In this budget edition, we discuss the various proposals segment and tax wise. Hope this effort of ours is useful for understanding the proposals. I would like to gather your attention to certain major amendments before the detailed analysis.

The changes in direct taxation are mainly focused to remove inconsistencies and rationalise the provisions. The significant amendment is the taxation on gains arising from transfer of virtual digital assets. The tax rate of 30% is huge and not allowing any set-off of losses against such gain would have a huge impact on the crypto industry. Further, the roll out of tax deduction at source for purchase of crypto currency would also create hurdles and may have a strong impact on the said industry. Having said so, there is a silver line here, that the government started recognising this class of asset. With the adequate and appropriate representations, I believe that there would be further fine tuning to these set of provisions.

The changes in GST laws are very minimal. The increase in transfer of credits through fake invoices is making the Government to further tighten the provisions dealing with availment of credit. These provisions are creating hardships to genuine taxpayers.

With this brief, I present you the detailed analysis on significant clauses on Finance Bill 2022. We wish this effort of ours is fruitful and we would love to receive feedback on this.

Proposals under Direct Taxation:

A. Individual Taxation:

a. Reliefs considering COVID 19:

Benefit from Employer:

- A new sub-clause (c) to clause (ii) to proviso to Section 17(2) is being introduced to provide any sum paid by the employer in respect of medical expenditure incurred by the employee on himself or any of his family members in relation to COVID-19, not to be treated as perquisite, subject to conditions as may be prescribed.

- Accordingly, the medical expenditure received from the employer subject to certain conditions by an employee or his family member shall not be treated as perquisites (normally perquisites provided by employer would fall under the definition of ‘salary’ and becomes taxable in the hands of employee) and there would not be any tax impact in the hands of the employee.

- It is further proposed to amend Section 56(2)(x) to provide that amount received by the family member of deceased employee from the employer of such deceased employee within a period of 12 months subject to the other conditions as may be prescribed, not to be treated as income in the hands of recipient.

- Section 56(2)(x) deals with taxation of income in the hands of recipient. But for this proposal, any income received by the family member of the deceased employee, would have been taxable in the hands of such family member. This is a right move, so that the family member is not burdened with tax or litigation.

Benefit from Other Persons:

- Like Section 17(2), it is proposed to amend Section 56(2)(x) to provide that amount received by any individual from any person in relation to expenditure incurred by him in relation to COVID-19 treatment for himself or any of his family members is not treated as income. It may be noted that the amendment made to Section 17(2) covers only amounts received from employer, however, this amendment covers amount received from any person.

- It is further proposed to amend Section 56(2)(x) to provide that amount (to the extent of INR 10 Lakhs) received by the family member of a deceased person from any person within a period of 12 months subject to the other conditions as may be prescribed is not to be treated as income in the hands of recipient (family member of the deceased). This enables the family member to receive amounts from other than employer of the deceased. However, there is a cap to the amount, which needs to be observed. The above amendments are applicable from the AY 2020-21.

b. Section 80CCD - Enhancement of contribution limit to NPS[1] by State Government Employees:

- Through the Finance Act, 2019, contribution limit to NPS by the Central Government Employees was increased from 10% to 14% of salary. To extend similar benefit to the state government employees, it is proposed to amend Section 80CCD, so as to provide employee of the State Governments to contribute up to 14% of his salary to the NPS during the previous year. The above amendment is applicable from the AY 2020-21.

c. Section 80DD – Enhancing the Scope of Section 80DD:

- Under the existing provisions of Section 80DD, any sum to the extent of INR 75,000 (INR 1,00,000 in case of severe disability) contributed by the assessee being an Individual or HUF, for the dependent disabled person, to the insurance company is allowed as deduction, subject to the condition that the annuity or amount is to be received by the dependent person only on death of the assessee. Further, Section 80DD(3) states that, if assessee receives such amount on the death of dependent, such amount is subject to tax.

- To provide relief to such dependent persons, Section 80DD has been amended so as to provided that assessee would be eligible to claim deduction under Section 80DD, even if policy provides for payment of annuity or lumpsum on attaining age of 60 or more by the assessee, provided payment to scheme is discontinued. It is further proposed that amount received by the assessee on the event of death of the dependent is not liable to tax by application of conditions specified in section 80DD(2)(a)(ii). The above amendment is applicable from AY 2023-24.

d. Surcharge on Long Term Capital Gain:

- Under the existing provisions, when total income exceeds INR 5 Crore, assessee is liable for a surcharge of 37 percent on tax amount. However, in respect of capital gains covered under Section 111A, Section 112A and Section 115AD, maximum surcharge is 15 percent.

- It is proposed to fix the maximum surcharge in respect of capital gains covered under Section 112 (in addition to existing sections) of 15 percent.

- Further, in case of AOP consisting of only companies as its members, it is proposed to fix the maximum charge of 15 percent on total income.

B. Trusts or Institutions:

e. Section 10 (23) and section 11/12 – Rationalisation of Exemption Provisions:

- There are different provisions governing the exemptions under the ITA in respect of charitable activities and the applicability of those provisions depends upon various parameters viz. nature of person, nature of activity, amount involved in such activity etc.

