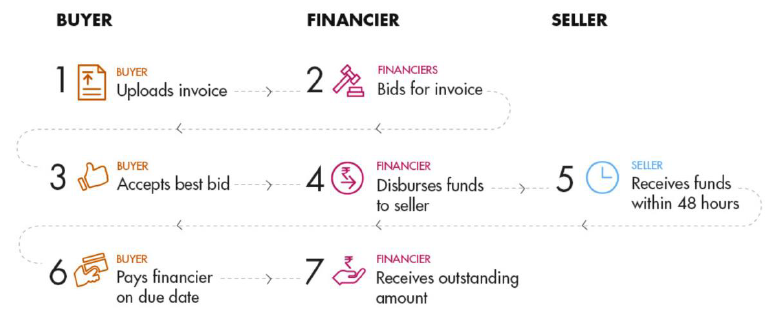

- Reverse Factoring:

Source: https://www.invoicemart.com/index.html#reverse

- Significant benefits to the MSME

- Under this system the MSME supplier is unlocking the funds without bothering about the future liability of default

- Normally the interest rate is lesser than bank interest and other funding modes, if their corporate customers credit rating is strong

- The existing factored invoices can be traded in secondary market also, thereby creating good demand for qualitative receivables amongst the financiers

- Supports the growth of MSMEs

- The Technology backbone

- The three trade finance platforms wanted to have the benefit of sharing for fraud prevention but keep the data private from each other. All the three exchanges are presently using the Hyperledger Fabric Technology developed by MonetaGo. MonetaGo is a software development company and Hyperledger member based in New York City that works with financial institutions and central banks around the world to provide private permissioned blockchain solutions.

- The solution was to create a hash of the invoice elements. A hash is a cryptographic representation of the invoice. Looking at a hash, you see indecipherable text, and you can’t tell anything about the invoice. Plus mathematicians have made it almost impossible to convert a hash back to the original data.

- However, if the trader submits the same invoice to another trade finance platform, the hash of the invoice will match the one already on the blockchain, raising a red flag.

- So what if the trader tweaks the invoice just a little? MonetaGo additionally hashes some of the elements of the invoice. Using fuzzy matching a very similar invoice won’t be rejected but will receive an amber flag, and the supplier will have to explain.

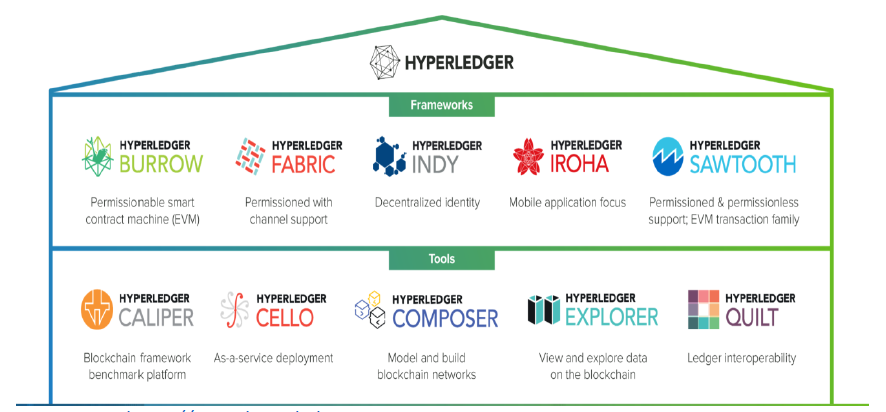

- Hyperledger Fabric is a blockchain framework implementation and one of the Hyperledger projects hosted by The Linux Foundation. Intended as a foundation for developing applications or solutions with a modular architecture, Hyperledger Fabric allows components, such as consensus and membership services, to be plug-and-play. Hyperledger Fabric leverages container technology to host smart contracts called “chaincode” that comprise the application logic of the system. Hyperledger Fabric was initially contributed by Digital Asset and IBM, as a result of the first hackathon.

- Pictorial presentation of various ongoing Hyperledger projects

Source: https://www.hyperledger.org

- Conclusion

Based on the above one can understand that the launch of TReDS platform is a milestone in the digital initiatives of RBI. This platform is expected to be a catalyst in the growth of MSMEs by significantly improving their liquidity position and ushering in transparency in the business eco-system. This platform is the first attempt in India for introduction of factoring without recourse and is expected to help not only quick realization of receivables but also appropriate price discovery for MSME financing. This platform could be leveraged as a key tool in the new financial architecture in furthering assistance to the MSME sector.

MSMEs can utilize the TReDS platform to encash the receivables on early basis even when otherwise they are not having access to formal banking channel due to various reasons including the credit history.