One of the mysteries of the 21st Century is the taxation of rental income under the IT Act[1]. The classification of such rental income is quite challenging and garnering a unanimous view among tax practitioners itself is impossible, forget about the authorities and courts. In this article, we try to analyse the various judgements on the issue and provide our conclusions about the classification.

Before proceeding to analyse the various judgments, a quick look at the scheme of IT Act is essential. Section 4 of the IT Act deals with charge of income tax on total income earned by the assessee in the previous year. The tax on the total income of the previous year has to be classified under the heads of income as provided in Section 14 of Act and accordingly the liability has to be computed. Each head of income is different from other head and has different entitlements, restrictions and prohibitions in the total scheme of the act. Hence, classifying an income under the appropriate head is important because of different tax consequences. For example, an income which is classified under IFHP[2] is eligible only for a standard deduction of expenditure as against actuals, however, the same income, which if classified under PGBP[3], does not have any restriction for claiming the expenditure. Hence, it is important to classify the income under appropriate head to avoid any future litigations on the said count.

Case Study:

Let us say, ABC Limited has constructed a building which can be fit for use for a company, say PQR Limited engaged in providing restaurant, banquet, accommodation, and other related services. PQR Limited has approached ABC Limited for the leasing of the said property. As per the contract, ABC Limited must invest in certain plant and machinery (lifts, generator set and others), furniture and fixtures and certain other items. The rent is agreed to be shared based on certain percentage of revenues earned by PQR Limited. Adding another layer of complication (but not hypothetical), let us assume that ABC Limited has taken part of the building on lease from various owners and leased it to PQR Limited.

The question would be, whether the rental income earned by ABC Limited should be offered to tax under IFHP or PGBP or IFOS[4]. Before analysing the same, it is not out of place to mention that classification of income under each of the above head have different tax consequences. For example, if the income is classified under IFHP, ABC Limited can only claim deduction upto 30% of net annual value in terms of Section 24(a) of IT Act. On the other hand, if ABC Limited classifies the said income under PGBP, then there is no restriction on the quantum of expenditure that can be claimed as deduction. Alternatively, if the income is classified as IFOS, then there is no possibility of deduction of any expenditure, either standard as allowed under IFHP or actual as allowed under PGBP. Apart from the above, there is also carry-forward of losses (the quantum and years for which they are allowed to carry forward), which are dependent again upon the classification of income and differ from one head to another. Hence, it is essential to understand under which head of income, the said income gets classified. So, let us proceed to answer the same.

Discussion on Possibility of Classification under IFHP:

Section 22 to Section 27 deals with IFHP. Section 22 states that annual value of property consisting of any buildings or lands appurtenant thereto of which the assessee is the owner, shall be the income chargeable to the income-tax under the head IFHP. From the above, it is evident that in order to classify an income from property under IFHP, it is mandatory that assessee is the owner of such property. If the assessee is not the owner of the property, the income earned from such property, would not be subjected to tax under the head IFHP. Hence, it is necessary to determine, the ambit of expression ‘owner of house property’ to decide the possibility of classification under IFHP.

The definition of ‘owner of house property’ has been defined vide Section 27 of Act. The sub-clause that is relevant to the current issue is the (iiib). Vide Section 27(iiib), a person who acquires any right (excluding any right by way of lease from month to month or for a period not exceeding one year) in or with respect to any building or part thereof, by virtue of any such transaction referred in Section 269UA (f), is deemed to be the owner of house property for the purposes of Section 22 to 26. Section 269UA (f), vide sub-clause (i) states that transfer in relation to immovable property referred to in sub-clause (i) of clause (d) of Section 269 UA, means a transfer of such property by way of sale or exchange or lease for a term of not less than 12 years and includes allowing the possession of such property to be taken or retained in part performance of a contract of the nature referred in Section 53A of Transfer of Property Act, 1882. The immovable property referred in sub-clause (i) of clause (d) of Section 269 UA, means any land or building or part of the building, and includes, where any land or any building or part of a building is to be transferred together with any machinery, plant, furniture, fittings or any other things, such machinery, plant, furniture, fittings or other things also.