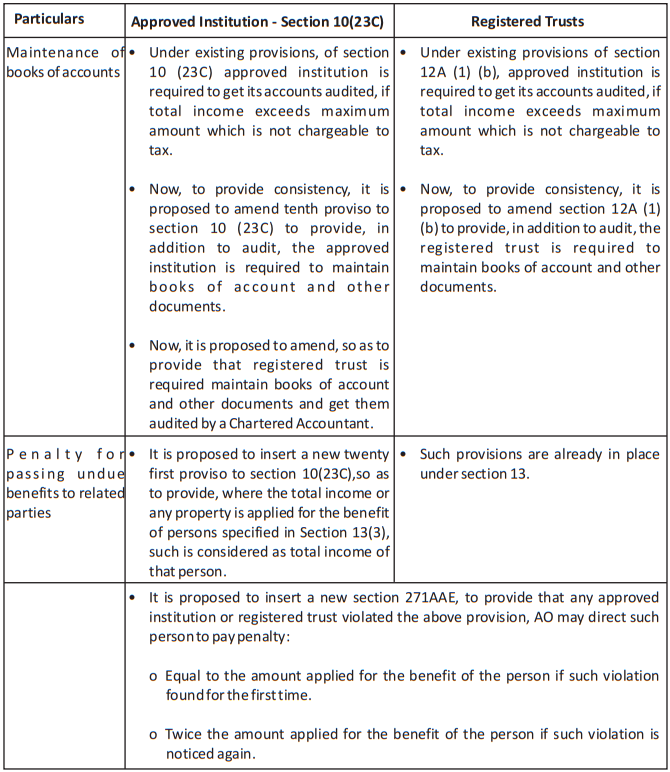

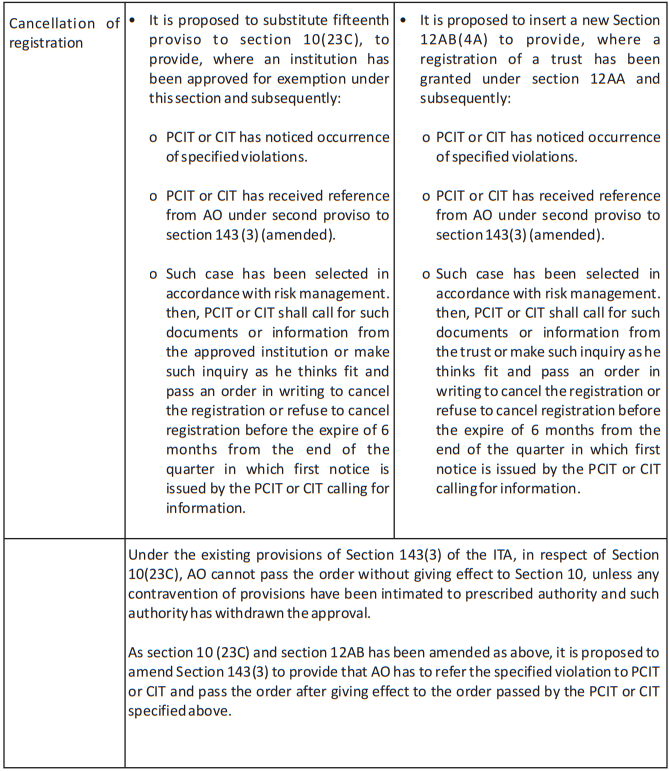

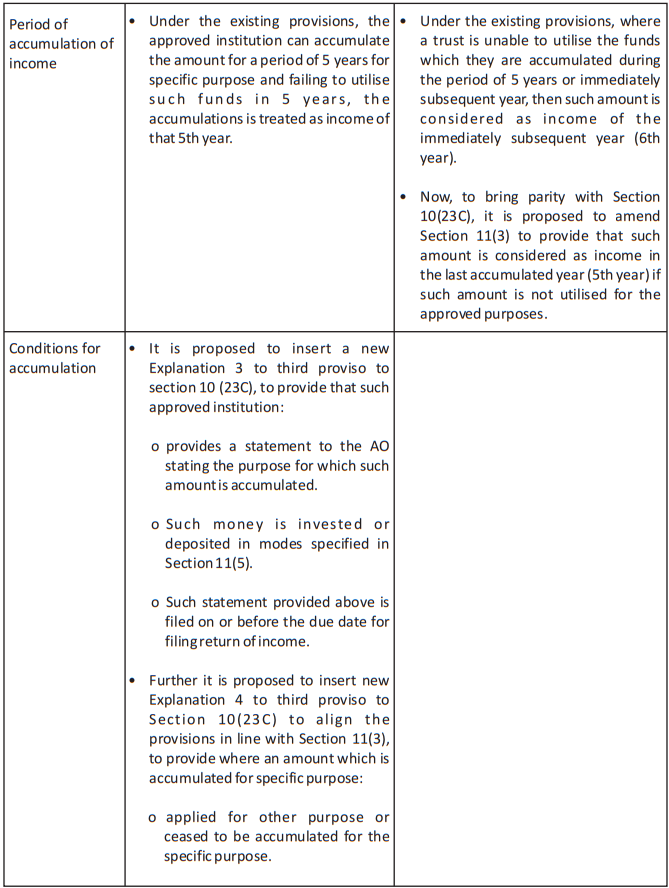

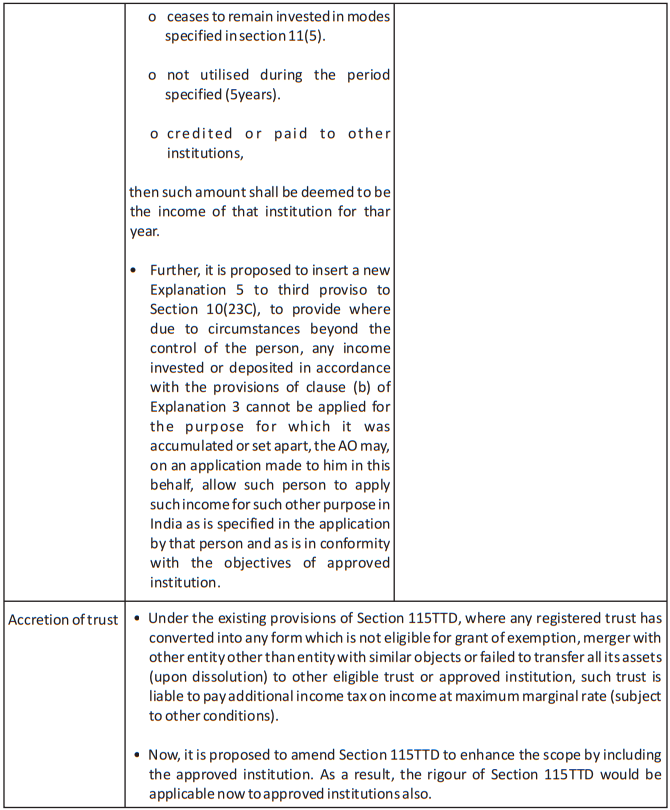

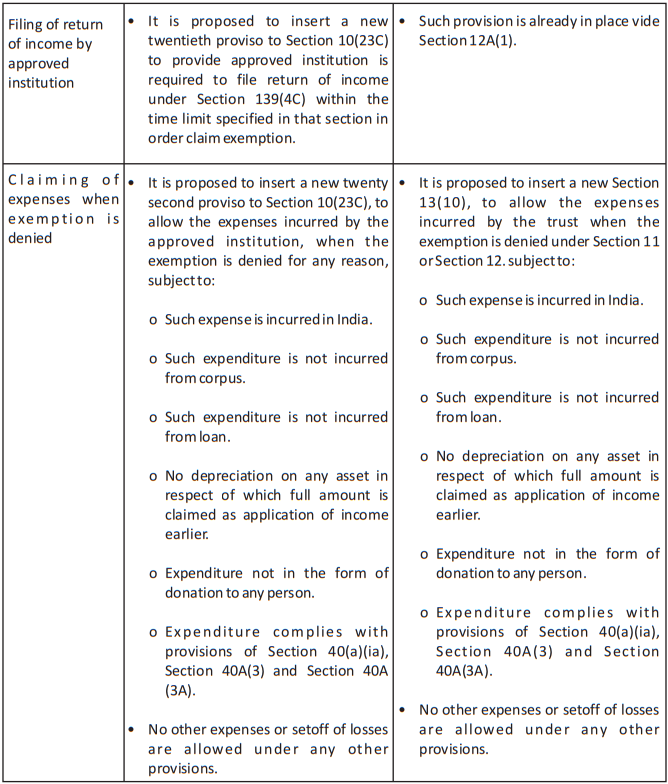

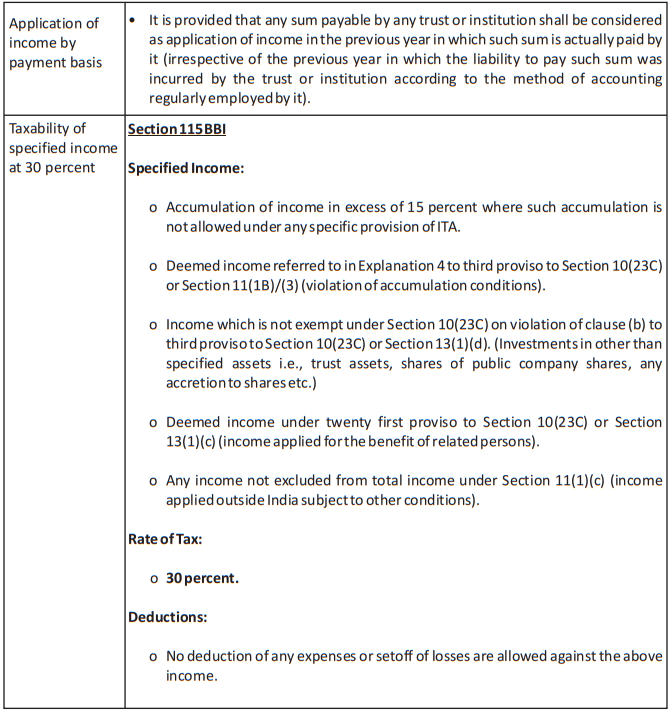

- While different provisions applicable to different persons for charitable activities, there are some differences between provisions contained in section 10(23C) [approved fund or institution or trust or any university or other educational institution or any hospital or other medical institution (for brevity ‘approved institution’)] and Section 12A/12AB [for brevity ‘registered trusts’]. To bring parity between these provisions, various provisions of Section 10(23C) and Section 12A/12AB are amended as follows from the AY 2023-24:

C. Cooperative Society Taxation:

f. Section 115JC and Section 115JF – Reduction of AMT[2] rate for Co-operative Society:

- Under the existing provisions, specified persons are liable to pay AMT at rate of 18.5%. However, through Taxation Laws Amendment Act,2019, MAT rate for companies has been reduced to 15% from 18.5%.

- To provide similar relief to co-operative societies, it is proposed to amend the provisions of Section 115JC to reduce the AMT rate to cooperative societies from 18.5 to 15%. However, no concessional AMT rate has been provided to other persons (despite the request from such taxpayers).

- Further, it is proposed to reduce surcharge from 12% to 7% when income of society is in between INR 1Crore – 10 Crore.

D. Virtual Digital Asset:

g. Section 115BBH - Taxation of Virtual Digital Assets:

- It is a known fact to everyone that the crypto currency has become one of the most profitable investment options in recent times and started to become an asset class. Such digital currency has been banned by many countries including Bangladesh, China, Egypt, Indonesia, Nepal, Qatar etc whereas same has been legalised in major developed nations including USA, Germany, France, Singapore etc. When it comes to India, there are many speculations from long period that the central government may ban crypto currency.

