In our previous article[1], the concept of deemed residency under Section 6 of ITA[2] has been discussed in detail. In this part, various issues related to determination of residential status of an individual are aimed for discussion. As per Section 6(1) of ITA an individual shall be treated as resident:

- If he is in India for a period of 182 days or more during previous year or

- If he is in India for a period of 365 days within 4 years immediately preceding previous years and 60 days or more during the previous year.

A person being an individual is treated as resident in India if any of the conditions i.e., (a) or (b) above is satisfied. Otherwise, such person is treated as non-resident. Further, Explanation 1 to Section 6(1) states that in case of an individual:

- being a citizen of India who leaves in India in any previous year as a member of crew member of an Indian ship or for the purposes of employment outside India, the period of stay for that year specified above as 60 days is to be replaced with 182 days.

- being a citizen of India or person of Indian origin, who is staying outside India, comes to India on a visit to India in any previous year

- the period of stay specified above as 60 days is to be replaced with 182 days.

- In the case of such person having total income, other than income from foreign sourced income, exceeding INR 15 lakhs, the period of stay specified above as 60 days is to be replaced with 120 days.

A plain reading of Section 6 seems to be easy to understand. However, each and every aspect of Section 6 needs to be analyzed carefully, as many practical difficulties would arise while interpreting the provisions.

Let us proceed to analyze various aspects of provisions of Section 6.

For the purposes of employment:

Explanation 1(a) to Section 6(1) states that in the case of an individual being a citizen of India who leaves India for the purposes of employment outside India, such person is treated as resident in India only when such person stays in India for a period of 182 days or more during the year under consideration instead of general rule of 60 days.

However, the term ‘for the purposes of employment’ is not expressly defined under the provisions of Section 6. Hence, it triggers interpretational issues.

The individual may leave India for obtaining employment outside India, may leave India to exercise employment outside India, may leave India on deputation to other country or may leave India for self-employment outside. The question arises is whether every illustration stated above is covered under the ambit ‘for the purposes of employment’?

While the first two instances are undoubtedly covered under the term ‘for the purpose of employment’ outside India, the uncertainty is left with other two instances which is tried to be resolved by various judicial fora.

Deputation:

The AAR in case of British Gas India (P.) Ltd., In re[3] has held that the requirement of Explanation 1(a) to Section 6(1) is not leaving India for employment but it is leaving India for the purposes of employment outside India. For the purpose of the Explanation, an individual need not be an employed person who leaves in India for employment outside India. Accordingly, the AAR has held that when a person being individual who is under the employment in India leaves on deputation is also covered under Explanation 1(a) to Section 6(1).

Self-Employment:

Circular[4] amending the provisions of Section 6(1) through the Finance Act, 1982 states that “with a view to avoiding hardship in the case of Indian citizens, who are employed or engaged in other avocations outside India…”. From the above extract of circular, it is evident that individuals engaged in other avocations were also intended to be covered.

The Kerala High Court in the case of O. Abdul Razak[5] has held that even self-employment is also covered under Explanation 1(a) to Section 6(1). The High Court has referred to CBDT[6] Circular 346 (supra) and held that going abroad for the purpose of employment only means that the visit and stay abroad should not be for other purposes such as a tourist, or for medical treatment or for studies or the like. Accordingly, the High Court held that going abroad for the purpose of employment therefore means going abroad to take up employment or any avocation as referred to in the Circular, which takes in self-employment like business or profession.

Following the Kerala High Court judgement in the case of O. Abdul Razak (supra), the Delhi Tribunal in the case of Jyotinder Singh Randhawa[7] has held that assessee being a professional golfer is a self-employed professional and hence for such citizen period of stay has to be increased to 182 days as per Explanation 1 (a) to Section 6(1).

The Hyderabad Tribunal in case of K. Sambasiva Rao[8] has referred the decision of the Supreme Court in the case of Aditya V. Birla[9] wherein the Supreme Court has held that employment does not mean salaried employment but also includes self-employed/professional work. Considering the Supreme Court judgement and Kerala High Court judgement in the case of O. Abdul Razak (supra), the Tribunal has held that going abroad for the purpose of employment therefore, means going abroad to take-up employment or any avocation as referred to in the circular.

Hence, the explanation covers not only the straight employment scenarios but also self-employment scenarios.

Various Situations vis-à-vis Explanation 1:

An act of going abroad and coming to India by an individual may be divided into three phases. First phase - leaving India for various purposes, second phase - visiting India on regular intervals and third phase - coming to India permanently.