Hence, on a combined reading of Section 269UA (f) and 269 UA (d)(i), what transpires is, if there is an immovable property which is nature of building together with machinery, plant, furniture or fittings or other things and being transferred vide lease for a term not less than 12 years, the person making such transfer shall be deemed to be owner for the purposes of Section 22 to Section 26. Accordingly, all instances of transfer of immovable property vide lease for a term not less than 12 years, the transferor would still qualify as the owner of the house property for the purposes of IFHP.

However, the ownership of the property is not a conclusive factor for classification of income earned under IFHP. If it can be substantiated that such letting out is not for earning the rent alone but to commercially exploit the property, then there can be said that the income earned shall be taxable under PGBP and not under IFHP. Hence, let us proceed to examine the classification under PGBP.

Discussion on Possibility of Classification under PGBP:

Section 28(i) states that the profits and gains of any business or profession which was carried on by the assessee at any time during the previous year shall be classifiable under PGBP. Let us now, proceed to understand, under what circumstances, such income shall be classifiable under PGBP.

The Supreme Court in the matter of Chennai Properties & Investments Limited[5] held that if the main objective of the company is to let out, then such income can be classified under the head PGBP instead of IFHP. The Supreme Court in the matter of Chennai Properties & Investments Limited (supra), placed reliance on the judgment in the matter of Karanpura Development Co Ltd[6], where in it was held that ‘as has been already pointed out in connection with the other two cases where there is letting out of premises and collection of rents the assessment on property basis may be correct but not so, where the letting or sub-letting is part of trading operation. The dividing line is difficult to find, but in the case of a company with its professed objects and the manner of its activities and the nature of dealing with its property, it is possible to say on which side the operations fall and to what head the income is to be assigned’.

The Supreme Court in the matter of Chennai Properties & Investments Limited (supra), further distinguished the two judgments which were against the taxpayers classifying income under PGBP. The two judgments were in the matters of East India Housing and Land Development Trust Limited[7] and Constitution Bench in the matter of Sultan Brothers (P) Limited[8]. We shall discuss the same hereunder.

The Supreme Court has distinguished the judgment in the matter of East India Housing and Land Development Trust Limited (supra), stating that, the main objective of the company was to buy and develop properties and promoting and developing markets and not the letting out of properties. Accordingly, the Supreme Court has come to conclusion that since letting was not at all the objective of the company and there was a rental income, such income shall be taxable as IFHP and not PGBP. The court was therefore of the opinion that income which was from the house property had not altered because it was received by company formed with the objective of developing and setting up properties. However, in the matter of Chennai Properties & Investments Limited, the main objective was to let out. Hence, there is a change in facts of the matter between East India Housing and Land Development Trust Limited (supra) and Chennai Properties & Investments Limited and stated that such judgment does not apply.

Further, the Constitution Bench in the matter of Sultan Brothers (P) Limited has held that despite of the fact that objective of the company is to acquire land and buildings and to turn the same into account by construction and reconstruction, decoration, furnishing and maintenance of them and leasing and selling of the same would not by itself turn into the lease as business income. The Constitution Bench has concluded that, ‘We think each case has to be looked at from a businessman’s point of view to find out whether the letting was the doing of a business or the exploitation of his property by an owner. We do not further think that a thing can by its very nature be a commercial asset. A commercial asset is only an asset used in a business and nothing else, and business may be carried on with practically all things. Therefore, it is not possible to say that a particular activity is business because it is concerned with an asset with which trade is commonly carried on. We find nothing in the cases referred, to support the proposition that certain assets are commercial assets in their very nature’.