- In the Finance Bill 2022, the Honourable Finance Minister has made a statement that the Central Bank will introduce its own digital currency i.e., digital rupee in 2022-23. Further, to tax the gain arising from transfer of crypto currency, it is proposed to insert a new set of provisions into the ITA. However, as of now there is no clear answer from the government whether such currency is to be treated as legal or not, but the newly incorporated provisions seem to convey the intention of the legislature to discourage the transactions in crypto currency.

- Virtual Digital Asset (for brevity ‘VDA’) has been defined under Section 2(47A) to mean any information or code or number or token (not being Indian currency or foreign currency), generated through cryptographic means or otherwise, by whatever name called, providing a digital representation of value exchanged with or without consideration, with the promise or representation of having inherent value, or functions as a store of value or a unit of account including its use in any financial transaction or investment, but not limited to investment scheme; and can be transferred, stored or traded electronically or a a non-fungible token or any other token of similar nature, by whatever name called.

- It is proposed to insert to Section 115BBH, to tax the gain arising from transfer of crypto currency at the rate of 30%, whether such gain is short term or long term. Further, only the cost of acquisition without any indexation benefit is allowed from the sale consideration as deduction and no other expenses are allowed while computing the gain.

h. Gifting of Virtual Digital Asset:

- It is proposed to amend the provisions of Section 56(2)(x) in order to tax receipt of VDA as gift in the hands of recipient subject to other conditions specified in Section 56(2)(x).

i. Setoff of losses:

- The important aspect of Section 115BBH is that, it is not allowed to set off any other loss against the gain from transfer of VDA and loss arising from such VDA is not allowed to set off against other income and such loss cannot even carry forward to next year.

- As Section 115BBH tries to tax gain arising from each digital asset separately (Section 115BBH and section 2(47A) have referred the word ‘virtual digital asset’), the question that may arise is whether the loss arising from one crypto currency is allowed against gain arising from other crypto currency during the same year, which needs to be answered in near future.

j. Deduction of Tax at Source:

- To track the transactions in VDA, it is proposed to insert Section 194S for deducting the tax at source. Accordingly, the payer is responsible to deduct tax at source.

- Every person who is responsible for making payment by way of consideration for transfer of VDA becomes payer and becomes obliged to deduct tax. However, payer has been divided into two categories i.e., specified person and other than specified person. The above amendment in respect of TDS is applicable from 01.07.2022 and other amendments in relation to taxation of VDS is application from AY 2023-24.

Specified Person:

- ‘Specified Person’ means a person being an individual or HUF whose turnover does not exceed INR 1 Crore in case of business or INR 50 Lakhs in case of profession during the preceding year or a person being an individual or HUF without income from business/profession.

- For specified persons, TDS is applicable, only in a case where the aggregate value of consideration payable exceeds INR 50,000 during the year. Further, provisions of Section 203A (obligation to obtain TAN) and provisions of Section 206AB (requirement to check filing of return by the payee) are not applicable.

Other than Specified Person:

- It is provided that TDS is applicable when the aggregate value of consideration payable exceeds INR 10,000. Further, provisions of section 203A and 206AB are applicable here.

Other Conditions:

- Where consideration is discharged in kind or exchange of other VDA, the payer must ensure that that the payee has paid tax (full tax) in respect of such transfer. When the TDS is deducted under this section, no TDS/TCS is required to be deducted/collated under any other provisions. When there is any overlap between provisions of Section 194S and Section 194O (TDS on e-commerce transactions), TDS is required to be deducted under Section 194S.

E. Corporate/Business Taxation:

k. Section 37 – Clarification regarding Expenditure which is prohibited in law:

- Explanation 1 to Section 37(1) states that expenditure incurred by an assessee for any purpose which is an offence, or which is prohibited by law shall not be deemed to have been incurred for the purpose of business or profession and no deduction or allowance shall be made in respect of such expenditure.

- However, there is a difference of opinion among the judicial fora in respect of certain expenses incurred by the assessee which is prohibited by the law. In order provide clarity, it is proposed to insert a new Explanation 3 to Section 37(1) to provide the following expenditure shall include prohibited expenditure covered under Explanation 1:

- for any purpose which is an offence under, or which is prohibited by, any law for the time being in force, in India or outside India; or

- to provide any benefit or perquisite, in whatever form, to a person, whether or not carrying on a business or exercising a profession, and acceptance of such benefit or perquisite by such person is in violation of any law or rule or regulation or guideline, as the case may be, for the time being in force, governing the conduct of such person; or

- to compound an offence under any law for the time being in force, in India or outside India.’. The above amendment is applicable from 01.04.2022.

l. Section 40(a)(ii) – Surcharge and Education Cess is not allowed as business expense:

- Under the provisions of Section 40(a)(ii), income tax paid by the assessee is not allowed as expenditure while computing the income from business. However, there are some judicial precedents, wherein it is held that cess and surcharge is not to be considered as income tax payable under the ITA and allowed as business expense.

- In this regard, it is proposed to insert a new Explanation 2 to Section 40(a)(ii) to provide that the term tax includes cess and surcharge by whatever name called. The above amendment is applicable from AY 2005-06.

m. Section 43B – Issue of debentures is not considered as ‘paid’ for the purpose of Section 43B:

- Under Section 43B, amounts in respect of certain expenses are allowed only on payment basis which inter alia includes interest on specified loans or borrowings. In this regard, Hon’ble Supreme Court in the case of M.M. Aqua Technologies Ltd. v CIT [2021] 129 taxmann.com 145 (SC) has held that issue of debentures is treated as actually paid for the purpose of section 43B. For a detailed article on this aspect, please refer here Section 43B - Supreme Court Decision in MM Aqua Technologies Ltd | SBS Blog.