Leaving India:

The next aspect in Section 6(1) is whether the provisions of Explanation 1(a) are applicable to subsequent previous years or applicable in the year in which such individual leaves India. Explanation 1(a) states that ‘being a citizen of India, who leaves India in any previous year……… the provisions of sub-clause (c) shall apply in relation to that year as if for the words "sixty days", occurring therein, the words "one hundred and eighty-two days" had been substituted.”

The reading of Explanation 1(a) shows that these provisions are applicable to the year in which such individual leaves for the purpose of employment outside India.

This aspect has been dealt with by the Bangalore Tribunal in the case of Manoj Kumar Reddy[10] (the decision of the Bangalore Tribunal has been upheld by the Karnataka High Court[11]) where in the Tribunal held that the word ‘that year’ refers to the previous year in which the assessee has left India for the purpose of employment outside India. Accordingly, the Tribunal has held that Explanation 1(a) to Section 6(1) is applicable to the previous year in which the assessee leaves India for the purpose of his employment.

Visit to India:

The word ‘visit to India’ too makes significant impact on determination of residential status of an individual. Direct Tax Laws (Second Amendment) Act, 1989, by which period of stay for COI[12] or PIO[13] has been increased to 150 days, throws some light on provisions of Explanation 1 (b) to interpret the term ‘visit to India’.

The statement of objects and reasons states that amendment to Section 6 will liberalize the criterion for determining the residential status so as to facilitate non-resident Indians to stay in India for a longer period in order to look after their investments without losing their 'non-resident' status.

Further, CBDT Circular No 684 dated June 10, 1994, explaining the amendments through Finance Act, 1994 states that non-resident Indians who have made investments in India, find it necessary to visit India frequently and stay here for the proper supervision and control of their investments. Accordingly, the period of stay for determining the residential status has been increased to 182 days.

Going through the legislative intent of the Explanation 1 to Section 6, it can be concluded that the purpose of incorporating such Explanation is to encourage NRIs to visit India on regular intervals to look after the investment made them.

Permanent return:

Having said that the period of stay in the case of visit has to be increased to 182 days, the question arises is whether permanent return to India is also covered under Explanation 1(b) to Section 6(1)?

The Bangalore Tribunal in the case of Manoj Kumar Reddy (supra) has held that one has to consider the entry of a person into India and if such entry is for the purpose of visit, then, period of stay 60 days has to been increased to 182 days. However, if in the previous year, the assessee has come to India permanently after leaving his employment outside India, then the Explanation (b) will not be applicable.

In this case, the assessee has come to India on visit and went back to foreign country. Subsequently, the assessee has come to India permanently in the same financial year. By quoting this fact, assessee has argued that once there is a visit to India, period of stay has to be increased to 182 days notwithstanding to the subsequent return to India permanently. However, the High Court considering the legal background of Explanation 1(b) has negated the arguments of the assessee.

Further, an interesting argument has been made the assessee that while computing the period of stay on permanent return to India, period of stay on visit has to be excluded. The assessee has

explained his contention with an example ‘In Example A, the learned AR submitted that a person comes on visit and his stay in India on visit is 120 days. He will be treated as non-resident as per clause (b) of the Explanation. In Example B, if a person comes on visit and stays in India for 90 days and returns abroad and, later on, comes back to India permanently and he stays in India for a period of 30 days, he will become a resident according to the Assessing Officer. This is because his stay in India has exceeded 60 days if period of visit is also included. In both the cases, stay is only 120 days. However, in Example B, a person becomes a resident while in Example A, he remains non-resident’. This time, the High Court has agreed with the contention of the assessee and excluded the period of visit to India while computing the period of stay in India.

The AAR in the case of Mrs. Smita Anand, China, In re[14] has, after the detailed analysis, held that as the assessee has returned to India after the resignation hence, such return to India cannot be equated with ‘visit to India’ under Explanation 1 (b) to section 6(1).

Considering the judicial analysis to Explanation 1 to Section 6(1), it can be understood that intention of the assessee to stay in India whether on visit or permanent makes significant impact on determination of the residential status. Even in the case of leaving India, the term ‘purposes of employment’ has been interpreted by keeping mind the legislature intention behind the incorporation of such Explanation to Section 6(1).

- In the case of leaving India for the purposes of employment, the period of stay has to be increased to 182 days.

- In the case of coming to India on visit, the period of stay has to be increased to 182 days.

- In the case of coming to India permanently, period of stay cannot be increased to 182 days and 60 days has to be computed for determining the residential status of an Individual.

Day of Arrival to be Included in Computation?