The Supreme Court in the matter of Chennai Properties & Investments Limited has distinguished the judgment of Constitution Bench of Sultan Brothers (P) Limited by stating that the entire exercise, whether an income falls under IFHP or PGBP should be based on the facts of each case and since in the facts of Chennai Properties & Investments Limited, the objective was to let out and accordingly the decision in Sultan Brothers (P) Limited can be distinguished.

From the above discussion, what can be summed up is, there is no straight answer as to whether an income is classifiable under IFHP or PGBP. It depends upon the facts of each case and the intention of the party who lets his property. If the intention is to earn a standard rent from the property, then it can be classified as IFHP, but if the intention is to commercially exploit the asset, then such income shall be classified as PGBP.

From the facts in the case study, it is evident that the objective of ABC Limited is not to just earn the rental income, which is evident from the fact that rent is based on the revenues earned by PQR Limited. In other words, ABC Limited has also taken a risk or done an adventure (in case of downside in revenues, ABC Limited would be losing the rentals) by resorting to the rentals based on the revenues instead of standard rentals. Hence, there are brighter chances for ABC Limited to classify the income under PGBP rather than IFHP.

The Supreme Court in the matter of Rayala Corporation Private Limited[9] has stated that the assessee company has only one business and that is leasing of its property and earning rent therefrom and hence concluded that income from leasing is chargeable under PGBP and not under IFHP as claimed by revenue. The Supreme Court in the matter of Raj Dadarkar & Associates[10] has stated that income earned from shopping centre, where the assessee is owner, by virtue of Section 27(iiib) is chargeable to IFHP and not PGBP, since the assessee has failed to show any evidence or other material to state that intention was to exploit the property not as owner. Hence, the intention assumes importance to classify the income either as IFHP or PGBP.

The Delhi High Court in the matter of Francis Wacziarg[11], has held that income earned from leasing out of hotels is to be treated as income from PGBP and not under IFHP as claimed by the Revenue. The Delhi High Court has confirmed the view taken by Commissioner of Income Tax (Appeals) wherein the Commissioner of Income Tax (Appeals) has held that income earned by assessee was taxable under PGBP for the reason that the license fee received by assessee is not a fixed sum of money as in the case of IFHP but is has been varying from year to year as it is based on a revenue sharing agreement, which arises according to the receipts. As stated in the facts of case study, ABC Limited has also entered a similar agreement with PQR Limited, where the lease rental or license fee is charged based on the receipts earned by PQR Limited and accordingly the same may be concluded as income under PGBP and not under IFHP.

The Andhra Pradesh High Court in the matter of Sileman Khan Mahaboob Khan[12] has held that income earned from letting out godowns which is a commercial asset by itself does not make income under PGBP and to be taxed under IFHP. The Andhra Pradesh High Court further stated that the nature of income shall not become PGBP only for the reason that one of the objectives of partnership deed is to undertake activity of construction and to let out them. In the facts of the case, the assessee was an exporter of tobacco and whenever he is not in requirement of godowns, the same were let out and the Andhra Pradesh High Court has held that since letting out of godowns is not a continuous activity and such let out is not without any amenities, the income earned from let out shall be subjected to tax under IFHP and not under PGBP. However, this can be distinguished from the facts of the current case study.

The Income Tax Appellate Tribunal (for brevity ‘ITAT’) of Chandigarh in the matter of Enn Zen Enterprises (P) Limited[13] was seized with facts wherein the assessee had leased the building and restaurant along with furniture and fixture and earned income. Such income has been disclosed as income from PGBP. However, the Assessing Officer has raised an objection that such income has to be assessed as IFHP and not as PGBP. The ITAT after perusing the facts has stated that, whether a particular letting is business or not has to be decided based on the facts and circumstances of each case and the same has to be looked from the perspective of the assessee to find out whether letting was done for a business or for exploitation of its property as owner. The ITAT further stated that it is now trite law that merely the fact that a premises is being let out on rent does not mean that income out of it is to be taxed as income from house property. It has to be seen what is, primary object of letting out such property. The object, as it appears, in the present case, is exploitation after the persistent efforts of the assessee at various levels. The development of two such hotels, not only one, in the assessee’s case also strengthen the contention of the assessee that is in the business of running hotels and concluded that income shall be treated as PGBP and not as IFHP.