- To overturn the judgement, now it is proposed to amend Section 43B to provide the issue of or debenture or any other instrument by which the liability to pay is deferred to a future date shall not be considered as payment for the purpose of section 43B. The above amendment is applicable from AY 2023-24.

n. Section 68 – Requirement to Explain Source of Source in the case of Borrowings:

- Under the existing provisions of Section 68, where any sum found credited in the books of the assessee and assessee has not offered any explanation about such credit, such amount is considered as income of that previous year.

- The issue of establishing source of source by the assessee has come for discussion before various appellate authorities. Many High Courts and Tribunals have held that assessee is not required to establish the source of source in respect of loan received by the assessee.

- To overturn those judicial precedents, it is proposed to insert a new proviso before the existing proviso to provide where the sum so credited consists of loan or borrowing or any such amount, by whatever name called, any explanation offered by such assessee shall be deemed to be not satisfactory, unless:

- the person in whose name such credit is recorded in the books of such assessee also offers an explanation about the nature and source of such sum so credited; and

- such explanation in the opinion of the AO aforesaid has been found to be satisfactory. The above amendment is applicable from AY 2023-24.

o. Section 79A - Setoff of Loss against Undisclosed Income:

- Under the existing provisions of Section 115BBE, no loss is allowed to be set-off against any income determined under section 68, section 69, section 69A, section 69B, section 69C or section 69D where such income is returned by the assessee or determined the assessing officer.

- In order rationalise the provisions of setoff of losses, a new Section 79A has been inserted into the ITA, to provide where consequent to a search under Section 132 or requisition under Section 132A or survey under Section 133A (other than 133A(2A)), the total income includes any ‘undisclosed income’, no setoff of any loss or unabsorbed depreciation is allowed against such undisclosed income.

- Further, the word ‘undisclosed income’ has been specifically defined under Section 79A to mean any money, bullion, jewellery etc which are not recorded/disclosed before the date of search or an expense which is found to be false.

- While Section 115BBE of the ITA talks about section 68 to section 69D, Section 79A focuses on undetected stock and unaccounted cash payments. However, section 79A restricts setoff of loss and unabsorbed depreciation whereas section 115BBE restricts setoff loss. The above amendment is applicable from the AY 2022-23.

p. Section 80IAC - Extension of time limit for Incorporation of Eligible Start-Up:

- Provisions of section 80-IAC states that to claim deduction under Section 80-IAC by the eligible start-up, such entity needs to be incorporated/established before the 01.04.2022. To extend the time limit, section 80-IAC has been amended to provided that a start-up may be incorporated on or before 31.03.2023 to claim benefits under section 80-IAC.

q. Section 94 – Bonus Stripping and Dividend Stripping to Securities:

- Section 94(8) of ITA states that where any loss arising on bonus stripping in respect of units shall be ignored for the purpose of computing the total income and such loss shall be considered as cost of acquisition of bonus issue.

- Now, it is proposed to amend the provisions of Section 94(8) to expand the scope of bonus stripping to securities as well. Further, the definition of unit has been expanded to include units of business trust, unit under Section 115AB, beneficial interest in AIF, shares and partnership interests. The above amendment is applicable from AY 2023-24.

r. Revision of TPO’s order under Section 263:

- Under section 263, PCCIT/CCIT/PCIT/CIT can revise the assessment order subject to the conditions specified therein. However, it is not specifically provided in Section 263, whether CIT has power to revise TPO order. In this regard, the Hon’ble Hyderabad Tribunal in the case of Agro Tech Foods Ltd.[3] has held that CIT can invoke the provisions of Section 263 to revise the TPO order.

- To provide clarity and consistency, it is proposed amend Section 263, to provide CIT can revise the order of the TPO. Further, it is proposed to amend Section 153 to provide, where TPO has revised his order based on the directions of CIT under Section 263, TPO shall pass revised order within a period of 9 months from the end of Financial Year in which order is passed by the CIT under Section 263 when such case is fresh assessment [section 153(3)]and within a period of 3 months from the end of the month in which order is passed by the CIT under section 263 [section 153(5)].

- Further, it is proposed to insert a new section 153(5A) to provide AO shall pass modified order within 2 months from the end of the month in which TPO order is received. The above amendment is applicable from 01.04.2022.

s. International Financial Services Centre (IFSC):

- Through the Finance Act, 2021, a Section 10(4E) wasinserted to provide that the income earned by a non-resident from transfer of non-deliverable forward contracts entered into with an offshore banking unit of IFSC is exempt from tax subject to other conditions. Now, it is proposed to expand the exemption to income earned from transfer of offshore derivative instruments or over the counter derivatives.

- Section 10(4F) states that any income by way of royalty or interest, on account of lease of an aircraft, paid by a unit of IFSC is exempt from tax if such unit commences its operations on or before 31.03.2024. Now, it is proposed to expand the exemption to scope to lease of ships as well. Similar amendment is also provided in section 80LA to claim deduction in respect of transfer of ship.

- Further, it is proposed to insert a new Section 10(4G) to exempt the income of a non-resident from portfolio of securities or financial products or funds, managed or administered by any portfolio manager on behalf of such non-resident, in an account maintained with any offshore banking unit in IFSC to the extent such income accrues or arises outside India and is not deemed to accrue or arise in India.