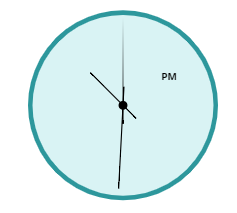

As discussed earlier, in order to treat a person resident in India, such person shall be in India for specified number of days in the previous year. The next aspect of Section 6 is, how to compute number of days for which an individual is present in India.

The issue that created lot of discussion at various fora is whether day of arrival to India or day of leaving India needs to be included or excluded while computing the number of days in India?

As this issue has not been dealt with by the provisions of Section 6, judicial fora have analyzed the issue at length and the summary of various decisions are discussed hereunder.

The Jaipur Tribunal in case of Dr. R.K. Sharma[15] has held that fraction of day need not be computed for the purpose determining period of stay in India. In this case, the assessee has arrived in India at 10:30 PM. In this regard, the Tribunal has pointed that prime hour of work having expired the assessee could not have done any useful work for the one and a half hours.

The Bangalore Tribunal in the case of Manoj Kumar Reddy (supra) has held that when one has to compute the period for which an assessee is in India, one has to start the counting from a particular day and to end the same with specific day. The period is to be counted from the date of arrival of the assessee in India to the date he leaves India. Thus, the words 'from' and 'to' are to be inevitably used for ascertaining the period though these words are not mentioned in the statute. The Tribunal has further referred to section 9 of General Clauses Act which states that

(1) In any (Central Act) or Regulation made after the commencement of this Act, it shall be sufficient, for the purpose of excluding the first in a series of days or any other period of time to use the word "from", and, for the purpose of including the last in a series of days or any other period of time, to use the word "to".

(2) This section applies also to all (Central Acts) made after the third day of January, 1868, and to all Regulations made on or after the fourteenth day of January, 1887.

Which means that while computing a period first day in a series has to be excluded when the ‘from’ is used in the context. In this regard, even though Section 6 does not use the word ‘from’, the Tribunal has opined that for computing the period, one has to necessarily import the ‘from’. Accordingly, the Tribunal has held that when once the word ‘from’ is used for computing the period, first day in the series has to be excluded.

Following the decision of Bangalore Tribunal in the case of Manoj Kumar Reddy (supra) and Jaipur Tribunal in the case of Dr. R.K. Sharma (supra), the Mumbai Tribunal in the case of Fausta C. Cordeiro [16] has held that fraction of day must be excluded while computing the period of stay in India.

Recently, the Ahmedabad Tribunal in the case of Pradeep Kumar Joshi I (Late) Represented by his Wife And L/H. Smt. Sangeeta P. Joshi[17] after the considering the other Bench judgements held that ‘We do not find any reason to deviate from the ratio laid down by the Honb’le Bangalore Bench as narrated therein above and relying upon the identical facts in the case in hand we exclude the date of arrival in counting the days of stay in India in the case of the assessee.’

From the above judicial precedents, it can be understood that the day of arrival needs to be excluded for computing the period of stay in India. The question arises whether such day of arrival needs to be excluded when there are multiple visits to India. In this regard, the Ahmedabad Tribunal in the case of Pradeep Kumar Joshi (supra) has held that day of arrival in each visit has to be excluded. The intention behind such decision would be that in order to consider a day, such day needs to be a full day of stay in India and partial/fraction of day need not be considered as day for computing period of stay in India.

We shall conclude this part which has dealt with the aspect of determination of residential status of an Individual on various occasions. In the next part, the aspect related to determination of residential status of an individual who is working in a ship/vessel or aircraft would be discussed.

[1]Deemed Residency - Concept and Issues Thereof

[2] Income Tax Act, 1961

[3] [2006] 155 TAXMAN 326 (AAR – New Delhi)

[4] Circular No 346, dated 30-6-1982

[5] [2011] 198 Taxman 1 (Kerala)

[6] Central Board of Direct Taxes

[7] [2014] 46 taxmann.com 10 (Delhi - Trib.)

[8] [2014] 42 taxmann.com 115 (Hyderabad - Trib.)

[9] [1988] 170 ITR 137/36 Taxman 9

[10] [2009] 34 SOT 180 (Bangalore)

[11] [2011] 12 taxmann.com 326 (Karnataka)

[12] Citizen of India

[13] Person of Indian Origin

[14] [2014] 42 taxmann.com 366 (AAR - New Delhi)

[15] [1987] 0 SOT 1 (Jaipur)[22-08-1986]

[16] [2012] 24 taxmann.com 193 (Mum.)

[17] I.T.A. No. 452/Ahd/2020