The ITAT of Hyderabad in the matter of Vijay Infotech Ventures[14], has held that objects of the company to carry on business of leasing out the properties to make profit will be subjected to tax under PGBP and not under IFHP. The facts were that assesse was leasing out the building for software technology and accordingly held that such income is under PGBP and IFHP.

Further, the Central Board of Direct Taxes (for brevity ‘CBDT’) vide Circular 16/2017 dated 25th April 2017 has clarified that income arising from letting out premises/developed space along with other amenities in an Industrial Park/SEZ is to be charged under PGBP and not under IFHP as claimed by Assessing Officers. Even though the above is applicable for industrial parks/SEZ, the intention can be garnered and applied to the current facts to derive that income is subjected to PGBP.

Hence, from the above jurisprudence, if the objective of ABC Limited is to lease out the property and earn income thereon and to commercially exploit the property instead of earning regular income from the property, then it is fit case, the income can be classified as PGBP instead of IFHP despite of the fact that ABC Limited is the owner or deemed owner for the purposes of Section 22 to Section 26. However, the said matter is not free from any litigation.

Discussion on Possibility of Classification under IFOS:

The next issue that may arise is, whether the income earned from PQR Limited can be classified as IFOS instead of PGBP. Section 56(1) of Income Tax Act states that income of every kind which is not to be excluded from the total income shall be chargeable to tax under IFOS, if it is not chargeable to income tax under any of the heads as mentioned in Section 14, from A to E.

Since, we have concluded that the income is chargeable to tax under IFHP or PGBP, the same will not be taxable under IFOS vide Section 56(1).

There might arise a question, since the ABC Limited has taken lease from various landowners and given the same commercial complex to PQR Limited, whether such sub-lease is subjected to tax under IFOS. Normally, the income from sub-lease transactions are subjected to tax under IFOS, since under the typical sub-lease, the person who is providing assets on sub-lease is not an owner and thereby fails to satisfy the condition under Section 22 to be called as IFHP. Hence, typical sub-lease transactions are subjected to tax under IFOS. However, in the instant case, as we have concluded that ABC Limited is deemed to be owner by virtue of Section 27(iiib), the income earned shall not be taxable under IFOS, since it satisfies the condition mentioned under Section 22.

Because of the above-mentioned reason, we can conclude though ABC Limited has sub-leased the property, there will not be any classification under Section 56(1) of Act. Hence, let us proceed to examine applicability of any other provisions of Section 56 to call income earned by Subishi or new entity as IFOS.

Section 56(2)(iii) states that, where an assessee lets on hire machinery, plant or furniture belonging to him and also buildings, and the letting of buildings is inseparable from the letting of the said machinery, plant or furniture, the income from such letting, if it is not chargeable to income-tax under the head PGBP. Hence, from the above, it is evident that, income from letting of machinery, plant or furniture belonging to him along with buildings and such letting of machinery, plant or furniture is inseparable from letting of buildings, then such income if not charged under PGBP, then such income will be subjected under IFOS.