- As per proviso to Section 56(2)(viib), amount received by a SEBI registered AIF-I or AIF-II is outside purview of Section 56(2)(viib). Now, it is proposed to amend the Section 56(2)(viib) to expand the exception to IFSC regulated AIF -I or AIF-II. The above amendment is applicable from AY 2023-24.

t. Section 115BAB - Extension of Time for Commencement of Production by new manufacturing company:

- Section 115BAB has been incorporated into ITA in order to provide concessional rate of tax at the rate of 15 percent for newly incorporate manufacturing companies subject to the condition that the company has commenced production on or before the 31.03.2023.

- Now, it is proposed to extend the time limit till 31.03.2024 for commencement of production in order to claim benefits under section 115BAB.

u. Section 115BAB - Removal of concessional tax rate on foreign dividend received by domestic companies:

- Under the existing provisions of the ITA, dividend received by a domestic company from foreign company in which it holds 26 percent sharing is liable to tax at concessional rate of 15 percent. This section has been incorporated in order tax dividends by domestic companies in line with Dividend Distribution Tax (for brevity ‘DDT’).

- As the DDT is abolished by the Finance Act, 20, now it is proposed to withdraw the concessional rate of tax under section 115BBD from the AY 2023-24.

F. Assessment Procedures:

v. Section 139(8A) - Filing of Updated Return of Income:

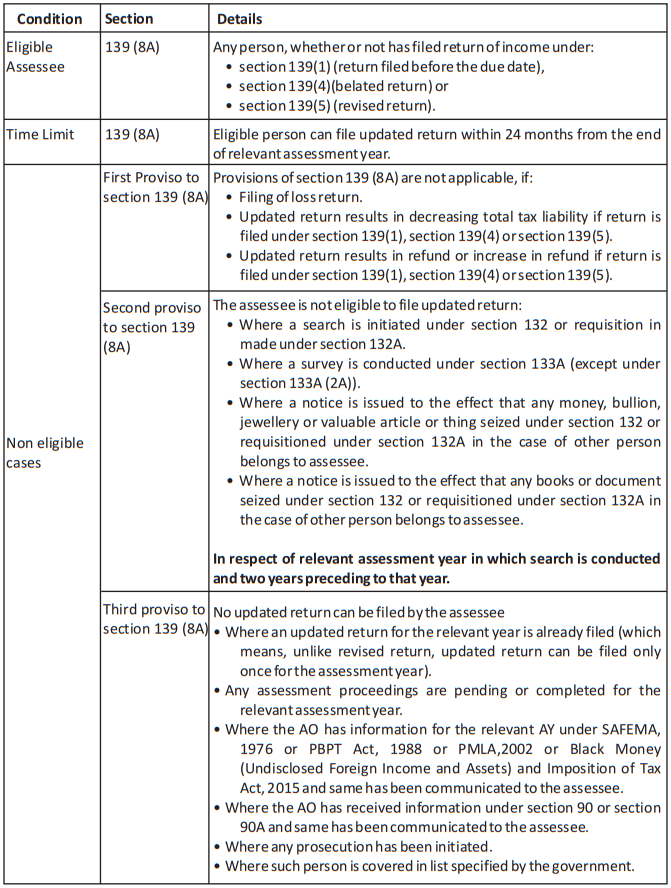

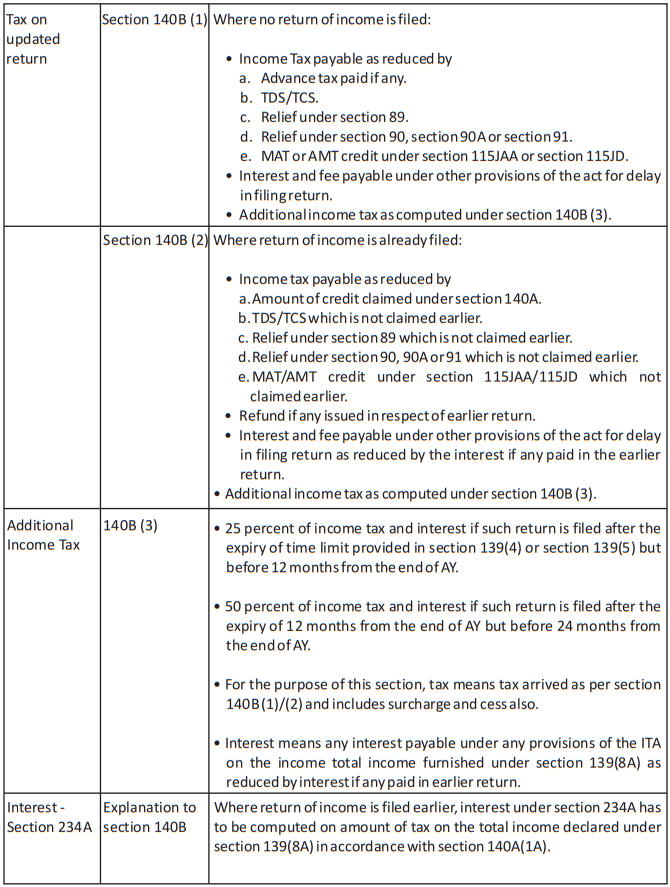

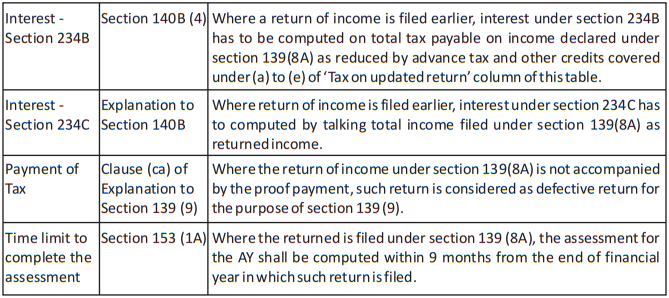

- It is proposed to insert a new provision into the ITA in order to facilitate filing of updated return of income by the taxpayer and these provisions are in addition to the existing provisions under Section 139(5) for filing of revised return of income. The salient features of furnishing of updated return are provided below:

The above amendment is applicable from 01.04.2022.

w. Section 144B – Rationalisation of Faceless Assessment Scheme:

- To eliminate the interface between the taxpayer and the income tax department for better transparency and accountability, the Central Government has introduced faceless assessment scheme through section 144B of the ITA. Considering the difficulties in implementation of section 144B, it is proposed to substitute faceless assessment with new provisions. The detailed article on changes in faceless assessment would be published soon in our monthly journal. The above amendment is applicable from 01.04.2022.

x. Section 148 – Rationalisation of Reassessment Procedures:

- Provisions relating to reassessments and search assessments have been replaced through the Finance Act, 21 thereby both reassessments and search assessments have to completed under Section 147. In order remove inconsistencies, it is proposed to amend following provisions as follows.

- Proviso to section 148 states that no notice under section 148 can be issued unless information with the AO suggests that income has escaped the assessment and AO obtains approval from the specified authority for issue of notice under section 148.

- However, section 148A provides a procedure to be followed before the issue of notice under section 148 which includes obtaining approval from specified authority in certain cases. Hence, to remove this duplication, section 148 has been amended to insert a new second proviso to provide where the AO has passed the order section 148A with the prior approval of specified authority, no fresh approval is required under section 148 again.

- Explanation 1 to section 148 states that information with the AO which suggests that the income chargeable to tax has escaped assessment means

- Any information flagged in accordance with risk management system. Now, it proposed to remove the word ‘flagged’ from the clause to enhance the scope of section 148.

- Any final objection raised by the C& AG. Now this clause has been substituted with the following clauses thereby scope of section 148 has been widened:

- Any audit objection raised.

- Any information received under section 90/90A.

- Any information made available to the AO under scheme notified under section 135A (collection of information from assessee). And Consequential amendment has been made in section 148A to equate this clause with search cases.

- Any information which requires action in consequence of order of a Tribunal or Court.

- Explanation 2 to section 148 states that, in cases covered under search and survey [except 133A (2A) and section 133A (5)], the AO shall be deemed to have information which suggest that the income has escaped the assessment for the three years immediately preceding the year in which search is initiated. Now, it is proposed to remove Section 133A(5) from the exception list in Explanation 2. Further, it is proposed to remove the reference to three years from in the cases of search.

- It is proposed to insert a new section 148B to provide that, in the case of search and survey cases, assessment order shall not be passed by the AO below the rank of JCIT without the approval of AdCIT, AdDIT, JCIT or JDIT.

- Section 149 states that notice under section 148 shall not be issued:

- If 3 years have elapsed from the end of relevant assessment year.

- If 3 years but not 10 years have elapsed from the end of relevant assessment year unless the AO has in his possession of books of accounts or other documents or evidence which reveal that the income, represented in the form of asset, has escaped assessment amounts to Rs.50,00,000 or more for that year.

- Now, it is proposed to amend section 149 to provide that notice shall not be issued if 3 years but not 10 years have lapsed unless Assessing Officer has in his possession books of account or other documents or evidence which reveal that the income, represented in the form

- Asset,

- Expenditure in respect of any event/occasion,

- An entry or entries in the book of account, which has escaped the assessment amounts to INR 50 Lakhs.

- It is further provided that in case where such amount is related to more than one assessment year, notice shall be issued for the each of assessment year. The above amendment is applicable from 01.04.2022.

- It is proposed to amend section 153 (153B for old cases) to provide that in computing the period of limitation for completion of assessment, period commencing from the date of initiation of search (not exceeding 180 days) till the date on which money, bullion, jewellery, document etc are handed over to jurisdictional AO has to be excluded. This amendment is applicable from 01.04.2021.

- Consequential amendments have been made under section 132 /132B to align them with changed provisions search assessments to bring them under section 147.

y. Extension of time limit for setting-up of Faceless Schemes:

- To complete the assessments through faceless mode, the government has come up with many schemes and incorporated respective clauses in various section of ITA. However, Transfer Pricing assessments including DRP procedure and ITAT procedure has not yet operationalised under faceless manner as the central government has not issued any such directions so far and time limit to issue such directions by the central is getting bared by 31.03.2022 (31.03.2023 for ITAT procedure). Hence, it is provided to extend time limit to 31.03.2024 to issue directions by the government for faceless procedure.

G. Deduction of Tax at Source:

z. Section 194-IA – Stamp Duty Value for TDS on Sale of Immovable Property:

- Under the existing provisions of Section 194-IA, any person responsible for making payment to resident for purchase of immovable property is required to deduct tax at source at the rate of 1 percent if the amount of consideration exceeds INR.50 Lakhs. However, in certain cases, stamp duty value is to be replaced with original sale consideration for the purpose computation of capital gains.

- To bring consistency, it is proposed to amend section 194IA to provide that tax is required to be deducted on sale consideration or stamp duty value whichever is higher. The above amendment is applicable from 01.04.2022.

aa. Section 194R – TDS on any Perquisite in respect of Business or Profession:

- Section 28(iv) of the ITA states that the value of any benefit or perquisite, whether convertible into money or not, arising from business or the exercise of a profession shall be taxable under the head PGBP.