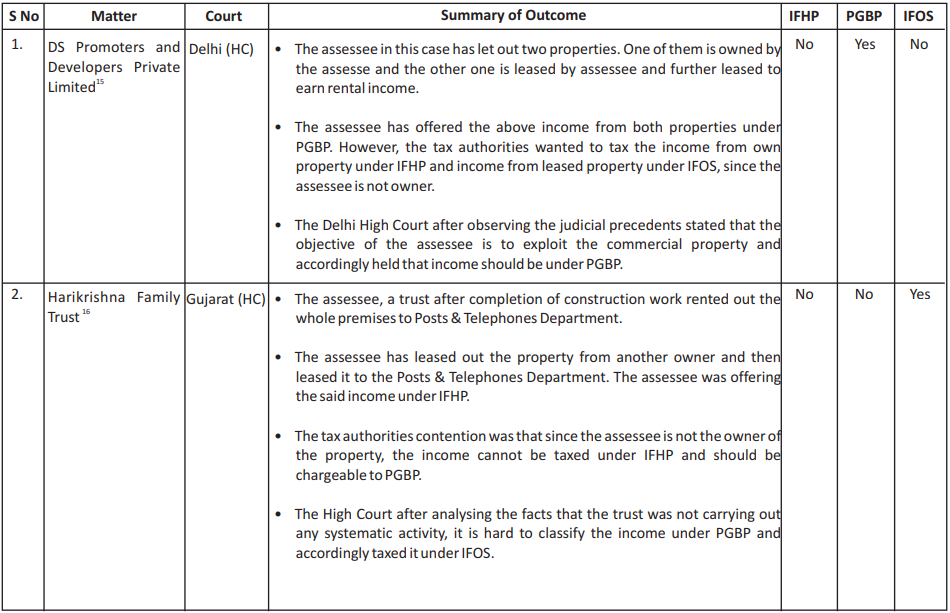

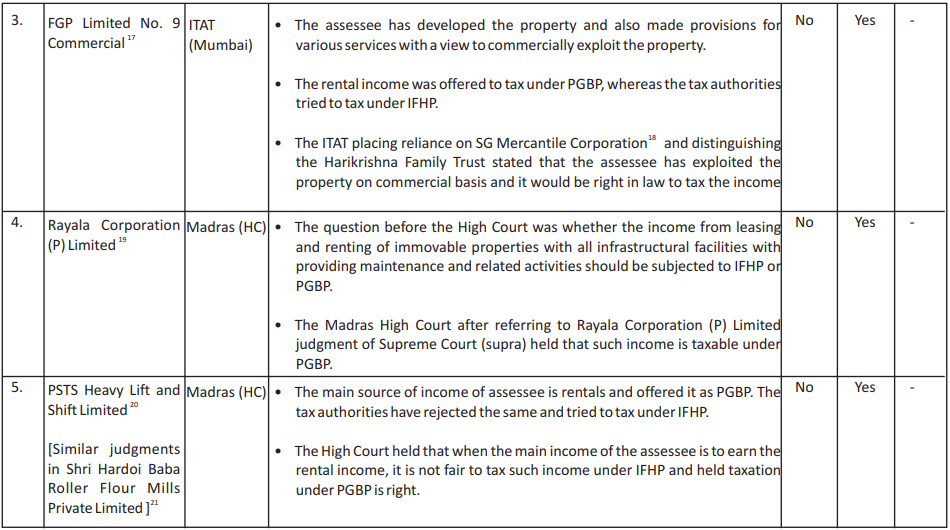

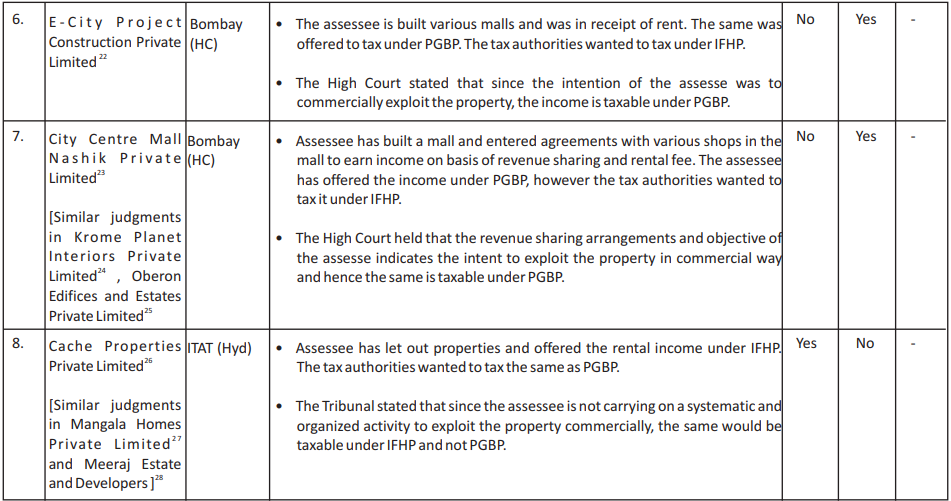

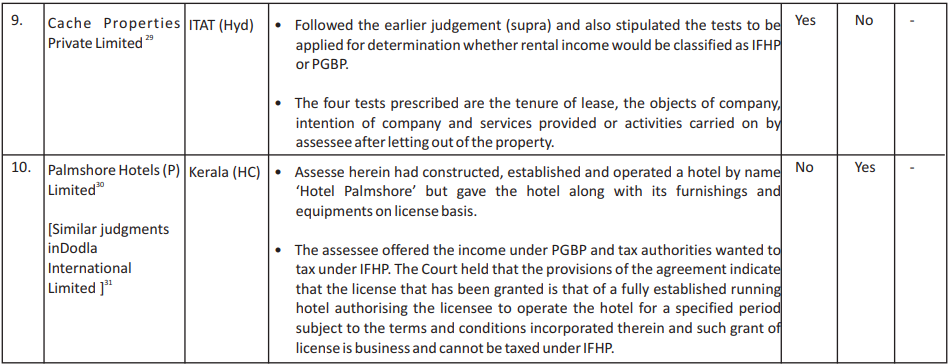

Hence, from the above discussion, we wish to conclude that the income earned by ABC Limited can be classified as PGBP. However, as part of their tax policy, they have to keep updating with latest judicial trends to revisit time and again the above stand adopted by them. The below are certain judgments of various courts, where different views were taken qua classification:

[1] Income Tax Act, 1961

[2] Income from House Property

[3] Profits and Gains from Business or Profession

[4] Income From Other Sources

[5] 2015 (5) TMI 46 – Supreme Court

[6] 1961 (8) TMI 7 – Supreme Court

[7] 1960 (11) TMI 7 – Supreme Court

[8] 1963 (12) TMI 4 – Supreme Court

[9] 2016 (8) TMI 522 – Supreme Court