- In order to track such type of transactions, it is proposed to insert a new section 194R to obligate the person responsible for making such sum to any resident to deduct tax at source at the rate of 10 percent when aggregate of such amount exceeds INR 20,000 during the year.

- Further, whether the perquisite is paid in kind, the payer before releasing the perquisite ensure that the tax has been paid by the recipient on such perquisite. It is further provided that individual or HUF is not required to deduct tax at source under this section when gross receipts or turnover does not exceed INR 1 Crore in the case of business or INR 50 Lakhs in case of profession. The above amendment is applicable from 01.07.2022.

bb. Section 206AB/206CCA – Higher TDS/TCS on non-filing of ITR:

- Through the Finance Act, 21, two new sections 206AB and section 206CCA were inserted into the ITA to force the assessees to file ITR where there is higher amount of TDS. Section 206AB (3) states that TDS is required to be deducted higher rate where the payee has failed to furnish ITR for both of the previous years which means filing of ITR for any of the year safeguards the assessee from higher TDS.

- Now it is proposed to amend section 206AB(3) wherein the definition of specified person has been changed to mean a person who has not furnished the return of income for the immediately preceding year for which time limit to file return of income under section 139(1) has expired and TDS/TCS in his exceeds INR 50,000/-.

- In other words, it would mean that failing to furnish return of income by payee even for one year (any of one year under old provisions) makes the assessee to attract higher TDS rate under section 206AB. Similar amendment has been made in section 206CCA.

- Further, it is proposed to exempt the persons required to deduct TDS under section 194-I, 194-IB and section 194M from the ambit of section 206AB and consequential amendments have been made under section 194IB in this regard. The above amendment is applicable from 01.04.2022.

cc. Section 158AB: Filing of repetitive appeals by Revenue:

- It is proposed to insert new section 158AB into ITA to facilitate the revenue to file the appeal before the ITAT/High Court after the decision of High Court/Supreme Court when identical question of laws is involved.

- Section 158AB provides that where any question of law arising (relevant case) is identical with the question of law arising in his case for any other assessment year or in case of any other assessee for any AY, and such question of law is pending before the jurisdictional HC or Supreme Court and the lower order is in favour of the assessee (other case), collegium may decide and inform the PCIT or CIT not to file appeal in the case of relevant case before the ITAT or HC till the disposal of appeal by the HC or Supreme Court.

- However, AO shall file an application, after the receipt of acceptance from the assessee, before the ITAT within 60 days or before the HC within 120 days in such Form as may be prescribed, stating that an appeal on the question of law arising in the relevant case may be filed when the decision on such question of law becomes final in the other case. And AO shall file the appeal within a period of 60 days from the specified date. The above amendment is applicable from 01.04.2022.

dd. Penalties:

- Under the provisions of section 271AAB, section 271AAC, 271AAD, penalty can be levied by the assessing officer. Now, it is proposed to amend said section to enable the CIT (A) also empowered to levy penalty in addition to assessing officer. The above amendment is applicable from 01.04.2022.

Proposals under GST Laws:

ee. Amendments impacting Input Tax Credit:

- Section 16 of CT Act deals with eligibility and conditions for taking input tax credit. The said section has been now amended to introduce a new condition for availment of input tax credit. Now, the registered person can claim credit only if the details of such credit are communicated to such registered person under Section 38 and the same have not been restricted.

- Section 38 has now been substituted to provide that the details of outward supplies shall be furnished by the registered persons in Section 37(1) and of such other supplies as may be prescribed and an auto – generated statement containing the details of input tax credit shall be made available electronically to the recipient in such manner and such time as may be prescribed.

- Section 38 further provides that the auto – generated statement shall consist of details of inward supplies in respect of which credit can be availed and details of supplies on which credit cannot be availed, whether wholly or partly by the recipient on account of the details of the said supplies being furnished under Section 37(1) under certain prescribed circumstances. Hence, the recipient can only avail the credit based on the auto – generated statement.

- The time limit for availing the credit pertaining to a financial year has been extended from due date of filing the return of September of the succeeding year to the 30th of November of the succeeding year. This provides additional time for the recipients to avail the any missed out credits. Similar amendment is also made for issuance of credit notes.

- Section 41 has been substituted to remove the concept of provisional credit and now prescribes that the recipient is eligible to take credit subject to conditions and restrictions prescribed. The said section further states that if the tax has not been paid by the supplier, then the credit availed by recipient need to be reversed along with interest in such manner as may be prescribed. The proviso to said section stipulates that the recipient can re-avail the credit, once the supplier makes payment of tax. The payment of tax by the supplier to the credit of central government is one of the conditions mentioned in Section 16 to avail the credit. However, there is no mechanism available for the recipient to check whether the tax on such supplies made to him, were actually paid by the supplier to the government. With the new Section 41 in place, may be the GST portal would come up with a mechanism to examine the same and allow the recipient to take the credit.

ff. Restriction on Filing of GSTR-1:

- A new clause has been inserted under Section 37 to prescribe that, a registered person shall not be allowed to furnish the GSTR-1, if the GSTR-1 for any of the previous tax periods has not been furnished by him.

gg. Interest under Section 50(3):

- With the removal of Section 42 and section 43, the interest specified at Section 50(3) gets redundant. As of now also, the same is not in play, since the provisions of Section 42 and Section 43 were never implemented. Now, the new sub-section states that, the higher rate of interest is applicable in cases where there input tax credit has been wrongly availed and utilised.

[1] National Pension System

[2] Alternate Minimum Tax

[3] [2021] 124 taxmann.com 517 (Hyderabad - Trib.)