[10] 2017 (5) TMI 586 – Supreme Court

[11] 2011 (11) TMI 19 – Delhi High Court

[12] 2015 (5) TMI 432 – Andhra Pradesh High Court

[13] 2016 (5) TMI 63 – ITAT Chandigarh

[14] 2017 (1) TMI 106 – ITAT Hyderabad

[15] 2009 (5) TMI 557 – Delhi High Court

[16] [2008] 306 ITR 303

[17] 2012 (10) TMI 559 – ITAT Mumbai

[18] 83 ITR 700

[19] 2020 (3) TMI 883 – Madras High Court

[20] 2020 (2) TMI 213 – Madras High Court

[21] 2019 (3) TMI 1004 – Allahabad High Court

[22] 2017 (7) TMI 779 – Bombay High Court

[23] 2020 (1) TMI 872 – Bombay High Court

[24] 2019 (4) TMI 1388 – Bombay High Court

[25] 2019 (3) TMI 1468 – Kerela High Court

[26] 2019 (5) TMI 1875 – ITAT Hyderabad

[27] 2008 (8) TMI 522 – Bombay High Court

[28] 2019 (10) TMI 1002 – Allahabad High Court

[29] 2021 (11) TMI 768 – ITAT Hyderabad

[30] 2017 (11) TMI 1086 – Kerala High Court

[31] 2021 (2) TMI 421 – ITAT Chennai